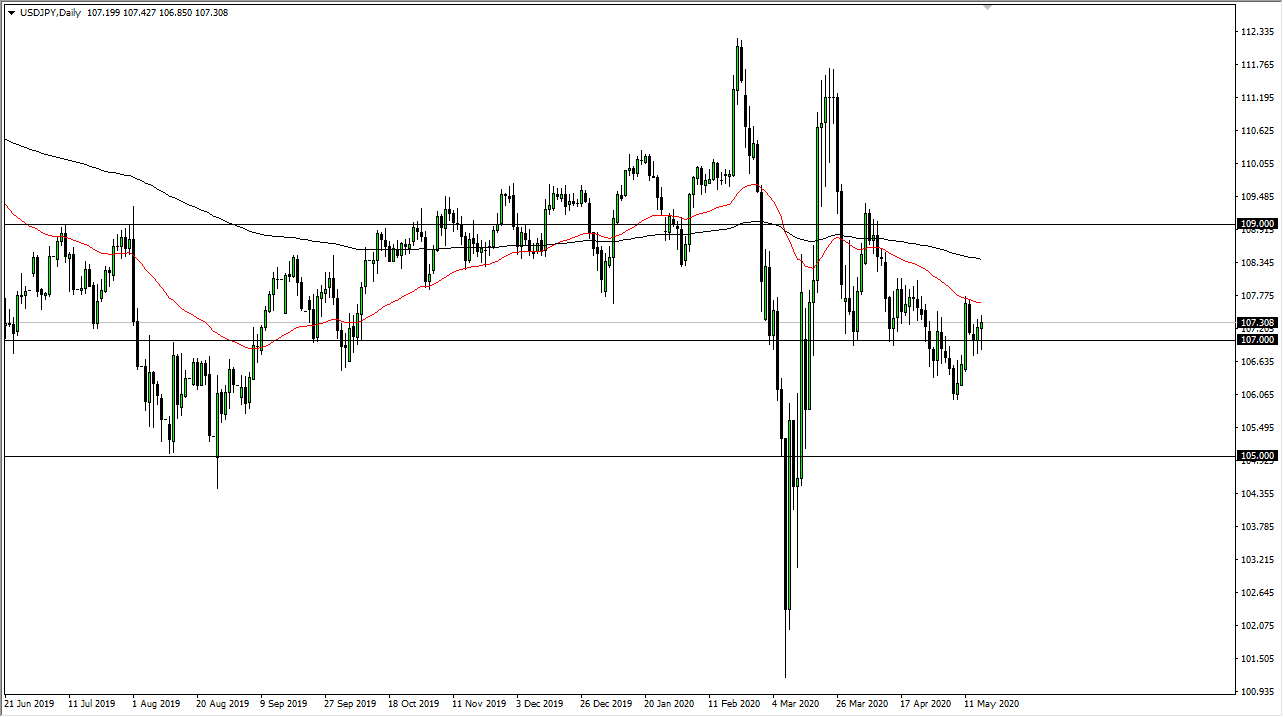

The US dollar has gone back and forth during the trading session on Friday, to close out the week on a relatively positive note as the candlestick looks a bit more like a hammer than anything else. This is a market that has the 50 day EMA sitting just above it though, so that could come into play and cause some issues. Ultimately, if we were to break down below the candlestick from the Wednesday, Thursday, and of course Friday session, the market will then wipe out a lot of that support and go looking towards the ¥106 level.

Below there, the market then will accelerate down to the ¥105 level, an area that I think is significant support. The ¥105 level is an area that has been important more than once, and I do think that it is only a matter of time before the buyers would come back into that level. However, if the ¥105 level were to be broken down significantly, then the market goes down to the ¥102.50 level.

To the upside, the 50 day EMA of course will offer resistance but so will the 200 day EMA. Furthermore, the market will see a lot of resistance at the ¥109 level. The market seems to be moving back and forth between 200 PIP levels, and I think that will continue to be the way forward. I would also point out that the market is extraordinarily tight, as the range of the last couple of weeks has shrunk. This does not last forever obviously and could lead to an explosive move. However, we do not have that right now and it is likely that we will see a move sooner rather than later. I think that the next week or so could be crucial, but this is one of those situations where you will “know it when you see it”, as we get a large candlestick in one direction or the other. I still favor the downtrend though, because quite frankly we have been in a downtrend for ages, recent volatility in the month of March notwithstanding. Keep in mind that this pair ask overly sensitive to risk appetite, and therefore you should pay attention to the stock markets and the like to give you an idea as to how this market may trade. Remember, the Japanese yen is considered to be the “safest currency.”