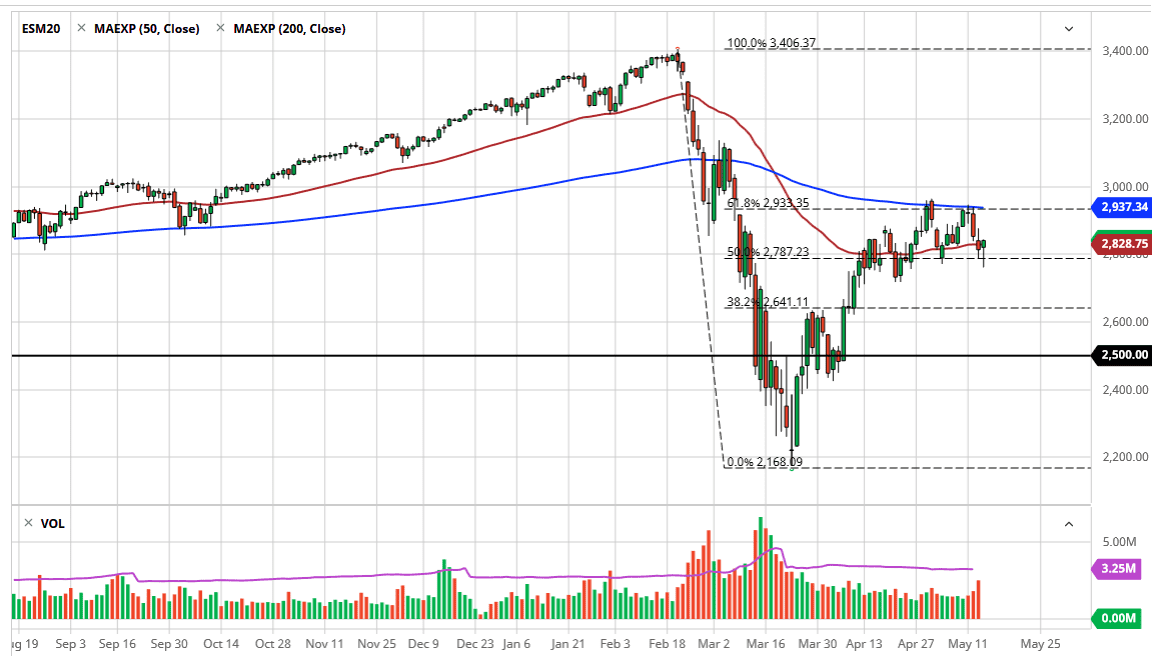

The S&P 500 has broken down a bit during the trading session initially on Thursday, especially in the Globex session as futures traders bet on further weakness. However, midday in the United States everything went awesome again, and we started to see buyers jump into the upside. The market has broken above the 50 day EMA, and now looks as if it is going to go looking towards the 200 day EMA above. I think in that area we will probably see a lot of bearish pressure, extending all the way to at least the 3000 handle.

Signs of exhaustion will be jumped upon, and I think at this point it is difficult to show a very bullish hand at this point, because quite frankly the selling has been so resilient. On the other hand, the buyers have been very resilient as well, so all things being equal I think it is only a matter of time before we will have to make a longer-term decision, which will show itself in the form of an impulsive candlestick.

Once we get that impulsive candlestick, then it is likely that we will see a bit of follow-through but right now it does not look like we are ready to get it yet. Because of this, I anticipate that we are going to continue to see a lot of choppy back and forth action, as the market simply has no idea what to do with itself. Furthermore, there are a lot of problems around the world to think that the market is going to simply take off to the upside in the way it had been over the last decade or so.

At this point, the market is likely to see the back and forth action as more of a day trading type of opportunity, but as far as some type of trend is concerned, we are clearly either trying to digest a lot to gains or perhaps even getting involved in a bit of distribution. That should make itself clear, but it is probably going to be next week as Friday is not necessarily conducive to people making massive moves unless of course we get some type of shock announcement. There is the possibility that Retail Sales in the United States moves the market, but if that does not, I can imagine what will considering how much noise we have had as of late and how much has been discounted.