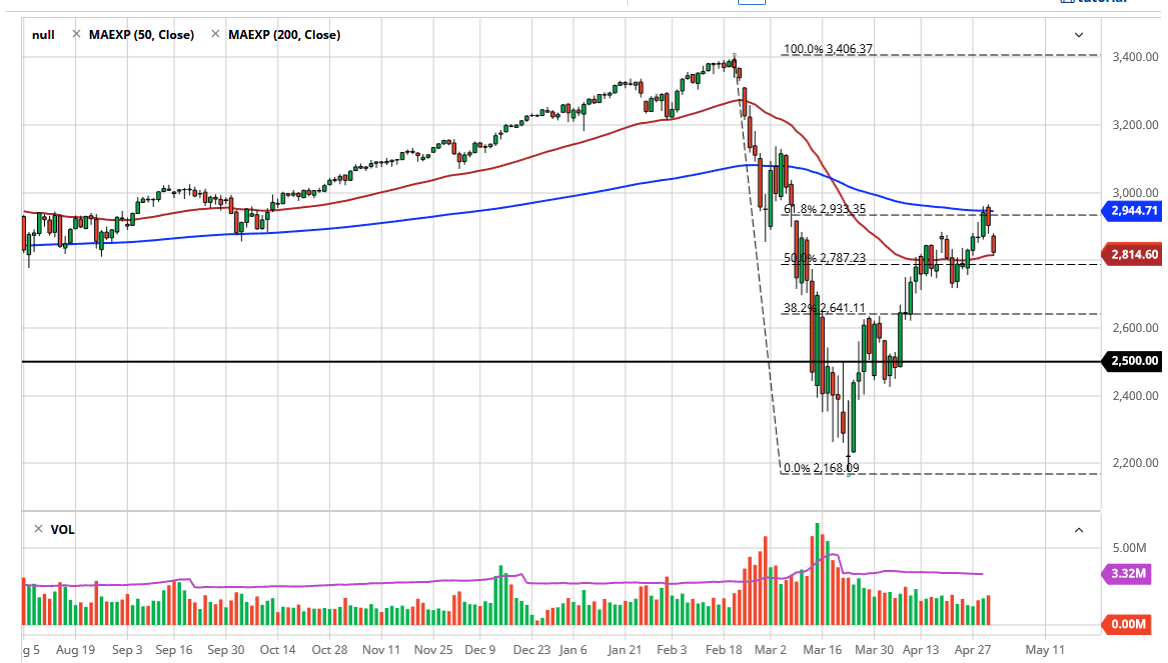

The S&P 500 has gapped lower to kick off the trading session on Friday, reaching down towards the 50 day EMA. If we can break down below that indicator, and certainly looks as if we can, then it makes sense that the market may go looking towards the 2750 level, an area that has been supportive and resistive in the past. I think that pulling back from the 61.8% Fibonacci retracement level makes quite a bit of sense considering that we had the 200 day EMA there, and of course the massive gap that has now been filled.

In other words, the market has done everything that it needs to do technically in order to continue going lower. I think you may have some time before we break down significantly but the one thing that you cannot ignore is the fact that the market is running out of momentum, and that is typically the first sign that the market could roll over and start selling off. All things being equal though, there is a gap above so do not be surprised if we have to fill that gap before we can make the bigger move lower.

To the upside, we would need to clear the 200 day EMA and then the 3000 level, which of course is very psychologically important. If we do clear that area, then I think we would be more than likely to rip towards the upside and go back towards the highs. That seems to be a bit of a stretch at this point, so I think it is much more likely to simply fade from here and continue going lower from a longer-term standpoint. Again though, I think it is highly likely that we could find a bit of a bounce and then sell into it near that gap.

With the jobs number coming out and likely to be absolutely horrific this week, I think that Wall Street will not be able to ignore that for much longer. Earnings season will continue to paint a dire picture, and with Trump now suggesting that he is ready to levy more tariffs on the Chinese, that is another thing for Wall Street to worry about. Tthe complete disconnect on Wall Street from the actual economy has been quite impressive, but I get the feeling we are too far from seeing that to converge again.