The S&P 500 has rallied quite nicely during the Friday session, despite the fact that the United States printed a job loss of 20.5 million, and an unemployment rate of 14.7% for the previous month. That being said, if you had any doubt whatsoever that the stock market is completely disconnected from the economic reality, the Friday session should have proved it to you. That being said, let us take a look at the market and see what the set up actually is.

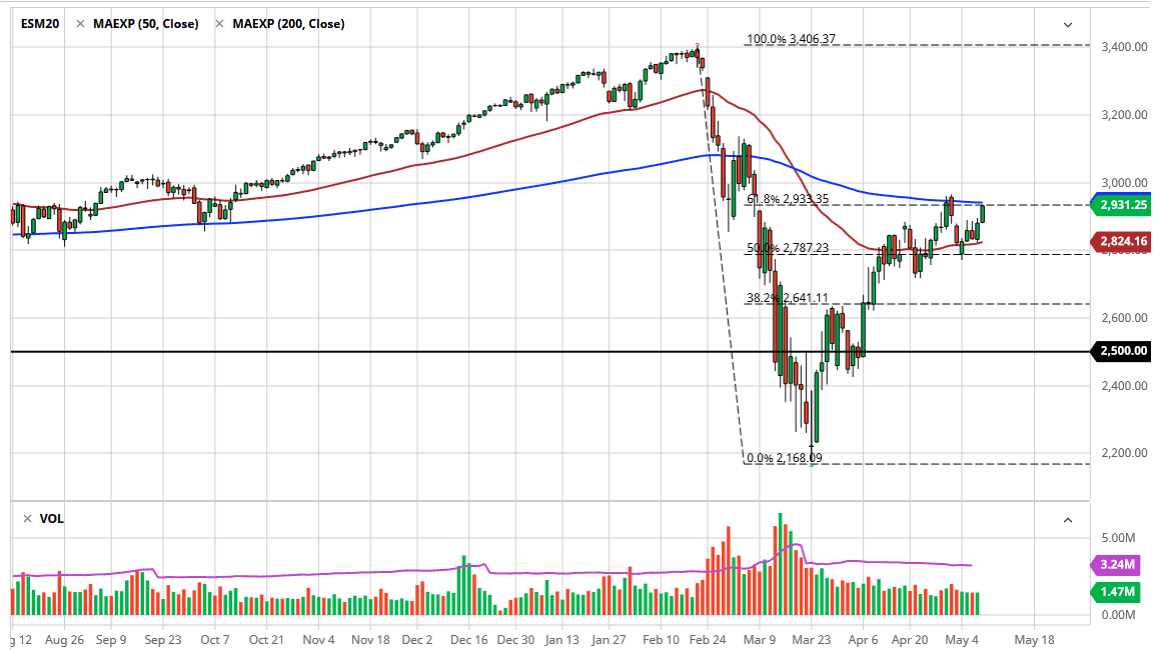

The 200 day EMA sits just above the clothes, and it is likely that we are going to try to break above there. It is also where we see the 61.8% Fibonacci retracement level. The 3000 level above is also going to cause some pressure. At this point, when you close this high in the range, it is quite common to see this market continue the move. If we can break above the 3000 level, it is highly likely that the market goes looking towards the 3100 level. In the short term, if we do pull back it is likely that there is a lot of support to be found in the form of the red 50 day EMA.

The S&P 500 continues to look through all employment data, perhaps in the hope that the economy snaps right back to the way it was before the pandemic. The economic numbers were starting to slip before the infection broke out, so the fact that the pandemic broke out was simply the little bit of a push the market needed. The question now is whether or not Wall Street is going to pay attention to the Federal Reserve liquidity, or the economy? So far, it is all about the Federal Reserve, as it has put a bit of a put underneath the market.

Unfortunately, it is probably only a matter of time before we get the next leg down but on Monday, it does look as if we are going to break towards the 3000 level. If we can get above there, then it is likely we go much higher. Until then, you can expect a lot of choppiness in this general vicinity, as there are a multitude of things working against the breakout. That being said, the reality is that the market simply will not roll over so far, and therefore fighting it has been a major way to lose.