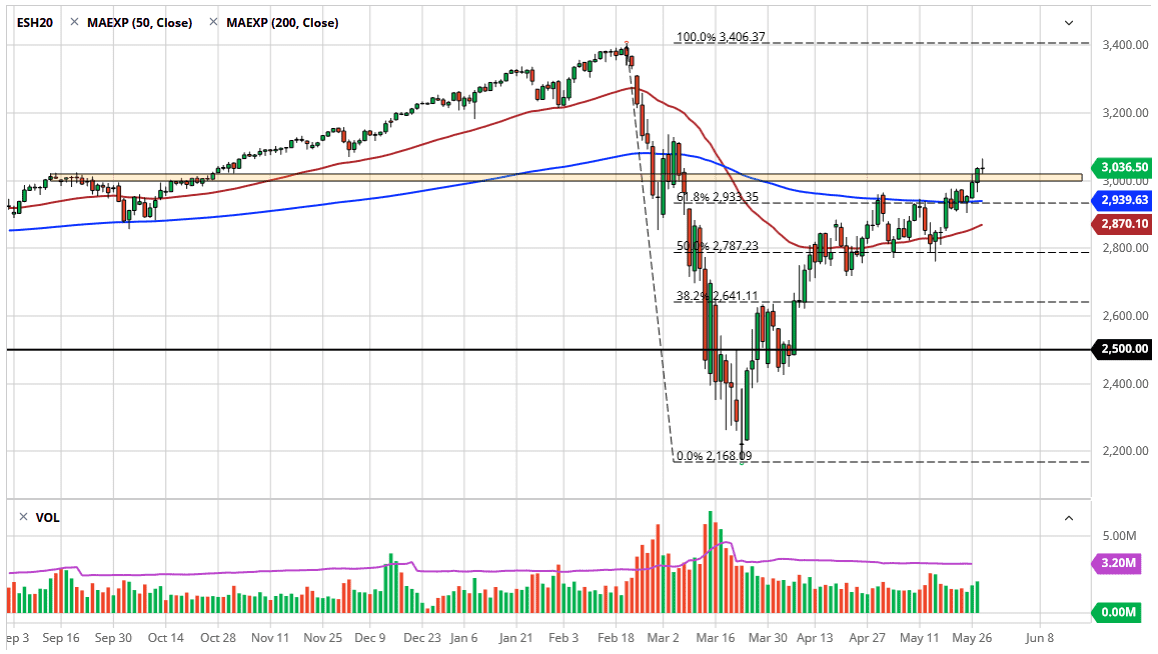

The S&P 500 has gone back and forth during the trading session on Thursday, showing signs of exhaustion. Ultimately, the 3000 level underneath is an area worth watching, because it is a large, round, psychologically significant figure. If we give that up on Friday, that could be an extremely negative sign. The market has resistance extending all the way to the 3100 level, as there is a 100 point range of noise in the past. Overall, I think it is only a matter of time before we make a bigger move, but in the meantime, this is going to be a very messy market to say the least.

At this point, the 200 day EMA underneath should offer significant support near the 2940 level, just as it is an area that has caused significant noise. If we break down below that level, then the 50 EMA is underneath and waiting to offer support. Do not get me wrong, I do not think that the market is ready to fall apart quite yet, but clearly there are a lot of concerns when it comes to the economic situation, so we could get a sudden move but at this point it looks as if we are running into a little bit of exhaustion at extreme highs.

The market looks to be like one that probably needs to at the very least needs to find some type of value. If we can break above the top of the shooting star, then the market is likely to go looking towards the 3100 level, where there is even more resistance. By breaking above there, the market is likely to continue to go towards the all-time high, as the last major barrier would be out of the way.

Remember, this market runs on liquidity more than anything else and as a result the markets are likely to continue to look at “cheap money” as a reason to jump into the marketplace. This is the way it has been for 12 years, and fundamentals get brushed to the sidelines rather quickly. Ultimately, the markets and the economy have nothing to do with each other and that something to pay attention to. Yes, the occasional headline can come out and affect the market, but the end of the day means little, as long as the Federal Reserve is willing to bail out Wall Street every time it flops.