The NASDAQ 100 continues its extreme battle with gravity, but you should keep in mind that this is essentially an ETF of Wall Street’s favorite stocks. Roughly 33% of the index features Facebook, Netflix, Google, and the usual suspects. With this, as long as Wall Street continues to plow into the same old names, this is an index it will continue to show signs of strength. Quite frankly, we are not that far from recapturing the all-time highs which is absolutely astonishing if you think about it.

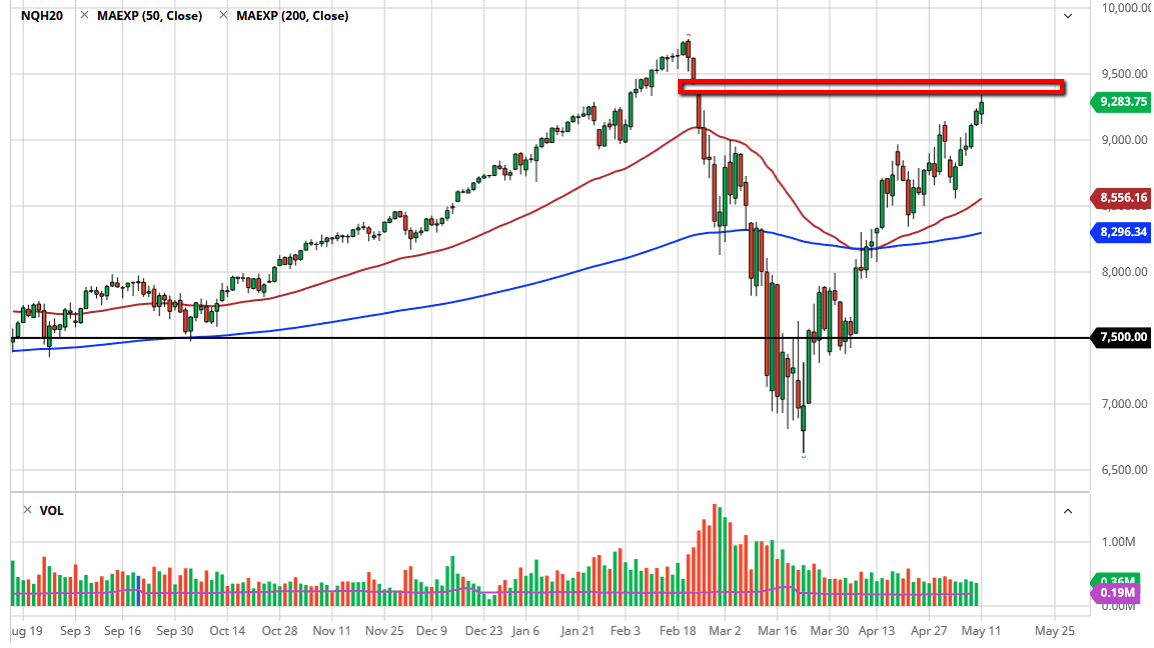

The massive disconnect between Wall Street and Main Street continues to be abundantly clear on this chart. With the US economy in so much trouble, it is a bit startling to see just how strong this chart has been. Just above current levels, there is a gap that sits at 9450 or so, so I think it is only a matter of time before we see the market try to make a move towards there. After all, we are remarkably close to getting to that point anyways, and at this point we might as well just make all-time highs again.

That being said, you cannot simply buy at any juncture. Looking for pullbacks will continue to be the best way going forward and I think that the 9000 level will offer support. However, if we were to reach the 9500 level, then the gap should facilitate some selling. One thing that is extraordinarily obvious on this chart is just how thin the volume has been, and it suggests that there is still a lot of indecision and mistrust of this rally, and quite frankly with good reason. Yes, the favorites of Wall Street are a major portion of this index, but the reality is that 30 million Americans are unemployed, and most people believe that is somewhat of an understatement of what actually has happened. If that is going to be the case, corporate profits are going to be an absolute disaster down the road, although it should be noted that some of the companies in this index will actually benefit from the “social distancing” that should continue to be the norm for a lot of offices around the country. If we break down below the 9000 level, then we will probably go looking towards the day EMA underneath for a bit of support as it has been somewhat reliable lately.