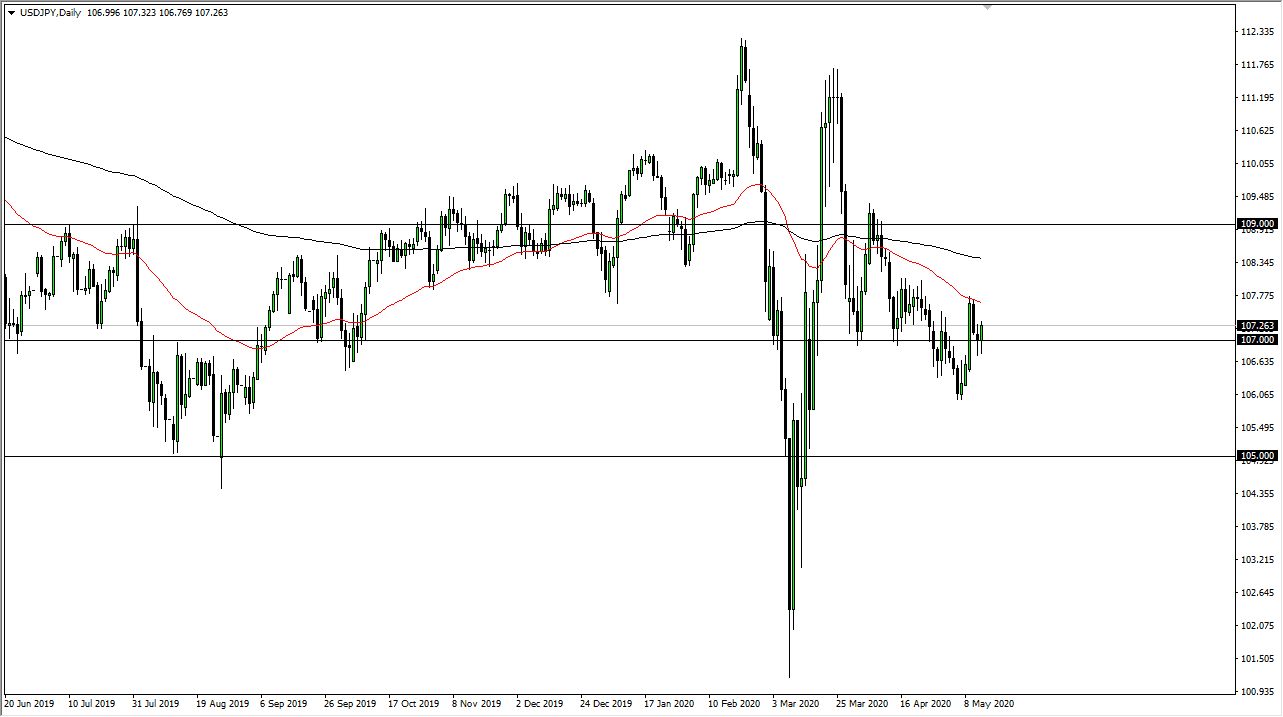

The US dollar initially fell during the trading session on Thursday but found enough support below the ¥107 level to turn around and show signs of strength. The market looks highly likely to see a lot of volatility, as the pair tends to be sensitive to the overall risk appetite of traders. A lot of times you will see the S&P 500 greatly influenced what happens next, and clearly of the upward swing in the stock markets in the United States during the day helped the situation.

The market has shown a proclivity to hang around the ¥107 level, as it is a large, round, psychologically significant figure and of course the previous support level that has been massive resistance. The fact that we have gone back and forth through this area tells me that we are probably trying to get rid of the meaning of this level, at least as far as its importance. The 50 day EMA is above and is sloping lower as it is painted on the chart in red. It has offered a significant amount of resistance recently, and therefore should be paid attention to. If we break down below the candlestick during the trading session on Thursday, then obviously it is a very bearish sign. At that point, it is likely that the market continues to go much lower.

Longer-term, I do believe that is what happens given enough time, but it is going to take a while to get there. I do believe that over the next few weeks we should see this market drop based upon risk appetite struggling, as although the stock markets, at least in the United States, have been stubbornly bullish. That being said, economic reality will enter the picture sooner or later, and we will start to see gravity take hold again. If that is going to be the case, then this pair should break down. I look at rallies as potential selling opportunities above, and not only the 50 day EMA as previously mentioned, but also the ¥108 level and most certainly the 200 day EMA. I am looking for signs and simply taken advantage of them. I am not interested in trying to buy this market, I believe that even if we are to bounce from here it is more than likely going to continue to show so much in the way of exhaustion that one can only short.