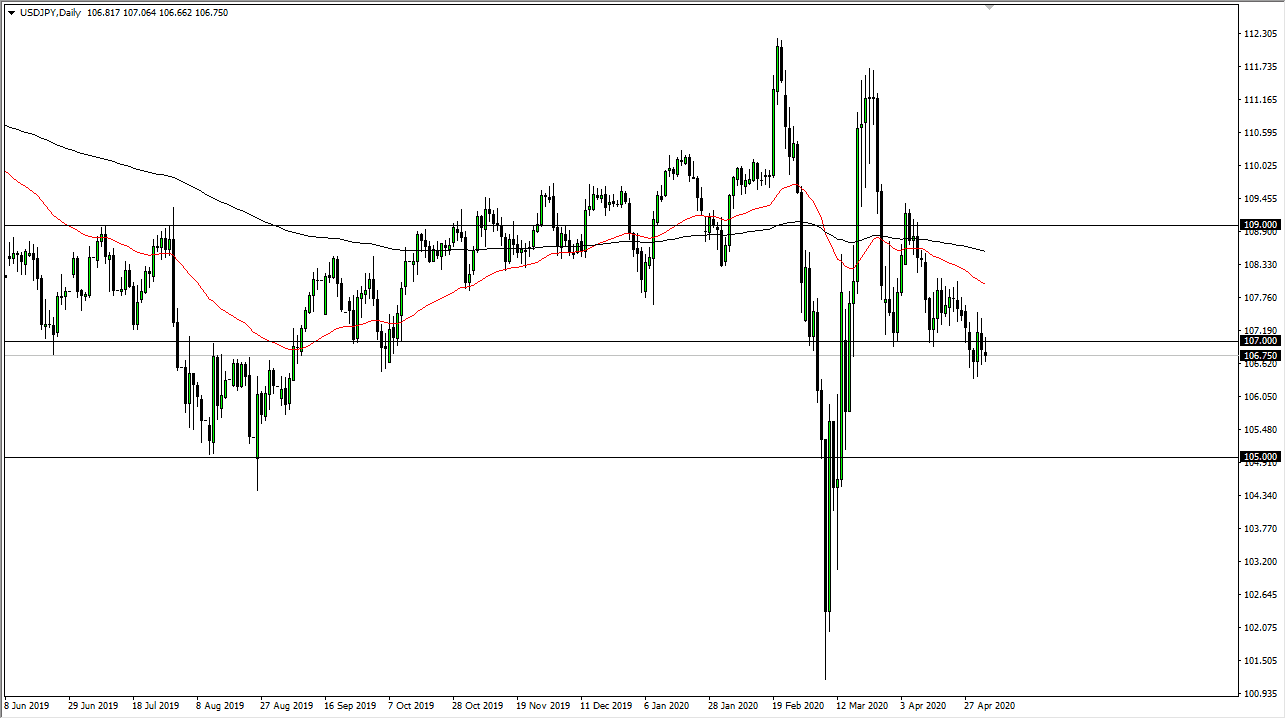

The US dollar initially tried to rally during the trading session on Monday but found a significant amount of resistance near the ¥107 level. At this point in time, you should pay attention to the ¥107 level as it is the previous support, so now market memory suggests that it should be resistance. You should also note that the 50 day EMA is drifting lower and starting to show signs of resistance again. The ¥106.50 level has been an area that has offered support, so if we break down below that level and a couple of the candle from last week, it is likely that we continue to go much lower. At that point in time, I would anticipate that the market is probably going to go looking towards the ¥105 level.

Even if we were to rally from here and break above the ¥107 level, it seems very unlikely that the market goes looking towards the 50 day EMA, and even less likely that it breaks above therefore a significant move. At this junction, the ¥108 level looks to be massive resistance, so it is not until we break above there that I would be concerned about the downtrend. That being said, I believe that the continuation is likely due to the shape of the candlestick that we had formed during the Monday session. The hammer from Wednesday of last week being broken to the downside would be the next sign of the market breaking down.

Keep in mind that there is a lot of “risk off” attitude out there, so it should be rather negative for this market, push it at lower as the Japanese yen is considered to be the ultimate “safety currency.” Signs of exhaustion on short-term rally should continue to offer selling opportunities, and therefore I will be paying attention to the markets in order to take advantage of that. There is so much in the way of exhaustion above that it is difficult to imagine a scenario where I would be a buyer, things would obviously have to change drastically. He will be choppy, but ultimately there is still enough negative pressure to continue favoring the downside. You will probably have to be very cautious and more importantly, very patient in order to take advantage of the trend and collect profits in a pair that is starting to act more like the EUR/USD than anything else, meaning that it is going nowhere most of the time.