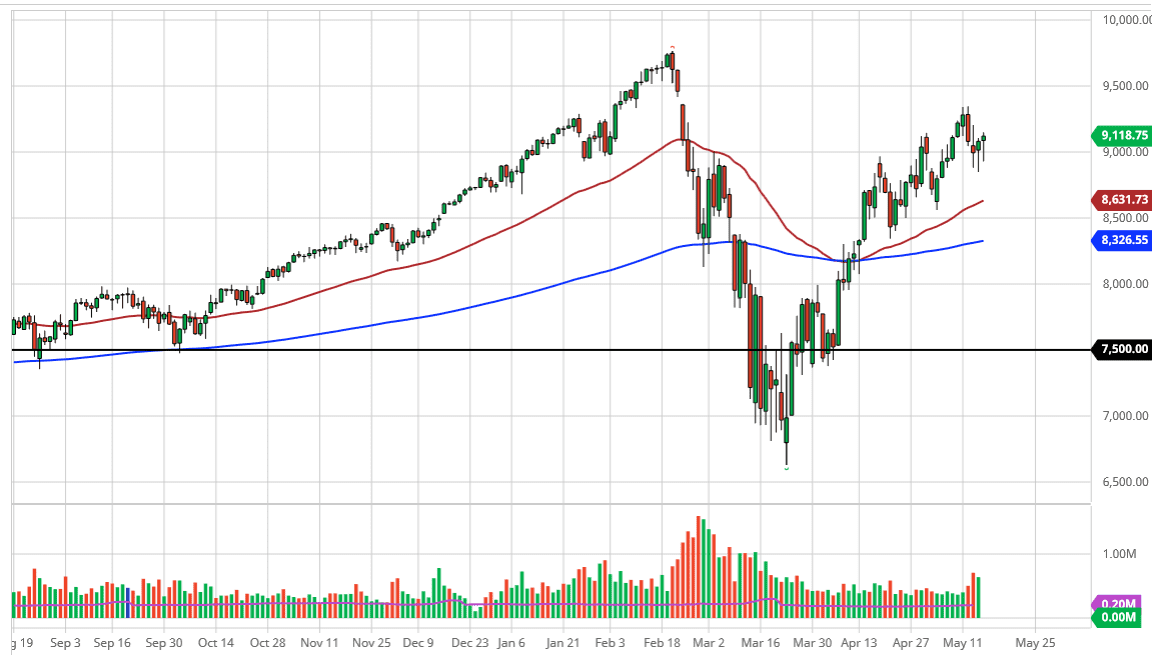

The NASDAQ 100 initially fell during the trading session on Friday, drifting below the 9000 level and another scary opening. However, the market turned around to form a bit of a hammer. At this point in time, the hammer mirrors the hammer from the previous session, and therefore it suggests that there are a lot of buyers underneath and we are ready to try to send this market higher. This makes quite a bit of sense, considering that the NASDAQ 100 is essentially an ETF of the four favorite companies of Wall Street.

These counties of course are Netflix, Facebook, Microsoft, and of course Alphabet. In other words, it is exceedingly difficult for this index to go lower over the longer term, unless of course Wall Street is suddenly bailing out on the ideas of growth. Ultimately, the market looks as if it is going to try to go higher and fill the gap just below the 9500 level. That is an area that I think will continue to offer a lot of interest, but if we break through there then there is almost absolutely nothing to stop this market from shooting straight towards the 10,000 handle. Pullbacks at this point in time will see support at the 50 day EMA, currently trading at the 8630 handle. If we were to break down below there, then the market will certainly find buyers near the 200 day EMA which is at roughly 8300. You should also pay attention to the 8500 level, it should offer plenty of support due to the fact it is a large, round, psychologically significant figure, and the scene of a previous.

If the NASDAQ 100 breaks down rather significantly, it will be a precursor for a lot of negative activity in stock markets not only in the United States, but possibly around the world. If the handful of Wall Street favorites cannot gain, as they are 30% of this index, then really at that point in time what can? This is why so many retail traders like the NASDAQ 100, under normal conditions, it is easy money. This is because Wall Street operates in a vacuum, and always has it stalwarts that it runs to. That being said though, if this market breaks down it is probably more or less a reaction to the rest of the markets falling apart and risk appetite being thrown out the door.