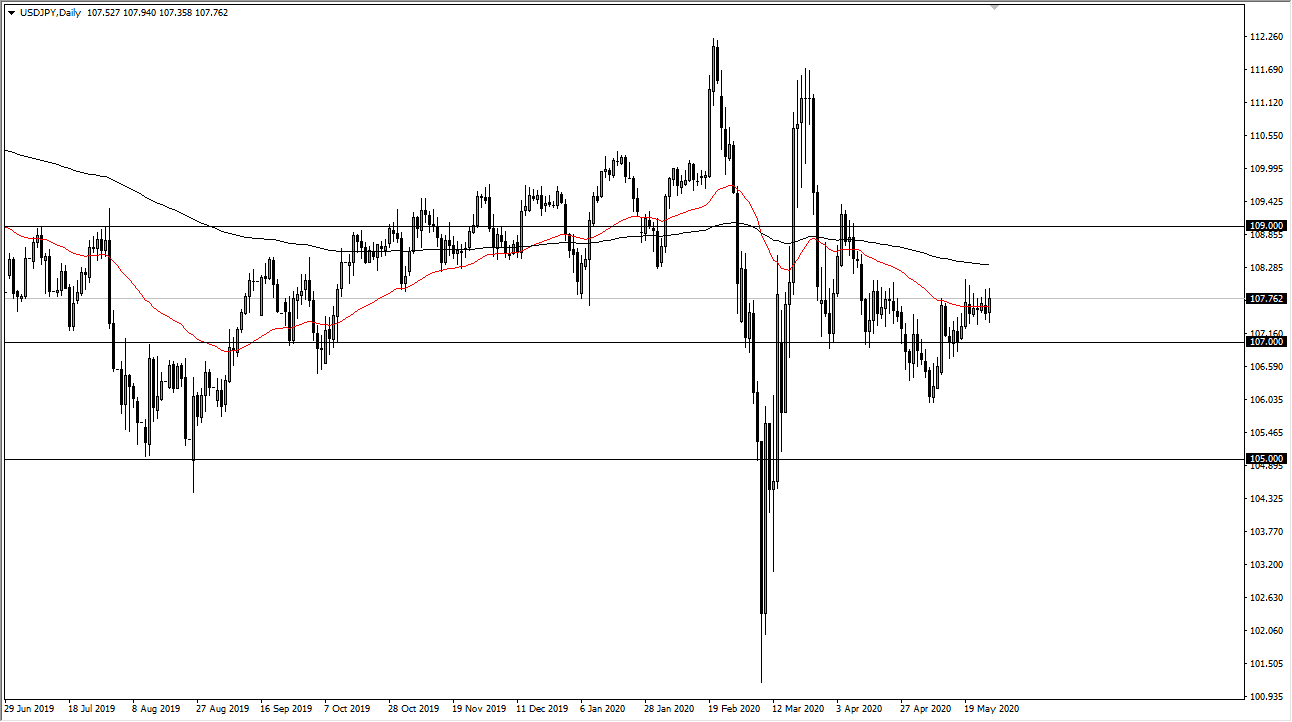

The greenback has gone back and forth against the Japanese yen during the trading session on Wednesday as we continue to see the 50 day EMA come into play and cause a lot of back and forth. Ultimately, the market is likely to continue to see a lot of back and forth due to the fact that the US dollar and the Japanese yen are both considered to be safety currencies. Because of this, if there is going to be some type of concern out there, it makes quite a bit of sense that the pair does not know where to go.

The ¥108 level above continues offer quite a bit of resistance, as we had seen during trading over the last five sessions. To the downside, the ¥107 level offers quite a bit of support, so having said that it is likely that the market continues to see a lot of back and forth short-term trading, so having said that it is likely that the most useful application of this pair is going to be go back and forth. Having said that, if we break above the ¥108 level, then the 200 day EMA above which is painted in black is a potential target. To the downside, if we were to break down below the ¥107 level, then it is very possible that we could go looking towards the 160 and level.

All things being equal, this is a market that will continue to see a lot of choppiness due to a lack of certainty, and with so many headlines out there coming into play, it will continue to see flows go in and out of this pair quite dramatically, and in equal amounts in both directions, and other words, it has got nowhere to be and therefore I think this is a pair that is something that you should be trading off of the 15 minute chart or something similar that more than anything else. I have got no interest in trying to go for a longer-term trade, at least not right now, as there is far too much in the way of uncertainty. However, once we do eventually get a large impulsive candlestick, then I could take quite a bit of interest in trying to play that breakout. However, it does not look like we are ready to do that anytime soon, so it is a simple matter of waiting.