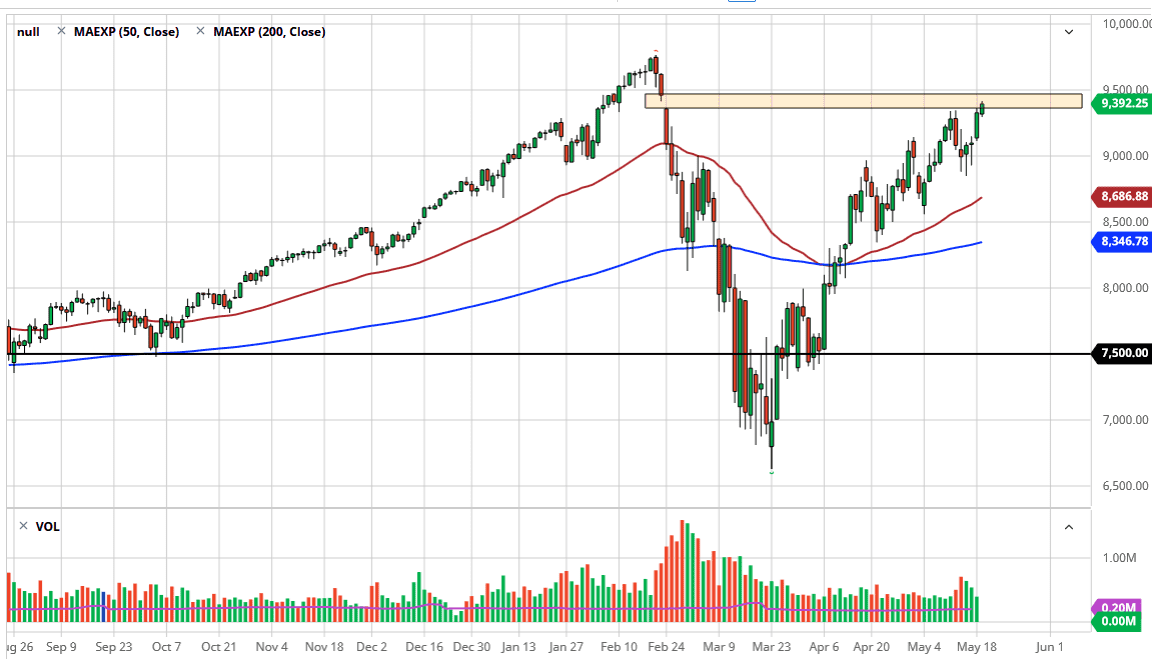

The NASDAQ 100 has rallied during the trading session again during the day on Tuesday but has not quite filled the gap yet. It certainly looks likely to, so now the question is whether or not it can break above the gap which is clear resistance. That is at roughly 9450, and I think given enough time we will probably try to break above it. At this point, it is likely that the market will see a little bit of a pullback due to the fact that it is extreme resistance, and of course markets cannot go straight up in the air forever. That being said, it is not easy to short this market considering that it is basically Netflix, Facebook, Alphabet, Microsoft, Tesla, and Amazon. In other words, all of the stocks that everybody peddles to the retail public.

A pullback from here makes quite a bit of sense and I think that it would offer some value. I still believe in the 9000 level as massive support, and I think that there will be plenty of buyers in that general vicinity. However, the market cannot go straight up in the air forever. The question now is whether or not the profit-taking will be swift, or if it will lead to something bigger. If it does lead to something bigger, I much more comfortable shorting the Russell 2000 or perhaps the S&P 500 due to the fact that they are at least a little bit more spread out than the NASDAQ 100 as far as concentration.

On the other hand, if we break above the 9450 level it is likely that the NASDAQ 100 races towards the 10,000 level in a surge of euphoria. Regardless of the economic realities, the reality is that the NASDAQ 100 will continue to go higher because a lot of the companies that make up the biggest part of it are essentially “stay-at-home companies.” Think of Microsoft and its operating system, office 360 product, etc. Netflix is an obvious one, and of course Facebook and Amazon will do well in this environment also. If these handful stocks do well, that is something like 45% of the index by itself. In other words, your trading of this index is actually trading a small ETF with a handful of not as important companies attached to it. This is one of the biggest problems that people trading this index have, they have no idea what it has actually made out.