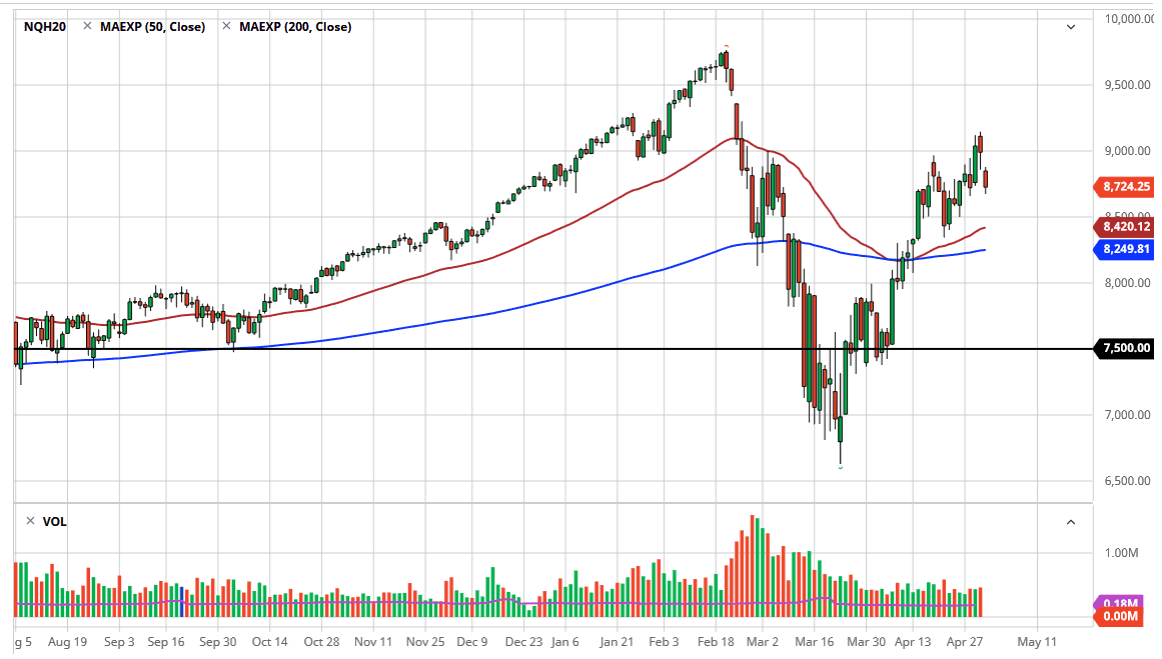

NASDAQ 100 traders sent this market much lower during the trading session on Friday, perhaps possibly due to Tesla or Amazon being sold off. Furthermore, there are a lot of concerns about President Donald Trump levying new tariffs against the Chinese, so there is that bit of a macro headwind just above. That being said, the gap above will probably get filled sooner or later.

Furthermore, there is a lot of noise underneath it should come into play and offer support. I am especially interested in the 8500 level as the 50 day EMA is starting to reach towards that region, and therefore it makes quite a bit of sense that in that area we should see a bit of buying or at the very least a bit of support. I like the idea of looking for value underneath, but if we do break down below the 8500 level it is possible that we could drop all the way down to the 8000 handle. One thing that is worth paying attention to is the fact that this week will feature the Non-Farm Payrolls figures, and that of course could be a major problem. So far, the market looks likely to ignore a lot of economic scenarios, but if the jobs number is even worse than anticipated, that could be enough to topple the market in general.

To the upside, we have formed a “hanging man” right at the 9000 level, so it is very unlikely to continue to be able to go higher with any higher velocity. The market had gotten far ahead of itself, so now the question is whether or not this is simply been a “bear market rally”, or if it is the markets recuperating some of the massive losses and coming back to reality. Ultimately, there are a lot of businesses out there is a lot of trouble, so I just do not see how the stock market can continue its behavior. This has been a “rip your face off rally”, but these types of markets and in these types of situations tend to swing wildly from one direction to the next. At this point, there is much more risk to the downside than up from what I see, and therefore I like the idea of shorting, but I am also cognizant of the 8500 level being a major barrier for the sellers to take out.