The US dollar has broken higher during the trading session on Friday, as the jobs number was not quite as horrific as once thought. That being said, the markets rallied a bit and it should be noted that this pair does tend to follow right along with stock markets. That is not always the case, and clearly has not been as of late, as a lot of people are paying a lot of attention to the Federal Reserve and is flooding of the market with US dollars.

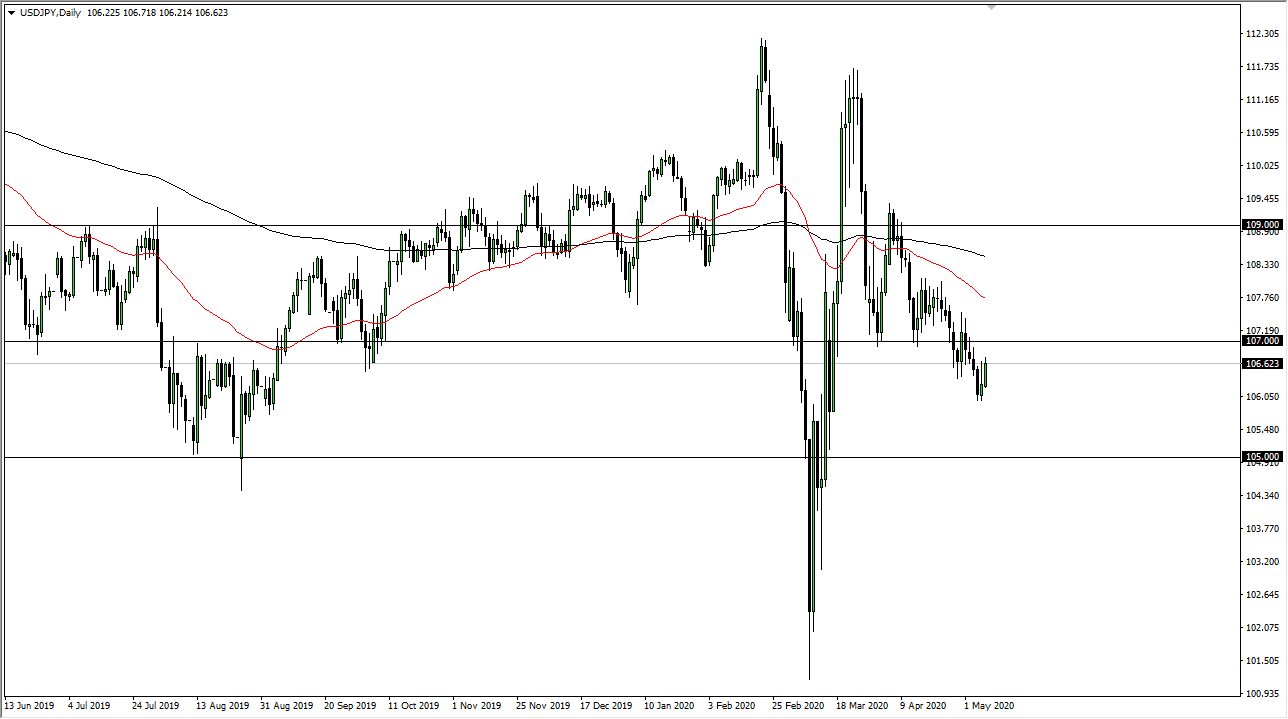

That being said, we should pay attention to the fact that this market has broken above the top of a shooting star shaped candlestick, which is technically now an inverted hammer. However, I think that the ¥107 level is an area that is worth taking a look at, as it was significant support in the past. After all, “market memory” is something that traders pay quite a bit of attention to, so it is important to recognize that it is an area that will more than likely cause a bit of tension. Above there, we have the 50 day EMA that should come into play as resistance as well, so I fully anticipate that there is a significant opportunity between the ¥107 level and that indicator. Signs of exhaustion are to be sold into, as I believe the downtrend is most certainly intact.

The market will eventually go looking towards the ¥105 level, which makes quite a bit of sense considering we had just broken through a descending triangle that measured for 200 points, which would suggest that ¥105 is where we are going to go. Rallies at this point do not have me thinking anything different until we break well above the ¥108 level, because if we do it would be a very bullish sign. I do not think that is going to happen anytime soon but of course I am always willing to react to changing market conditions. The candlestick has rallied quite significantly, closing at the highs of the session. This typically means that we are going to see a bit of continuation, but I think that is probably somewhat limited. With this, simply sitting on the sidelines and waiting for the correct opportunity to take advantage of this weakness. The Japanese yen is a “safety currency” after all, and that should continue to attract a lot of attention in these uncertain times.