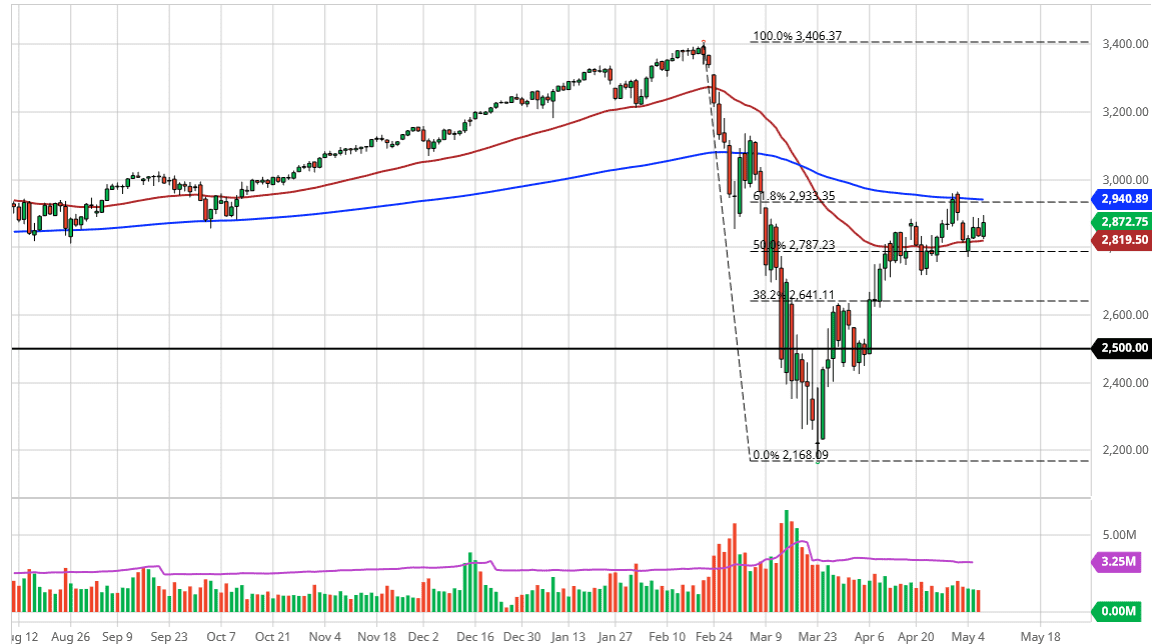

The S&P 500 has tried to rally during the trading session on Thursday but failed again at the exact same spot it has over the last couple of days. With that being the case, the gap that ended up sending the market lower from the highs is still somewhat intact. That being said though, the market breaking above there would be something to pay attention to, but I think you can be a buyer until you get above the 200 day EMA on a daily close. Do not be overly surprised if that happens, because Wall Street is expecting negative interest rates by the end of the year. This was seen in the Fed Funds Rate Futures during the trading session, as the December 2020 contract went negative yields during the day.

Wall Street loves cheap and free money, and it will use it to buy stocks, just as it has since the beginning of the Great Financial Crisis. Ultimately, it is not until we break down below the 2800 level that I would consider selling this market, but it has not gone lost on me that we have formed three wicks in a row that were right at the gap that kicked off the major selling last Friday. Be aware of the fact that the jobs number of course can cause major problems, as it will cause a lot of choppiness. I would not be surprised at all to see this market hang around in the same general vicinity, bouncing around between the 50 day EMA and the 200 day EMA as traders are trying to find some type of clarity when it comes to where we are going next and if we can get some type of explosive candlestick that could be the clue that we are looking for. The range has been compressing, but that is not a huge surprise considering that the jobs number is coming. At this point, we are running out of momentum so a break down from here is not necessarily out of the question, but it seems as if the market simply will not rollover. If that is going to be the case, then it is likely that we will be very noisy in general. I do not like putting a lot of money to work between now and the end of the day, unless of course we break either above the 200 day EMA which I would be a buyer of, or if we break below the 50 day EMA and perhaps even the 2800 level that I would be a seller of.