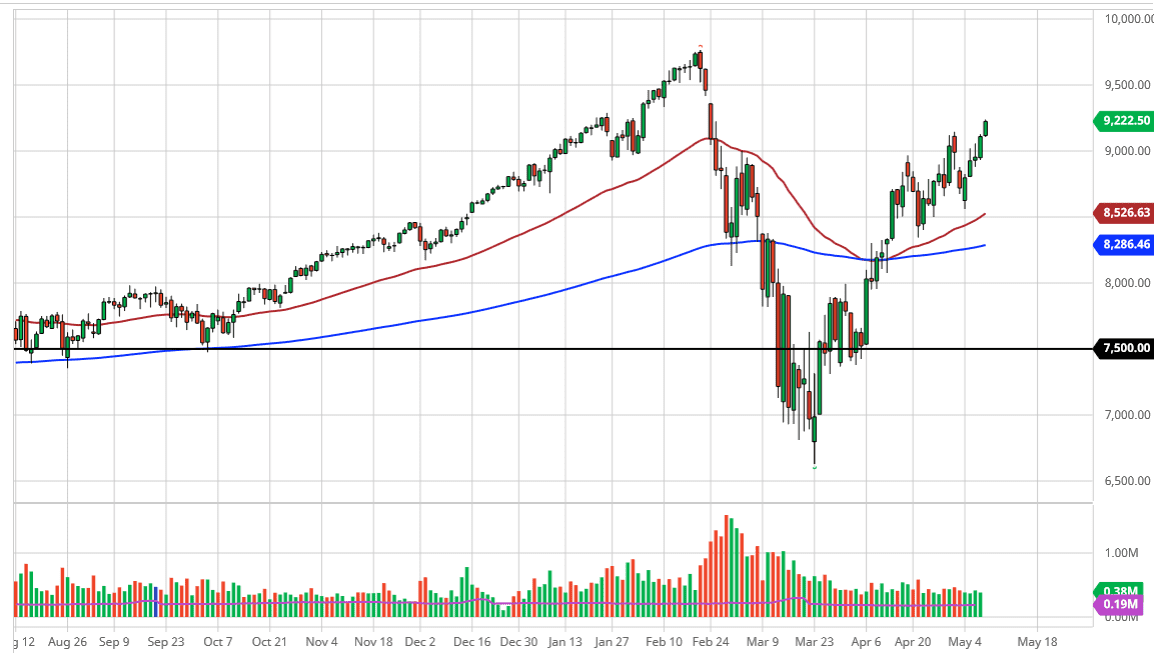

The NASDAQ 100 has broken higher during the trading session on Friday, making a new high for the year. The market did this on the same day that the employment figures produced the worst results in the history of the Bureau of Labor Statistics. The NASDAQ 100 is heavily influenced by a handful of technology companies, so therefore it is essentially a large ETF of all of the names that Wall Street loves. This is why this market continues to rally.

At this point in time, the market should have plenty of support at the 9000 level, as it is a large, round, psychologically significant figure, and the fact that we are broken above the gap that had been set there. At this point, it looks as if we will be looking towards the next gap which is closer to the 9400 level. Until something changes quite drastically, it is probably going to be a “buy on the dips” type of set up. This is a market that has been forming a sawtooth move to the upside, and therefore I think that pullbacks continue to offer value the people are willing to take advantage of.

At this point in time, the NASDAQ 100 continues to show a complete disdain for the idea of falling, so therefore you cannot fight it. Granted, there is probably a day of reckoning, but that day seems to be quite a ways away. The fact that we closed towards the top of the range suggests that we are going to continue to go higher, as there is typically follow-through on one of these moves. Nonetheless, this mess continues to be very much of a grind, so look for value on pullbacks if you are in fact trying to go long. This is a market that simply will not rollover, at least not in the short term. If you are looking to short this market you are trying to fight Facebook, Microsoft, and many of the other cult stocks as well, like Tesla. In other words, it is much easier to express a negative opinion by shorting individual stocks. With the NASDAQ 100, you are either buying the dips or you were on the sidelines. Longer-term, I do expect another massive break down, but we are not in that scenario quite yet. All things being equal, this is a market that defies logic, but it is about being profitable and not “intellectually correct.”