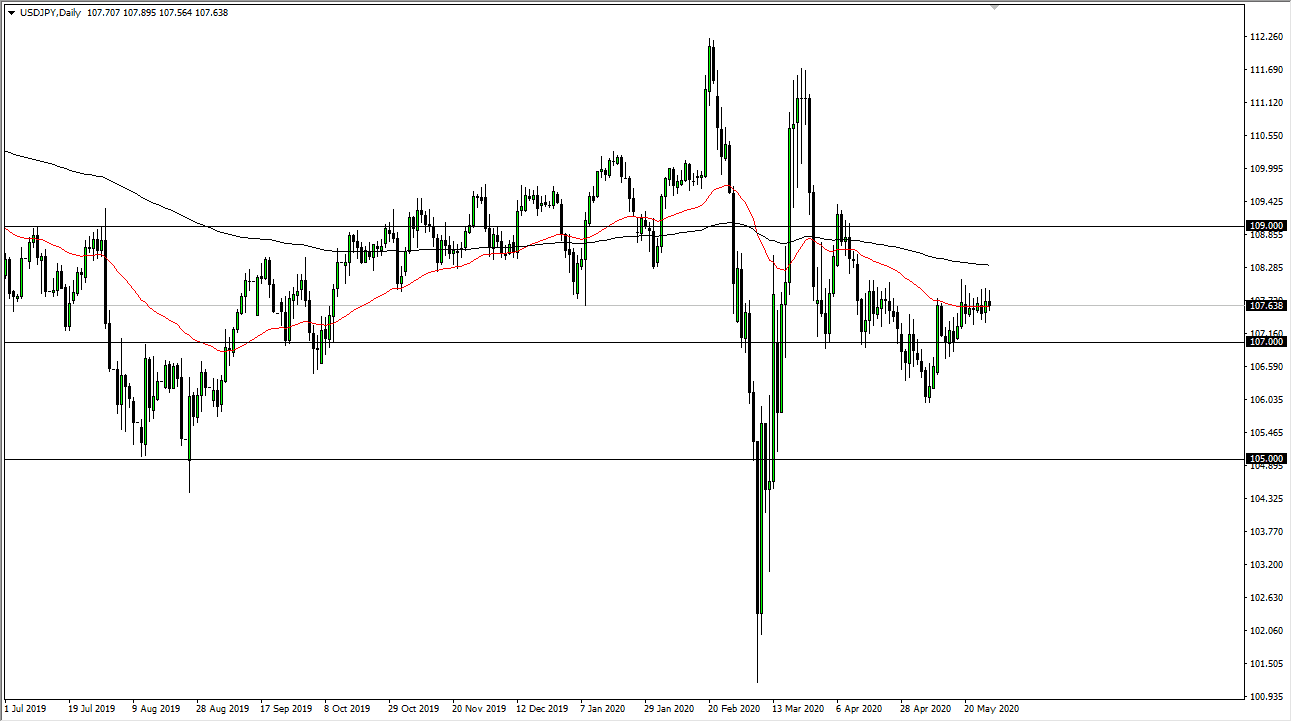

The US dollar initially tried to rally during the day on Thursday but found resistance in the same area that it has more than once, as the ¥108 level continues to be very resilient. The market looks likely to continue to trade in the same range it has been in, between the ¥108 level on the top and the ¥107 level on the bottom. I think at this point it is likely to see the market going back and forth try to figure out where to go next. At this point, the market is likely to see a lot of choppy behavior and confusion when it comes to the global situation. This market will clearly act the same way, due to the fact that currencies are both considered to be “a safety currency.” In other words, people will run to both in times of uncertainty.

If we can break above the ¥108 level, then it is likely would go looking towards the 200 day EMA just above, possibly even the ¥109 level after that. To the downside, if the market was to break down below the ¥107 level successfully, then the market is likely to go down towards the ¥106 level. That is an area that has seen a bounce, and then after that we could open up the door to the ¥105 level.

I think the only thing you can count on in this pair is a lot of noisy trading, which is essentially how the markets are trading on the whole anyway. This pair has nowhere to be anytime soon so quite frankly I cannot be bothered. However, if you are a scalper this might be the place to be because at worst you probably going to lose about 30 pips. That being said, if you do see a breakout of this range, then you know that the markets going to make more serious move. Otherwise, it is going to be more of the same nonsense that we have seen of the last couple of weeks, and as a result it is likely that we will see more back-and-forth choppy trading but quite frankly does more damage to retail accounts than anything else. If you are looking for a bigger move, this is not going to be the pair for you but if I see something change, I will be the first one to let you know at Daily Forex.