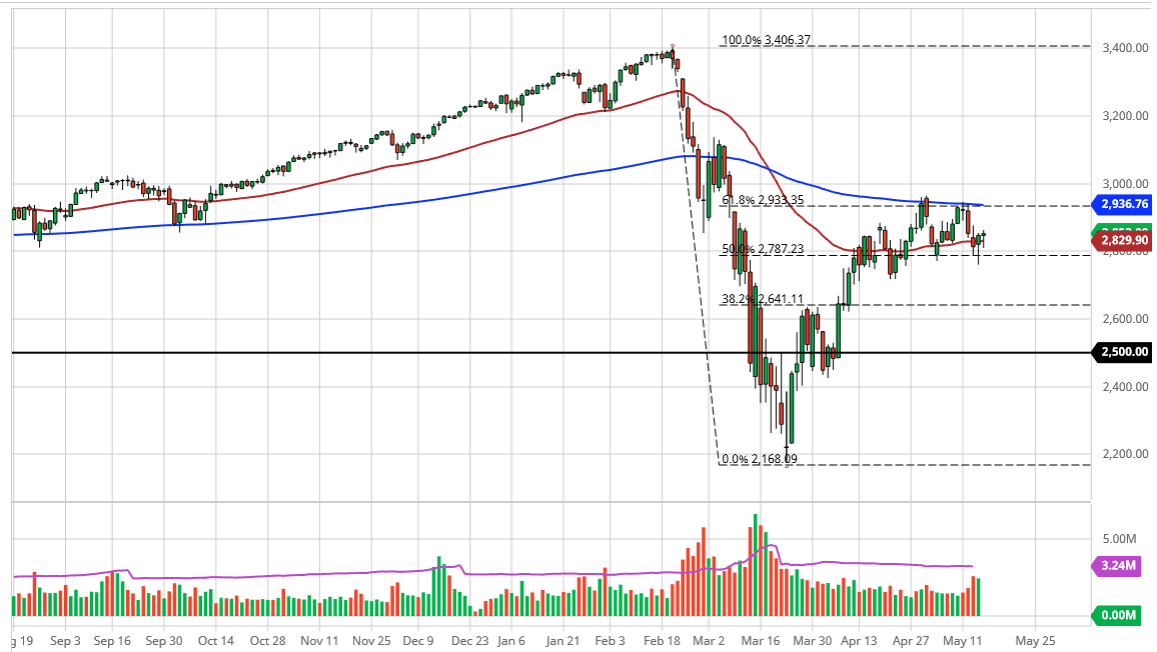

The S&P 500 went back and forth during the trading session on Friday, as we dug into the hammer and looked rather negative for a large portion of the session, but late in the day the so-called “plunge protection team” showed up and pushed the stock market higher as it did on Thursday. There is a significant amount of support underneath at the 2800 level, so that should be paid attention to as a potential “floor” in the market. As long as we can stay above that level, the market has an opportunity to rise. That being said, there is also significant resistance above at the 200 day EMA, at roughly 2936. That is an area that should continue to offer resistance, extending all the way to the 3000 level.

I anticipate a great squeeze here, and we will get a large move sooner or later. The 61.8% Fibonacci retracement level as most certainly offered a lot of resistance and the 3000 level above there will also offer significant resistance, with of course the 200 day EMA showing up. All things being equal, the market looks like it will continue to see sellers on rallies, but if we were to break down below the 2800 level on a daily close, it could open up the door down to the 2640 handle. Underneath there, the market could go as low as 2500. The market certainly seems to be running out of momentum, and it should be noted that the last couple of candlesticks have seen a slight increase in volume. That tells you that some things up, now it is just a matter of the market proving itself as to which direction it wants to go.

Furthermore, we have to keep in mind that the earnings season issues are still overhanging the market, and of course lots of concerns about coronavirus numbers and the troubles in reopening the economies around the world. In other words, everything has to go perfectly right in order for the markets to continue going higher, and that does not seem highly likely at this point in time. Fading rallies is by far my favorite way to trade this market, but I would not hesitate to start shorting a major breakdown either. I anticipate that this next week or so could be rather interesting to say the least.