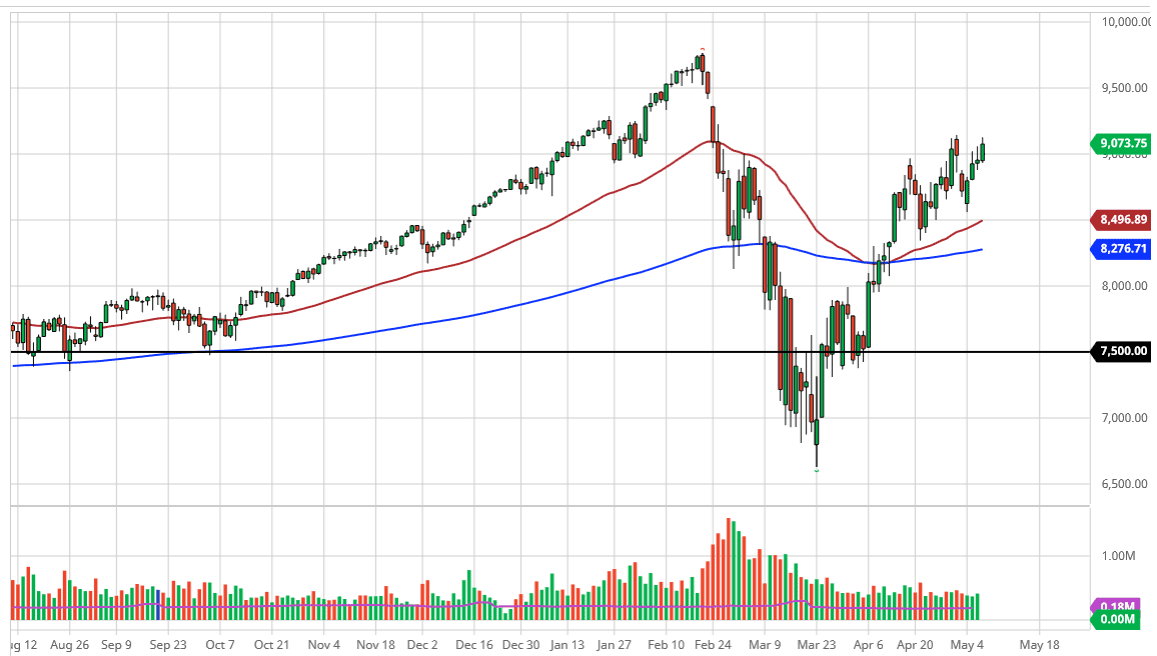

The NASDAQ 100 has rallied again during the trading session on Thursday to test the highs again, as we are above the 9000. As we head into the Non-Farm Payroll Friday session, in the NASDAQ 100 looks as if it is going to continue to see a lot of buying pressure underneath as the NASDAQ 100 is essentially a conglomeration of five major stocks followed by another 95. As long as names like Facebook and Microsoft do well, this index will do well. Technology stocks have most certainly led the way going forward, and that is obvious by looking at this index.

Now I believe the support level is at the 8500 level, so it is not until we break down below there that I would be concerned about the uptrend. Furthermore, the 50 day EMA is sitting right in that same level, and therefore I think it is only a matter of time before we see buyers come back into take advantage of the market being cheap at that point. In fact, what I am hoping for is that the jobs number spooks the market enough to send it lower, just so I can serve buying again at that level which makes so much sense as far as a value trade is concerned. Having said that, if we were to break above the highs from last week, then you have to simply suck it up and start buying at that point to aim for the massive gap above at the 9500 level.

It should be noted that Wall Street seems to think that there are going to be negative rates going into December 2020, as the Fed Funds Futures rate dropped below the zero level during the day. That means that Wall Street is counting on plenty of cheap money to continue to fuel the debt bubble, and of course the equity bubble. That being said, I believe that the market will continue to find dips as buying opportunities, regardless of the fact that I do not see how the fundamentals match up with the price action. It is not until we break down below the 50 day EMA that we can even begin to entertain the idea of trying to short the market. Expect a lot of choppiness on Friday but ultimately there are probably buyers waiting to take advantage of any dip as it happens, and Non-Farm Payroll could very well be a catalyst.