The S&P 500 is sitting on top of support at the end of the session on Wednesday, and as a result it will be interesting to see how Thursday and Friday play out. There are one of economic announcements coming out during the week, and Jerome Powell certainly spooked the market during the trading session when he suggests is that there would be no negative interest rates going forward. After all, Wall Street has been trading on the idea of cheap money and got even more excited about the prospect of free money.

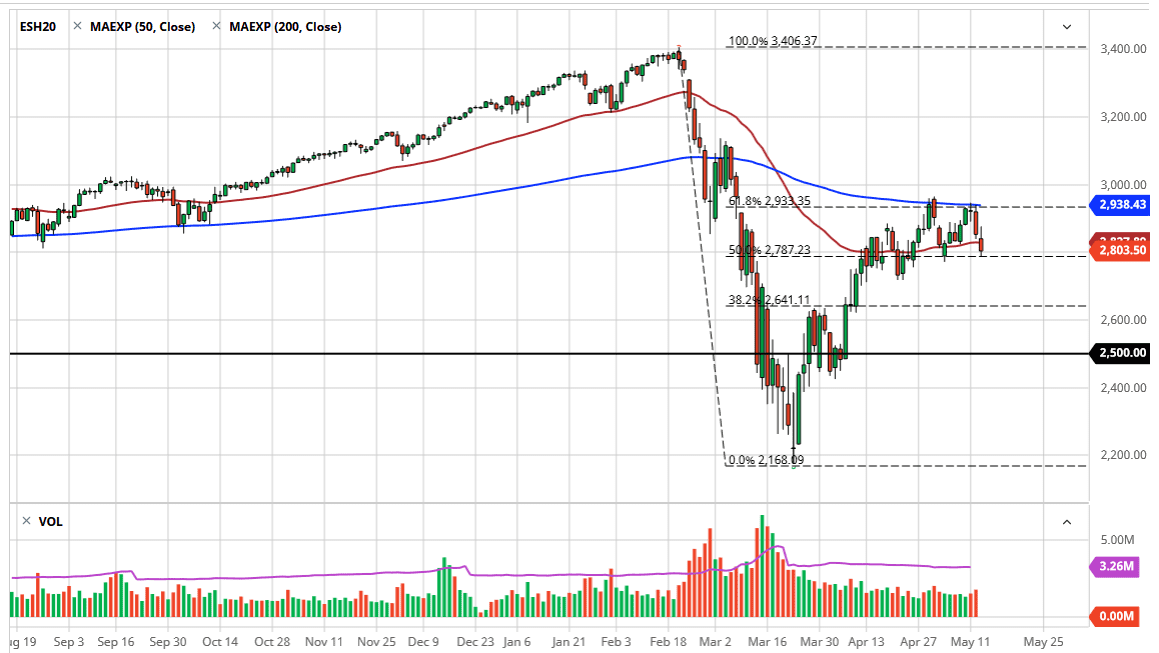

That being said, the 200 day EMA sits above and the 2940 handle, which is also where the 61.8% Fibonacci retracement level is. With that, there should be plenty of resistance above and I think that sellers will come back in every time we try to rally. It is worth noting that the most recent high was slightly lower than the one before, so it looks like we are trying to break this thing down but obviously it is going to take quite a bit as the market simply refuses to roll over and die. With the extraordinarily low rates coming out of the Federal Reserve, Wall Street has been trading on the sugar higher for well over a decade now. In fact, fundamentals have been thrown out the window and it has been all about liquidity over the last several years, and that is still the narrative.

We are in the midst of earnings season and of course they will have a certain amount of influence but at the end of the day as long as money is cheap and easy, the downside will be somewhat limited. That being said, if we were to break down below the 2800 level it could open up the door to the 2640 level. That is an area where I would expect to see a lot of support underneath, and as a result it is likely that a bounce from there is probably what you would see next. To the upside, if we can break above the 200 day EMA and perhaps even the 3000 level, then the market is likely to continue going higher. Expect a lot of noisy trading, but as things stand right now, we are essentially in a range of roughly 140 points in this index. We will eventually get an explosive move but the market does not seem quite ready to make that decision yet.