Rupee has lost value due to the growing coronavirus impact.

The RBI has been careful to point out that economic conditions in India remain challenging due to concerns about supply chain and have expressed concerns about the potential of inflation mid-term.

The Rupee broke resistance in late February and began to trade above 72.000. As of May the Rupee has lingered between 74.000 and 76.000 which it has not touched since late April. Global concerns about the Coronavirus and its effect on nations remain a tangible trigger in foreign exchange. The government of India remains aggressive in its policy and has shown the desire to confront economic concerns with proactive policy.

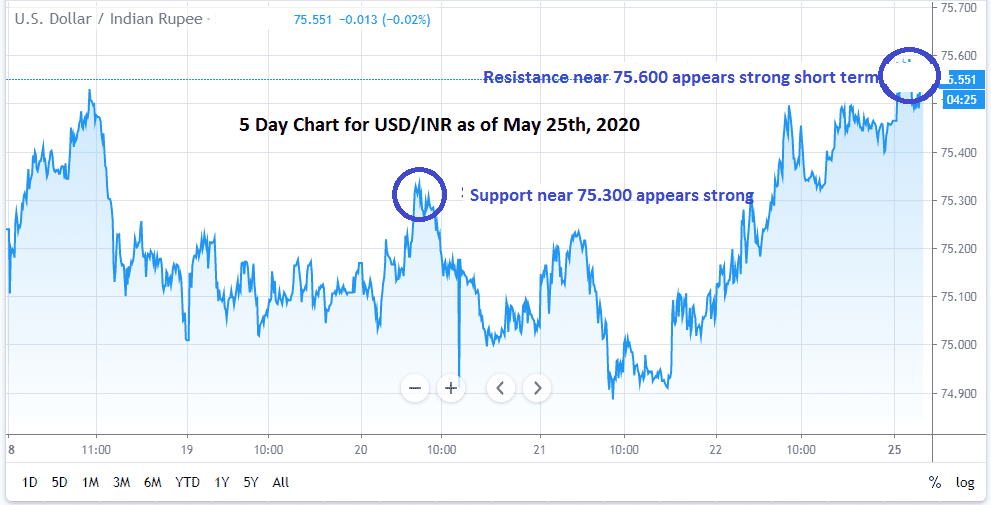

Trading within the Rupee the last three months has certainly tested a weaker range against the US Dollar. From August of 2019 until February of this year the Rupee’s range essentially was between 70.000 and 72.000. However that range now feels like a distant memory for traders with a short term perspective. A current range between 74.700 and 76.100 Rupees versus the USD is likely to remain the battleground short term.

Short term the Rupee continues to test its weakest levels against the US Dollar and the mark of 75.600 appears to be a key hotspot at this juncture. If the Rupee breaks through the 75.600 level and is not able to strengthen against the U.S Dollar, traders psychologically may begin preparing themselves for targets of 75.700 and beyond with a fear for further weakness.

Due to the interest rate cut from the Reserve Bank of India and the worries about unknown complications which could still confront India’s economy due to the Coronavirus, the short term appears to have more risk of weakness for the Rupee. A stronger move towards 75.400 remains a possibility but a support level currently of 75.300 looks to be strong.

The week is just beginning for traders and the early part of this week could be affected by the absence of U.S foreign exchange traders who are on holiday. However, the Rupee is also an important currency internationally because of the size of India and the economic growth the nation has made over the last decade. Currents conditions internationally remain challenging for all nations economically short term and the mid-term remains unclear. Presently, technical traders may want to be braced for further weakness for the Indian Rupee over the next week, but here are some reasonable resistance and support numbers to use against the U.S Dollar as an outline with potential goals.

Indian Rupee Short Term Outlook:

Current Resistance: 75.65

Current Support: 75.40

High Target: 75.85

Low Target: 75.35