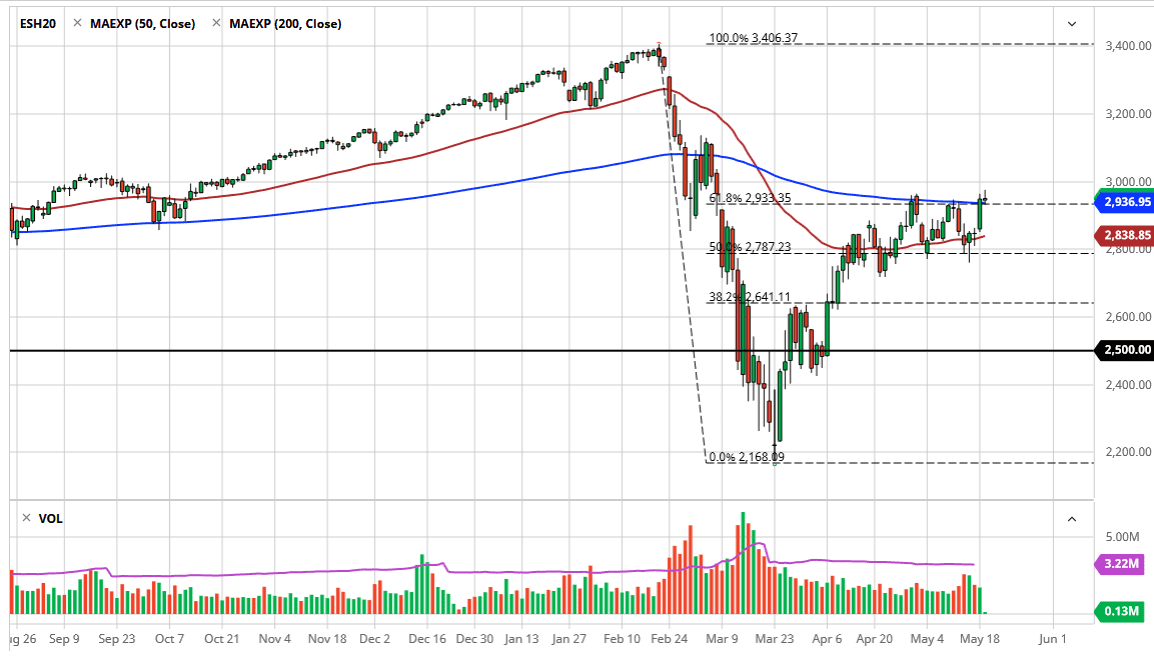

The S&P 500 has initially tried to rally during the trading session on Tuesday but gave back the gains to form a shooting star. This is a pattern that we are starting to see time and time again, the market rallying on some type of hope for the first couple of sessions, only to give up the gains and start selling off later in the week. What does this tell us? It tells us a lot of things, but the skinny on that answer would be that the market has no idea what it wants to do. We are at several technical levels that could come into play, and of course the economic reality is much different than what the stock market has been showing for some time.

Looking at the shape of the candlestick, it is a shooting star that of course is negative. Furthermore though, we are sitting right at the 200 day EMA, the 61.8% Fibonacci retracement level, and of course the 3000 level. All things being equal, you should also pay attention to the fact that the gap to the left is continuing to show resistance as well.

I do think that the sellers will come back in but whether or not we break down through the 2800 level is probably a completely different question. Eventually we will get some type of major break out of this 200 point range, but right now we just do not see it and therefore it is unlikely to be able to trade a longer-term move. I think given enough time, we will get that ability and then it is likely that we will see a longer-term run. If we break down below the 2800 level, we could go to the 2640 level, perhaps even the 2500 level if things get really rough. Alternately, if we break above the 3000 level, I will anticipate a move to the 3100 level initially, followed by an attempt at the highs.

In the meantime, you are going to see a lot of noisy trading and therefore a lot of frustration if you are not careful and try to get too bullish with too large of a position. Ultimately, I think that a little bit of diligence is probably crucial, as the volatility seems to be getting worse, not better. However, we do have a somewhat well-defined range, so use that.