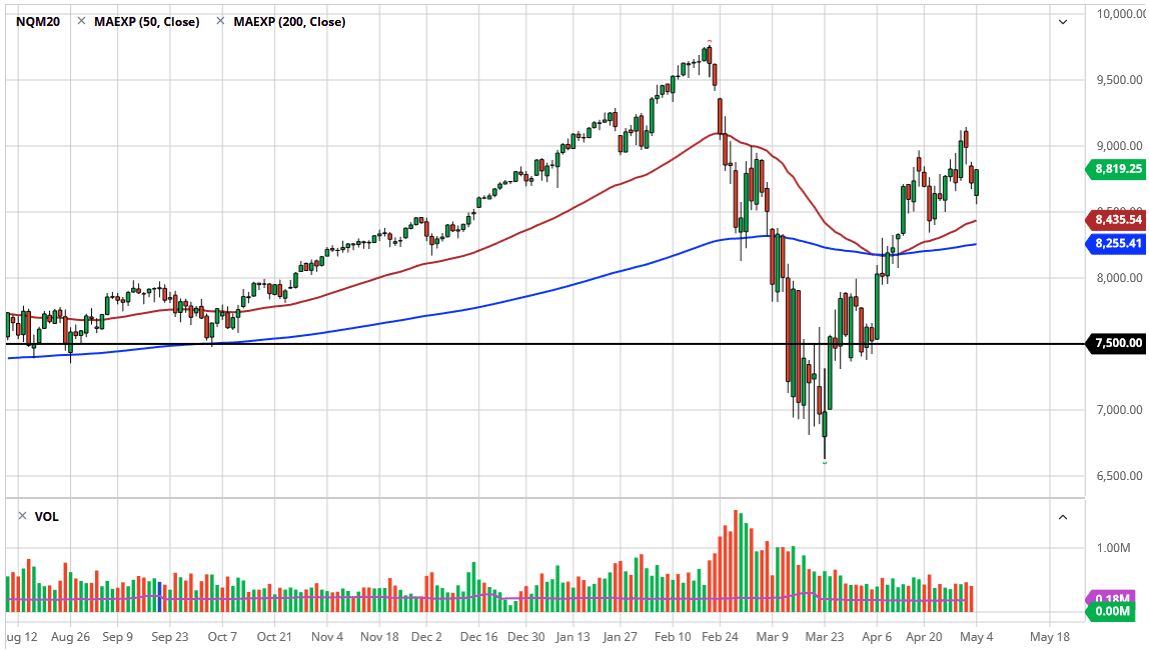

The NASDAQ 100 has fallen at the open on Monday, but then turned around to fill the gap and continue going higher. There is a gap above that still needs to be filled, and that of course is true not only with the NASDAQ 100, but also the Dow Jones Industrial Average contract, and of course the S&P 500 contract. Ultimately, this is a market that will be looking at the 9000 level as a possible area to the upside, as it is not only a large, round, psychologically significant figure, but it is also the top of the gap that has yet to be filled. That is up being a very “tidy” target that traders can aim for. Whether or not we can get above that level is a completely different story, but if we do then take out the recent high could open up the move towards 9500 which is also the scene of a gap.

Keep in mind that the NASDAQ 100 is highly influenced by Apple, Facebook, and a few other majors. This is not an index that is even remotely close to being equal weighted, as just for stocks are roughly 33% of the volume. Because of this, it does tend at quite a bit differently than other indices so you should keep that in mind. I do think at this point that pullbacks will continue to be buying opportunities, especially near the 50 day EMA which is painted in maroon on this chart. It currently sits at the 8435 level and approaching the 8500 level.

For what it is worth, the 200 day EMA is sitting at 8255 as well, so I think there are multiple levels that are going to cause a lot of areas that you can look for value. To the upside, I think it is going to take a significant amount of momentum to finally break above the 9000 gap, but if we do then you can argue with that either. At this point, you should keep in mind that although you can talk about how the index is an equal weighted, the reality is that the stock market and the economy are two totally different things. If the market does break down from here, you can probably count on the idea of the NASDAQ 100 recovering quicker than the S&P 500 or the Down Jones Industrial Average E-mini contract.