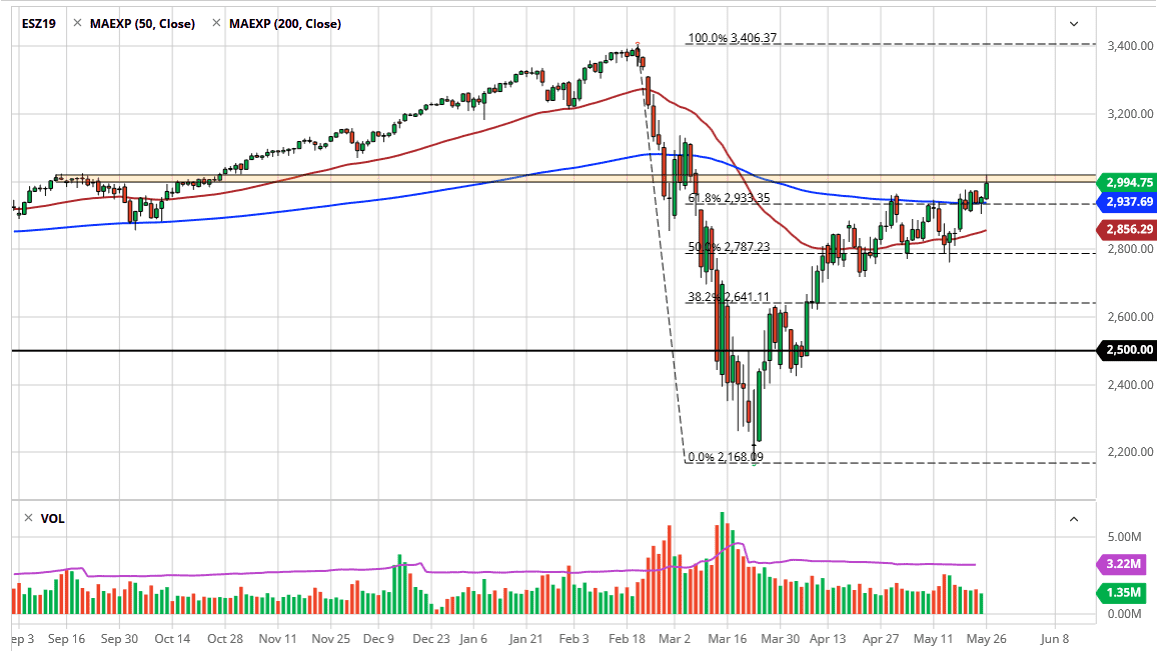

The S&P 500 rallied a bit during the trading session on Tuesday as traders came back from the Memorial Day holiday. Ultimately, the 3000 level was broken above at one point during the trading session, but late in the day we started to get noise about the United States and China trading barbs again, so that of course has people concerned. After all, we have been going straight up in the air based upon the hope of the world economy is going back to normal again. That being said, it seems as if traders had forgotten that the United States and China were still at all odds over a whole plethora of things.

The 3000 level of course is psychologically important, so at this point breaking above that level opens up the door to bigger moves if you can hang on to it. Ultimately, the market looks likely to attempt it again, but the market may be a little bit stretched. With that being the case, do not be surprised at all to see this market reach down towards the 200 day EMA to build up the necessary momentum. If we break down below the 200 day EMA and perhaps more importantly the hammer from the Monday session, then we could go looking towards the 50 day EMA. This is essentially a mirror image of what we are seen in the NASDAQ 100 market over the last 48 hours so the two markets should essentially move in tandem. The 2800 level underneath is massive support as well, so having said that I would anticipate that there should be plenty of buyers in that area. If we were to break down below the 2800 level, it could open up massive selling and a breakdown like we had seen several months ago.

I like the idea of buying short-term dips because the market has been extraordinarily resilient. However, if we do get that major breakdown then things could get rather ugly. That would obviously coincide with some type of overall negativity, so with that in mind I do not expect to see that happen in the short term but if it does, I certainly will be paying attention as the market could very well lose 160 points rather quickly. To the upside, a move above the 3000 level opens up the door to the 3100 level, but there is so much in the way of noise between here and there that the move will be easy to say the least.