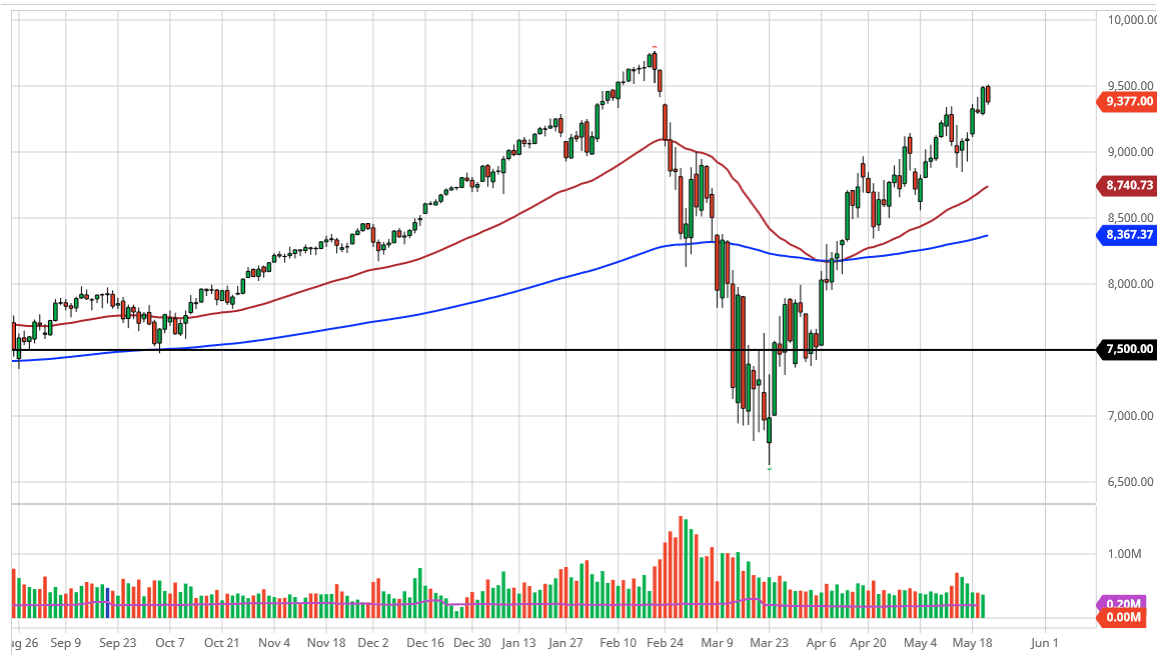

The NASDAQ 100 has pulled back significantly during the trading session on Thursday as the 9500 level has offered far too much in the way of resistance. At this point in time, the market has broken down to the bottom of the range for the trading session and it makes sense that the markets find a little bit of follow-through. At this point, the 9300 level would be another target, and then possibly the 9250 level. After that, the 9000 level will be a major area of interest. We look at the chart, it is clear to see that there is an up trending channel, and it has held quite nicely. With this typically suggests is that a larger move is coming and if we can break out of it tells you which direction were going to go.

Above, near the 9750 level there is the all-time high for the NASDAQ 100 and it makes sense that we would see some sellers in that area as is typical. Ultimately, this is a market that I think will continue to see a lot of noise in general due to the fact that it is the “darlings of Wall Street” that traders are looking to buy or sell depending on what the general attitude of the day is. Keep in mind that roughly 40% of the index is Facebook, Amazon, Alphabet, Netflix, and Tesla. Those five stocks have the biggest influence by far, so it is essentially an ETF of those companies. As those companies, perhaps with the exception of Tesla, are all doing quite well in a pandemic world, it means that the stocks will drag this index right up with it.

I anticipate a lot of noise in general, and as a result it makes quite a bit of sense that we have to pull back occasionally. I believe that the 9000 level is essentially the “floor” in this market, so do not be surprised at all to see buyer step in and get aggressive in that area. A breakdown below the 9000 level could send this market much lower. Ultimately, if I am looking to short stocks or indices at this point, it is likely that I will be a seller of the S&P 500 instead of this index as it is so well supported by the “groupthink” that runs Wall Street traders and retail traders alike.