The US dollar has initially rally during the trading session on Thursday before pulling back from the highs after the Fed Fund Rate Futures for December 2020 went negative. In other words, the market is expected negative interest rates in the United States, and therefore it could become a reality quicker than anticipated. That being said, it is not good for the US dollar and it will have people looking to get away from that currency. That being the case, the market should continue to go much lower as the Japanese yen will continue to be much more attractive in that environment.

Furthermore, you should keep in mind that the Japanese yen is a bit of a “risk off” currency, so with the horrible jobs number coming out on Friday it is highly likely that people will continue to favor the yen over several other currencies. With that being the case, the market is likely to see a continuation of the move that had been reaching towards the ¥105 level for some time. I previously stated that selling short-term rallies was probably best way to go, and we have had another opportunity to do so.

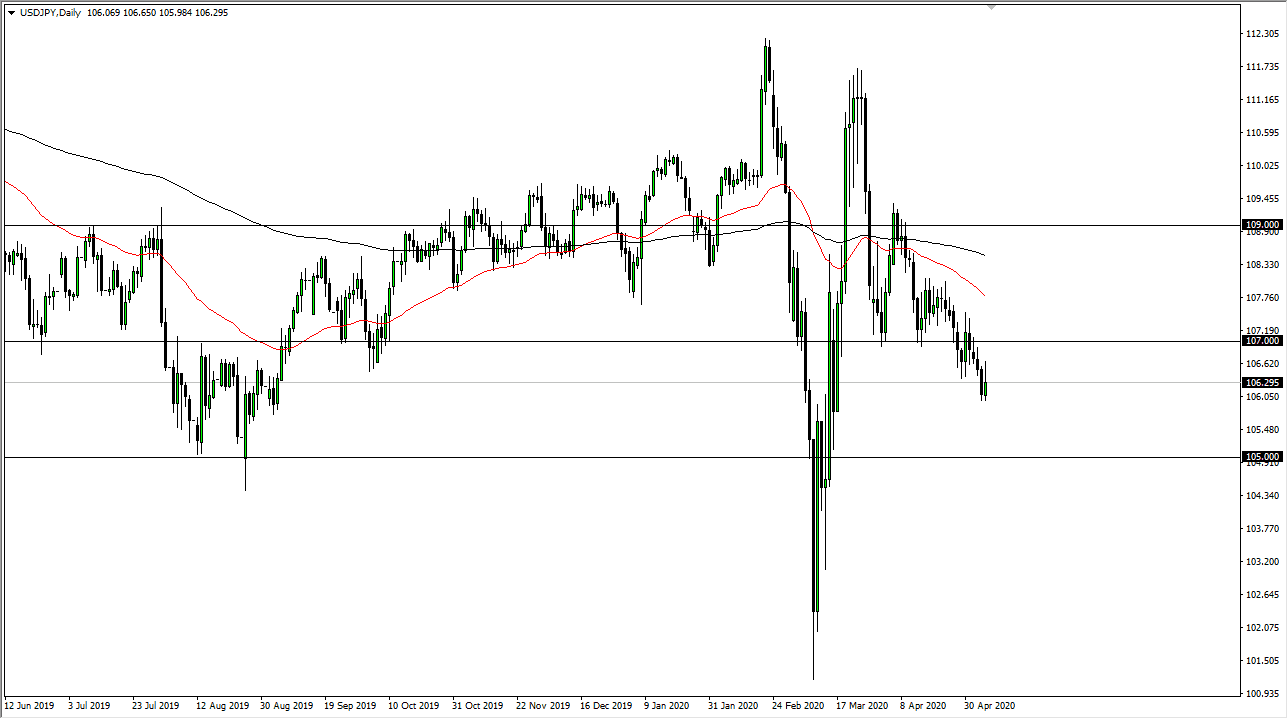

To the upside, the ¥107 level should be resistance, and sold into. The fact that the candlestick formed a little bit of an inverted hammer does suggest that we have further to go to the downside, so I like the idea of fading short-term rallies more than anything else but would also be a seller if we break down below the bottom of the candlestick for the day. Either way, I do not have any interest in buying this pair, it has got some way to go before things change completely. Expect a lot of volatility during the trading session on Friday, but quite frankly think it is only a matter of time before we sell off yet again so look at any pop in this pair due to the Non-Farm Payroll figures as a gift to start shorting at higher levels. The 50 day EMA above also will offer resistance as it is rolling over and showing just how weak this pair has been. With that in mind, I have plenty of reasons to think that we continue going lower so therefore I am not looking for a set up to the upside. If that changes, I will let you know here at Daily Forex.