The NASDAQ 100 initially tried to rally again during the trading session on Tuesday but gave back the gains in a rather ferocious manner slicing through the 9100 level. At this point I think we are probably prone to see a move down to the 9000 handle. Ultimately, that is an area that was previous resistance so it would make sense that it should offer support. It will also be a bit of a magnet for price and I think it is possible that we are simply at the top of a channel that continues to be a major influence on the market.

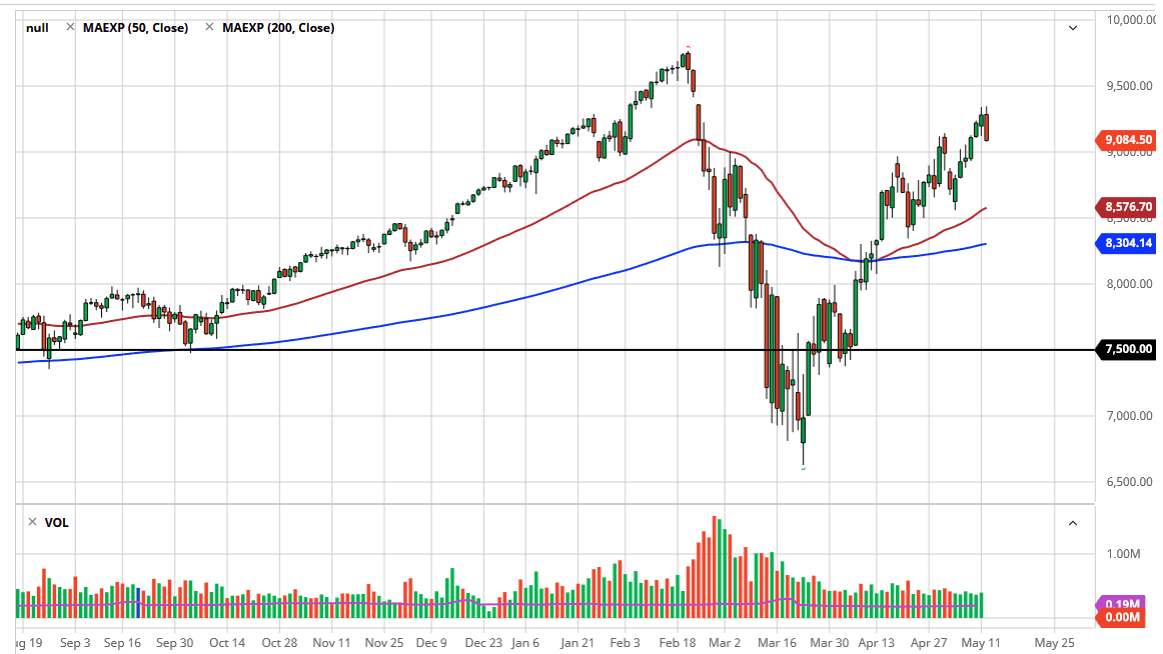

That being said, remember that the NASDAQ 100 is essentially all of the Wall Street darlings, so it is not really a real market in the sense of a broad based average of companies. It is Facebook, Google, Amazon, and a few other company such as Tesla. As long as there are people willing to play the “pump it up game”, then it is likely that this market will continue to find buyers. I anticipate that the previous uptrend line of the channel or the previously mentioned 9000 level are the first couple of areas that buyers will come into play, but I also recognize that the 50 day EMA which is pictured in red on the chart is very likely to be an area of interest as well.

To the upside, there is the obvious that continues to cause issues which is found that the 9500 level roughly, and therefore I think we are going to start to see whether or not this rally really can take hold for the long term. At this point, we have seen a significant bounce, but you should also keep in mind that the market is clearly overdone and therefore I think that if a couple of the main stocks that everybody follows runs into trouble, it could cause major problems here. In the short term, I suspect a pullback is waiting for traders, and now it only comes down to the daily candle closing in a supporting manner. If we were to break above that little gap that sits just below the 9500 level, then we will clearly break out to a fresh, new high, completely divorcing from economic reality which has been the way the market has been behaving since the Great Financial Crisis. In other words, it is a very real possibility.