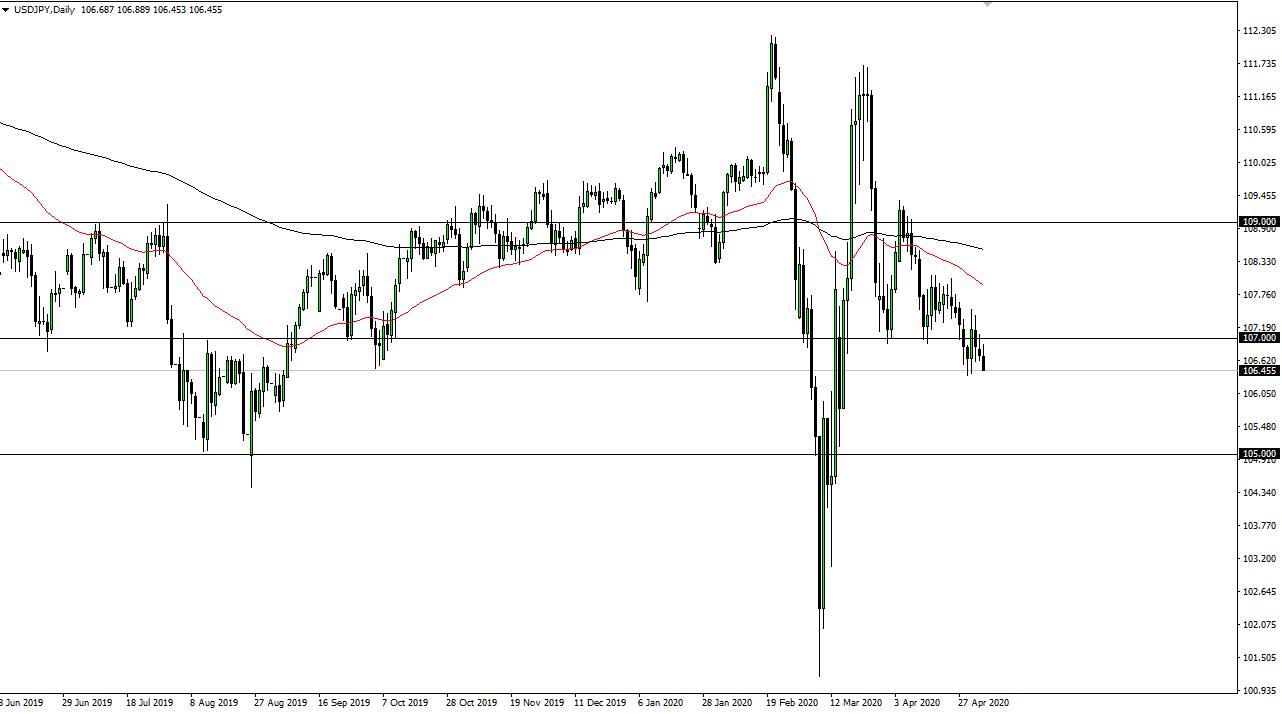

The US dollar initially tried to rally during the trading session on Tuesday but as you can see broke down rather significantly, reaching down towards the lows of the previous week. If we can break down below the ¥106.25 level, then we will more than likely go much lower. In the meantime, I like the idea of fading short-term rallies, as the ¥107 level is going to be significant resistance. After all, it had been previous support so “market memory” would come back into play.

At this point, it certainly looks as if we are ready to go much lower, and the ¥105 level will more than likely be targeted over the longer term. I think that it will take some time before we get there, so it is going to be more of a grind lower than anything else. You should have plenty of opportunities to get involved on short-term rallies, but if get some type of significantly negative headline out there, the pair may accelerate to the downside as the Japanese yen is considered to be a significant safety currency. Granted, the US dollar is a safety currency as well, but when it comes to this pair it certainly measures risk and the exact opposite way.

One thing that is worth paying attention to is the hammer from the previous week, because if we break down below it is likely that the market goes much lower. Rallies at this point will see resistance at ¥107, and then of course the ¥107.50 level. As far as buying this pair is concerned, it would take a significant amount of bullish pressure in general in order to go long. We would have to break above the ¥108 level on a daily close to consider it, and that could send this market towards the ¥109 level.

That being said, it would take a significant shift in attitude to make that happen. I think short-term traders will continue to go back and forth and push this pair around, and when you look at an ultra-longer-term chart, we are getting close to the end of a massive symmetrical triangle, that could at least in theory send this pair several dozen handles in one direction or the other. In the short term though, the analysis looks relatively bearish in general. I do think there are a lot of phantoms out there that could rise and spook the markets again.