The Brazilian Real has been selling off quite drastically against the greenback since February 1 the coronavirus infection really started to take hold. What is interesting is that the Brazilian Real is considered to be one of the stalwarts of Latin America, and currently it is been absolutely pummeled against most currencies around the world, especially against the US dollar.

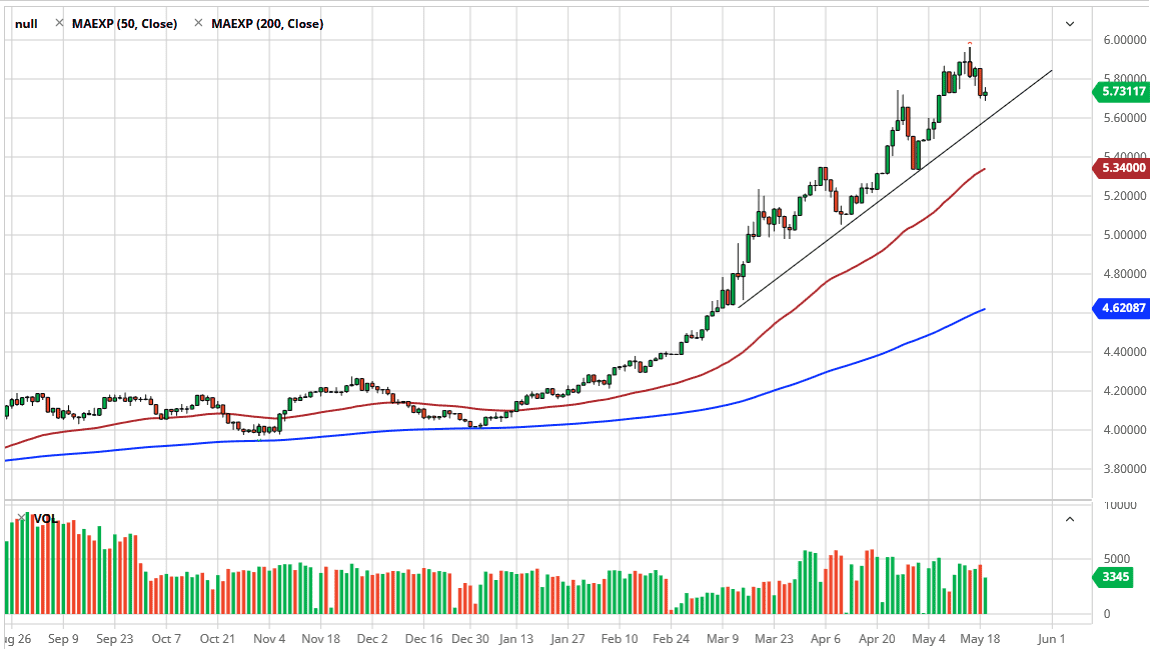

As you can see on the chart, there is a perfect channel that we have been climbing since the USD/BRL exchange rate crossed the 4.60 level. There is a high likelihood that we continue to see the US dollar break higher against the Real as the infection rate in Brazil continues to strengthen, and as a result it is likely that the market will continue to sell the Real as an extension. It is difficult to imagine that the economy is going to expand like it has in the past as long as we have these issues. Furthermore, the United States being the owner of the world’s reserve currency helps this continue as well. The US dollar will see a lot of bullish pressure against most currencies, and as the emerging markets are concerned, it seems to be even more so.

When I look around at the Russian ruble, the Indian rupee, the South African Rand, and of course the Brazilian real, it is obvious to me that emerging market economy still are in a lot of trouble, as shown in the FX markets. Furthermore, the debt around the world for these countries are quite often denominated in US dollars so it is going to cause a natural demand for the greenback anyway. The Brazilian real is considered to be a “gateway currency”, at least for South America. If you are trading on a South American thesis, this is the first place you look, perhaps followed by the Colombian peso. With that being the case, it is obvious that the world is very bearish on South America right now, and as a result it looks like we are going to go looking towards the 6.00 level again in this pair. I think short-term pullback should see plenty of support near the 5.6 level and offer value. Furthermore, the 50 day EMA is currently at the 5.34 level and rising quite rapidly and in a steady manner. Looking at this chart, there is no reason to think that we will continue to go higher over the next several weeks.