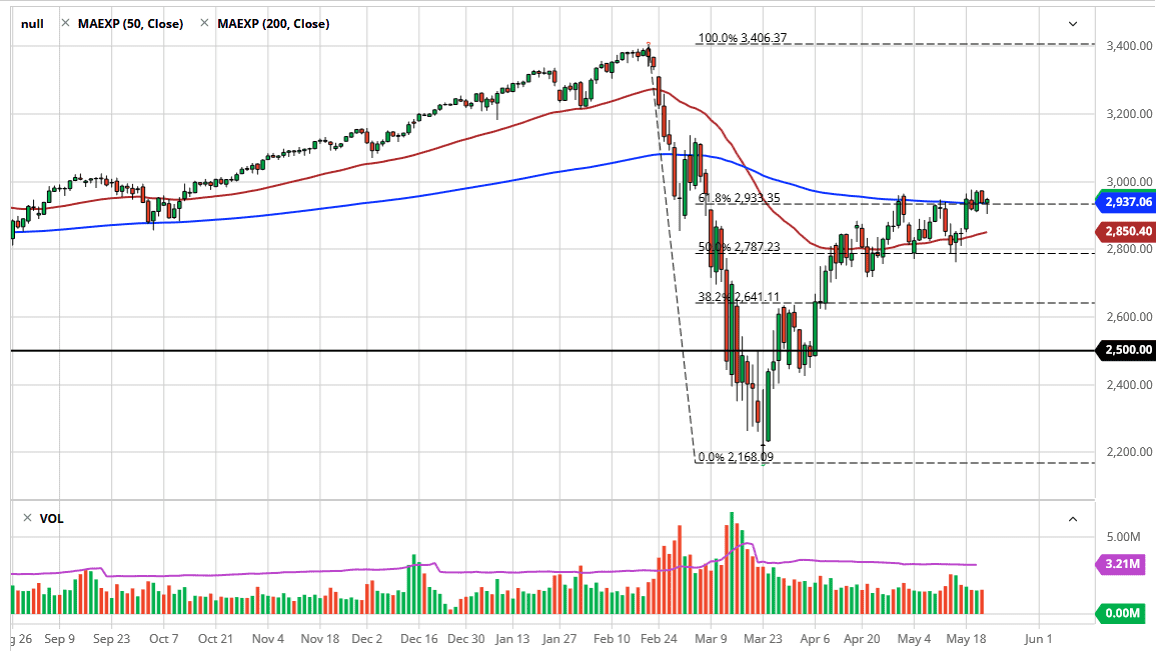

The S&P 500 initially fell during the trading session on Friday, reaching down towards the bottom of the one of the candlestick before finding buyers underneath. At this point, the market is likely to see a lot of resistance above though, as the 200 day EMA is right through the middle of the candlestick, and that suggests that the market is likely to see a lot of volatility in both directions. At this point, it is difficult to imagine a scenario where we simply take off in one direction or the other, and I think we are going to see more of the same. However, the 3000 level above of course is a major issue, so we need to pay attention to that as well.

The 3000 level being broken to the upside would be a very bullish sign, as it is not only significant resistance in this area that it would be overcoming, but it would also be getting above the round figure that allows it to continue to reach towards even higher figures. The candlestick of course is a bit of a hammer and that suggests that there are buyers waiting to get involved. If we break down below the bottom of the hammer, that then turns it into a “hanging man”, which is very bearish. At that point I would anticipate that the market probably goes looking towards the 50 day EMA. After that, the market then looks likely to go down to the 2800 level.

All things being equal, we are essentially trading in a 200 point range between that previously mentioned 3000 level and the 2800 level. This makes sense considering we are basically through earnings season and at this point there is not a whole lot to move the markets from in that sense. It is likely to see a lot of noise from coronavirus headlines and of course worries about whether or not the economy is truly going to open up the way Wall Street expects it to. I think they are going to be surprised by the reality, but in the short term it looks as if they may get their attempt to break out. I would be cautious about jumping in right here though, I think it is simply a “50-50 ball” as far as trading is concerned. However, we will eventually get our move and when we do it should be obvious.