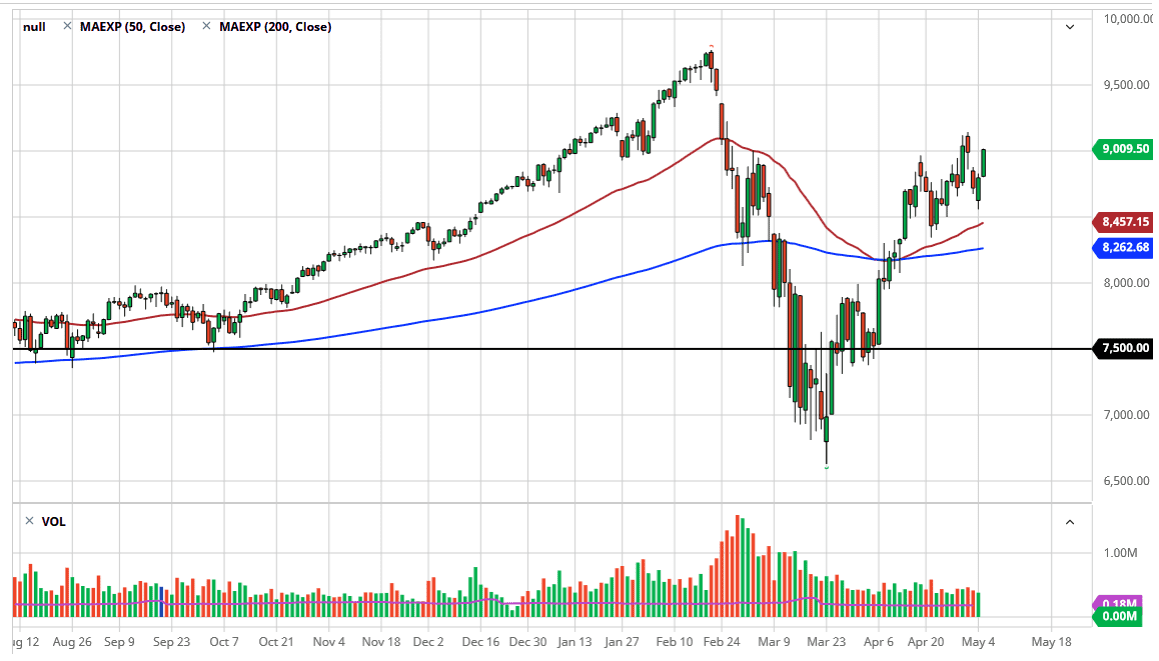

The NASDAQ 100 has broken to the upside during the trading session on Tuesday, filling the gap in order to show signs of significant bullish pressure yet again. At this point, the NASDAQ 100 is being driven higher by a handful of companies, which of course are the usual rules such as Netflix, Facebook, etc. At this point in time, it is likely that the market will continue to see more of a “big four” type of attitude when it comes to how it trades. We are almost ready to break above the recent high, and if we do then there is not a lot to keep us from trying to go towards the gap at the 9500 level.

If the market does in fact fall from here, it is likely that the market then could go down towards the 8500 level where I would anticipate seeing a lot of bullish pressure. The 50 day EMA is starting to reach higher and sits just below that level. Ultimately, the market could continue to see a lot of volatility, so at this point in time it makes sense that you will need to be cautious about your position size. That being said, there is most certainly a lot more bullish pressure than bearish and therefore it looks as if we are ready to continue going higher given enough time. In fact, it is not until we break down below the 8500 level that I would consider shorting now that it appears the market is not paid attention to the fundamental analysis of the global economy.

More than likely, we will simply see back-and-forth trading with an eye to the upside, perhaps finally breaking out. That being the case, the market is likely to see a lot of noisy behavior, and therefore you will have to be overly cautious about over sizing your position. The 200 day EMA currently sits at the 8250 level, and it is likely that it will continue to keep this trend higher as well. There is no reason for stocks to go higher other than the fact that they are. At the end of the day, do not get too hung up on the fundamentals, and simply follow what price tells you to do. The rally has been extraordinary, just as the breakdown, if and when it comes, will be.