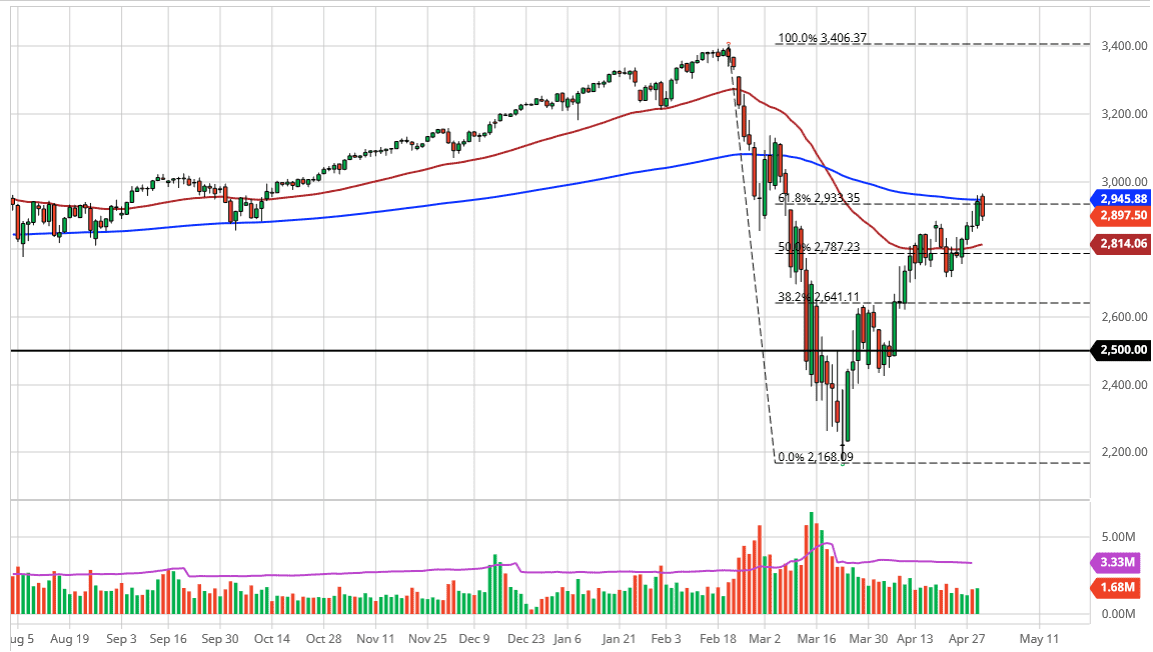

The S&P 500 pulled back a bit during the trading session on Thursday, as we had run into the 2945 level, which is where the 200 day EMA sits. The fact that we pullback is an especially important thing to pay attention to, mainly because it was the end of the month, and of course traders will be booking some profits. Furthermore, we struggled at the 200 day EMA, which is not a huge surprise considering the typically you do not just slice right through it like it is not even there. Beyond that, there is also a gap in this area that offered resistance so that of course makes a bit of headwind for the market.

The 61.8% Fibonacci retracement level is sitting in the same area as well, and that of course we have the 3000 level above. In other words, there is a whole slew of factors that come into play, as the convergence of all of these problems continues to be a major headwind for this market. However, the 50 day EMA which is just above the 2800 level should come into offer a bit of support. Do not get me wrong, I recognize that the economy is in bad shape, but the Federal Reserve is more than willing to liquefy the markets, and of course Wall Street will applaud this by pushing indices higher.

We are in the midst of the earnings season so you can expect a lot of noise in general. The 3000 level above being broken to the upside would almost guarantee that were going to go to the highs yet again. That being said, you see these massive bear market rallies during major financial crises, so there is still the argument that we are simply bouncing in order to fall again. That story is one that needs to present itself rather quickly though, otherwise we will have yet another “V-shaped recovery” like we had at the end of 2018. The next 24 hours should be relatively straightforward. We either break above the top of the candlestick for the session on Thursday and continue to go looking towards the 3000 level, or we break down below the bottom of the candlestick from Wednesday and selloff into the 50 day EMA. All things being equal, the market looks like it is going to have to make some decisions rather soon.