The NASDAQ 100 fell a bit during the trading session on Friday but turned around to form a bit of a hammer by the time the markets were closing out. This is pretty remarkable, considering that the market is very stretched at the moment. However, the “FOMO” continues to be a major issue in this market. This makes sense though, because the NASDAQ is essentially an ETF of all things Wall Street loves.

When the top four holdings are Netflix, Amazon, Alphabet, and Facebook, it is difficult to argue with the fact that it would go higher. These are all the “great story stocks” that Wall Street loves to jump into. It is the ultimate form of “groupthink”, that only a handful of stocks receive the most inflow of trade capital. It is not a huge surprise, that is the way it has always been, and you have to keep in mind that this index does not necessarily reflect reality. It reflects what people think about those handful of stocks. Having said all of that, there is a narrative that these companies will continue to do really well due to the shut in of the economy, but we are starting to come out of that so it will be interesting to see if there is any give back.

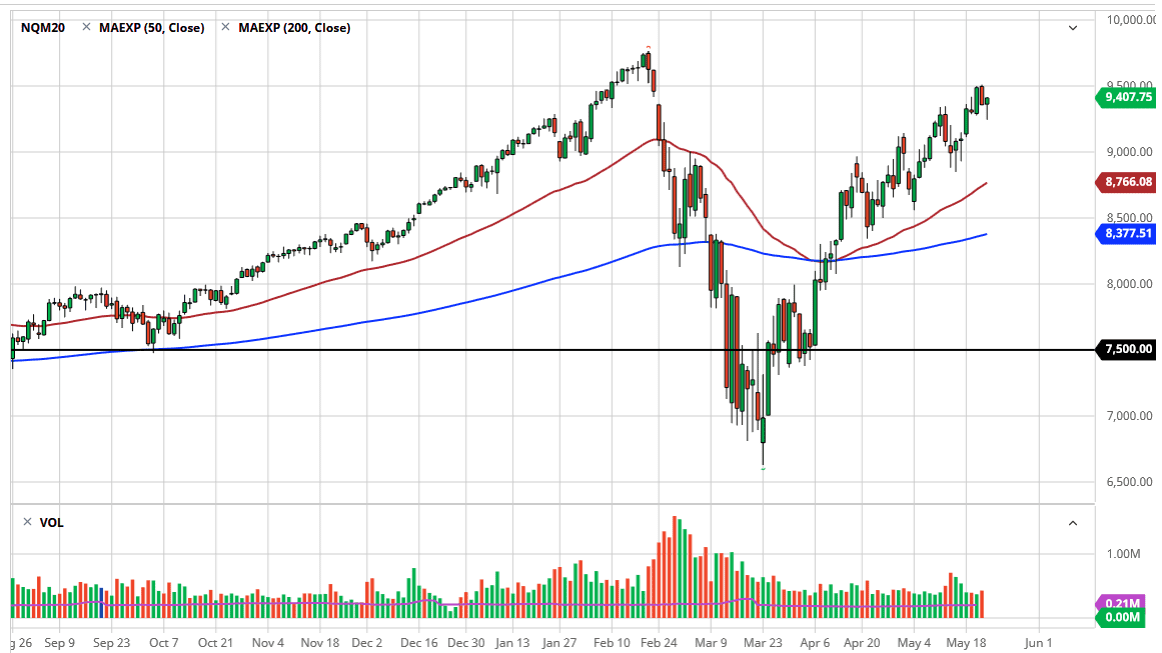

If we were to break down below the bottom of the hammer for the trading session, that opens up a move down to the 9000 level, an area that I think probably could get retested due to the fact that we are tussling with a major gap right now, but if we break above the highs of the session on Thursday, then we are clearly going to the all-time highs right away. After that, I would anticipate a move to the 10,000 level. The 10,000 level of course is a significant figure and will cause a certain amount of psychological resistance. If we were to turn around a break down below the 9000 level though, there is also the 50 day EMA that will probably come into play. What is interesting about the NASDAQ 100 is that it is extraordinarily resilient, but if the markets break down significantly, it will mean that there is even much more panic and other indices that do not have the benefit of having some of these companies weighted as much as they are here. Remember, these favorites make up roughly 33% of the index.