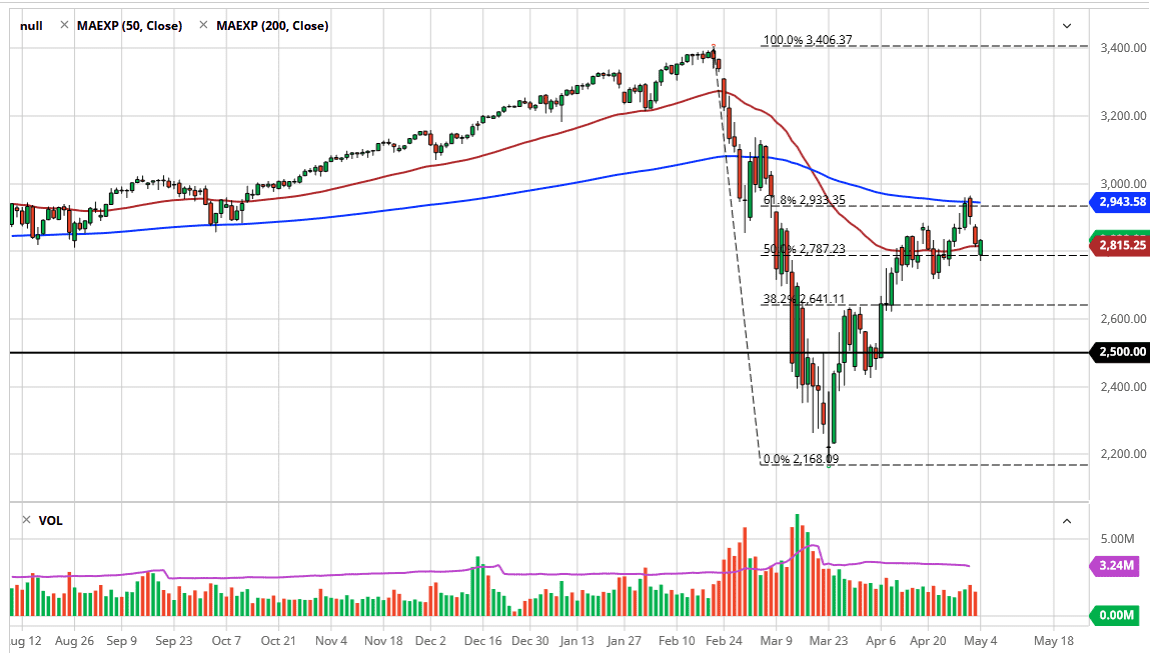

The S&P 500 initially gapped lower to kick off the trading session on Monday, and at this point it looks as if the 50 day EMA is starting to attract a certain amount of attention. That being said, there is still a gap from the beginning of the Friday session that is probably due to be filled in the next couple of sessions. That would make a bit of sense, because on Friday we get the jobs number so it is likely that we will see a couple of days of movement and then Thursday will be rather quiet, all things being equal.

To the downside, the market still sees the 2750 level as support, so if we were to break down below there it would be an extremely negative sign and probably of this market looking towards the 2600 region, perhaps the 2640 level which had been important in the past. It is worth noting that the 61.8% Fibonacci retracement level has offered a significant amount of resistance, so the fact that we pulled back from there makes quite a bit of sense as it is a level that a lot of traders will pay attention to. Furthermore, the 200 day EMA is sitting right at that level as well, so this is a significant place to see selling pressure. If we can break above that level, it would obviously be a very bullish sign and could send this market to much higher levels, possibly looking to take out the highs given enough time.

The question now is whether or not we will see follow-through after the jobs figure. The jobs figure will probably be quite shocking, but the market already knows that. The question is whether or not the Bureau of Labor Statistics shocks the world or not. I anticipate that we will continue to see a lot of choppy volatility, and as a result it definitely puts a bit of a limit on the ability of the market to rally in the short term. If we break down from here, I anticipate that there will eventually be value hunters looking to get involved. Yes, the market rallying the way it has makes no economic sense but the economy in the stock market have had nothing to do with each other since the Great Financial Crisis, so therefore all you can do is simply follow price action.