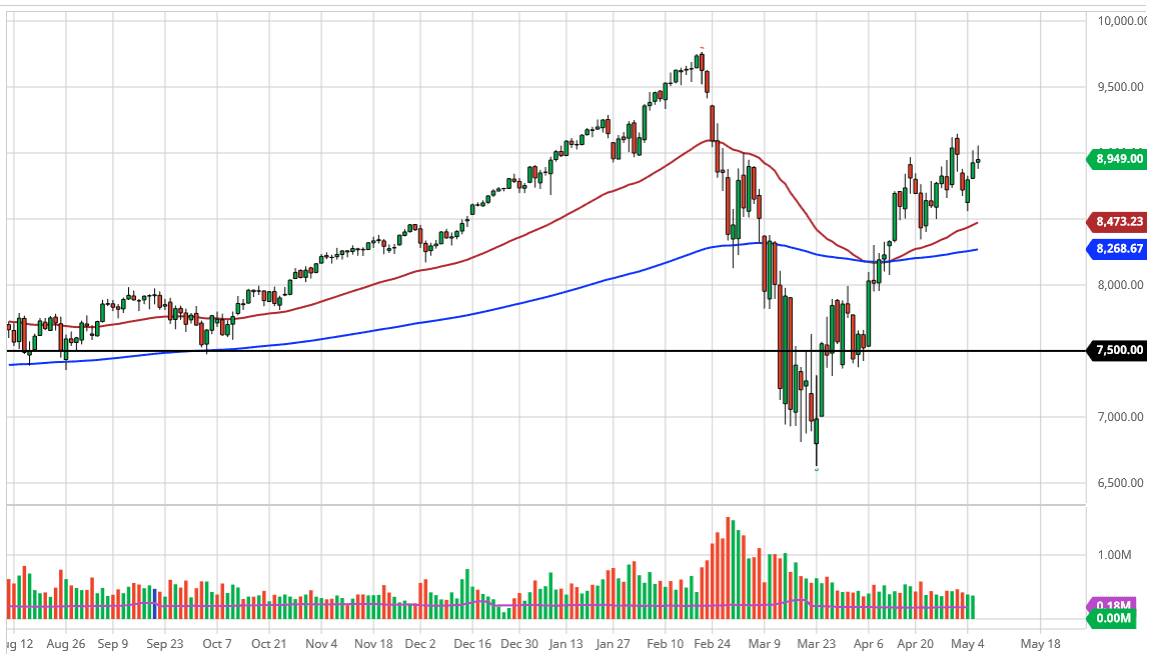

The NASDAQ 100 took off to the upside during the trading session on Wednesday but gave back the gains to form a shooting star. The gap has been filled, and we failed to make a fresh, new high. The fact that we pulled back late in the day is not a huge surprise, considering that the market is getting ready to tackle the Non-Farm Payroll figures coming out on Friday. With that in mind, I can imagine that people were wanting to put too much money to work in the interim. Once we get past that announcement, it is possible that we will see a little bit more clarity, but right now it looks as if the 9000 level is continuing to offer quite a bit of pressure to the downside.

To the upside, the 8500 level underneath features the 50 day EMA, and the same area where we had seen support previously. That being said, the market breaking down below there then allows it to reach towards the 200 day EMA, something that attracts a lot of attention. All things being equal though, forming the shooting star of course is something that you need to pay attention to. It would not surprise me at all to see the Thursday candlestick be a little bit red and show signs of profit-taking if nothing else.

The alternate scenario is we break above the high from last week, which of course would be a very bullish sign, perhaps offering the possibility of a move towards the 9500 level. That is the top of the gap that has yet to be filled, and then we could see quite a bit of interest paid to that level. At this point though, the next 24 hours will probably be very quiet, so unless you have strong conviction as to whether or not the stimulus will continue to push the market higher, it is difficult to put a lot of money to work as you are essentially gambling with your account. If we were to break down below the 200 day EMA, it is likely that the market will go towards the 8000 level, possibly even the 7500 level after that. The last couple of weeks have been very choppy, and I consider the next move to probably be more of the same. Ultimately, caution is probably the most important thing that you can pay attention to.