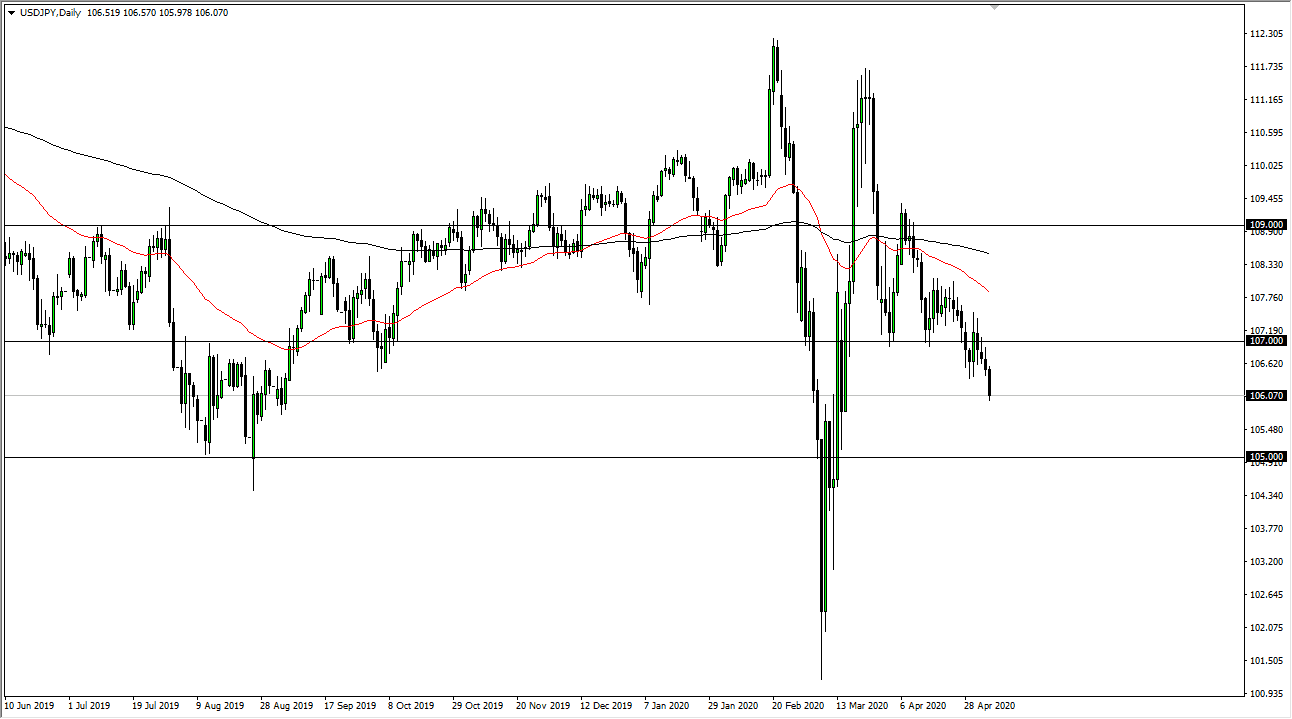

The US dollar has broken through significant support that has been in effect for the last several days, and now is threatening the ¥106 level. That is a large, round, psychologically significant figure but this is a minor support level from the longer-term standpoint. It is obvious to me that the ¥105 level underneath is a potential target as it has been both support and resistance in the past, and of course markets tend to like these big figures. With that in mind, it is highly likely that the market is going to try to get there given enough time.

What I find interesting is that the job summer comes out on Friday and this pair is overly sensitive to that announcement. It is almost as if we are setting up for that announcement, and that we are getting ready to make the larger move. If we break down below the ¥105 level, then the market is highly likely to go looking towards the ¥103 level next. This is a market that is overly sensitive to risk appetite in general, which looks to be falling apart. To the upside, the ¥107 level is likely to offer significant resistance as it had previously been supported. Market memory does dictate that we should see some pressure there.

Even if we break above that level, there is a lot of resistance that extends all the way to the ¥108 level, and of course the 50 day EMA is starting to cut lower from there as well. At this point, the market is likely to continue to see a lot of selling pressure on these rallies, so that is going to plan, simply selling every time I see a certain amount of exhaustion into the marketplace. On the other hand, if we simply break down through the bottom of the candlestick, the market then goes down to the 105 level rather quickly. All things being equal, this is a scenario where I do not have an argument where I am willing to buy this pair, but obviously will let you know here at Daily Forex if and when my analysis changes. However, at this point it is obvious that we are in a major downtrend and that of course is not going to change anytime soon due to the fact that the Japanese yen is a major “safety currency.”