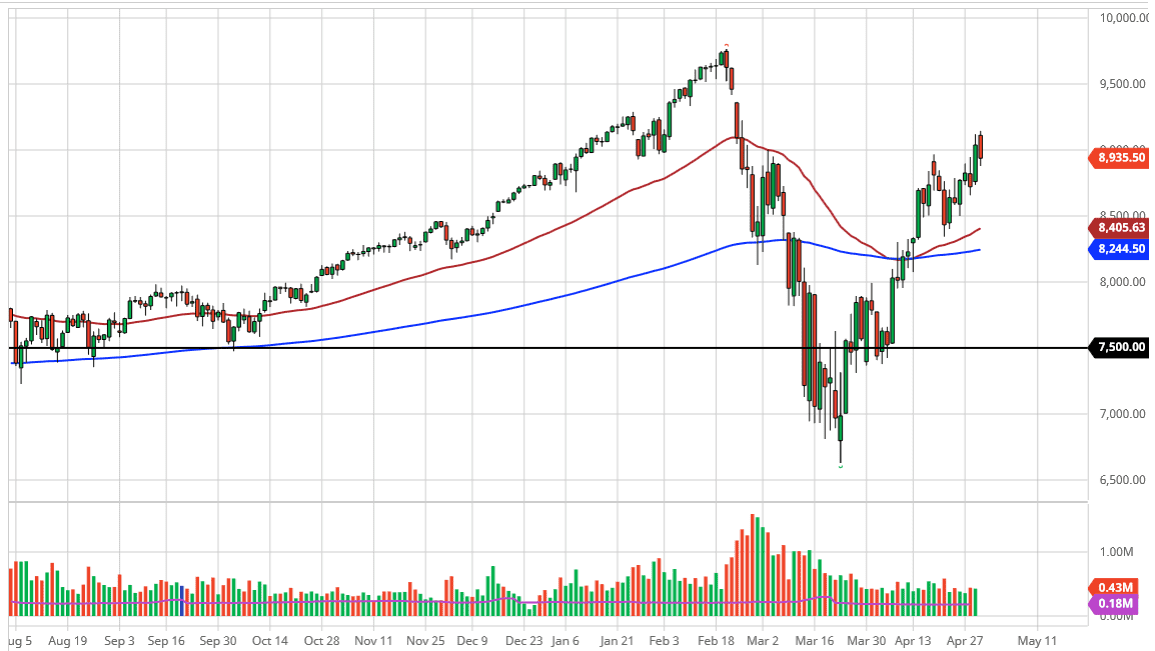

The NASDAQ 100 has pulled back a bit during the trading session on Thursday, after breaking significantly above the 9000 level. Having said that, it was the end of the most of their may have been a little bit in the way of profit-taking, while Tesla and Amazon both got hit a bit. That being said, this is a market that should see plenty of support underneath, and therefore it is likely that we will see buyers coming in to chase the momentum that we have found in this market. After all, is the first in the month and there will be traders out there looking to put money to work.

I believe that there is significant support all the way down to at least the 8750 level, if not the 8500 level. The 50 day EMA is sitting just below there, so that could come into play as well. If we break above the top of the candlestick for the trading session from Thursday, this market could very well go looking towards the gap above at 9250, which looks to be a potential target at this point anyway. That being said, we do not go straight up in the air forever, so a pullback would make sense even if you still believe in the bullish attitude.

That being said, I believe that you have to pay attention to how the future start out in Asia, because the Europeans will be celebrating May Day. Ultimately, Wall Street will probably go looking for some type of return, but if we do pull back then it is probably best to simply stand on the sidelines and wait until Monday when everybody comes back to work again. Another thing you may need to keep in mind is that at the end of the day there may be some selling as we go into the weekend in order to avoid headline risk for a lot of traders out there. Regardless, the trend is obviously a very bullish and therefore I do not really have a scenario in which a willing to short this market, despite the fact that the economy is absolutely crushed at the moment. You cannot make the mistake of trading the markets based upon the economy, because they have almost nothing to do with each other since the Great Financial Crisis over a decade ago.