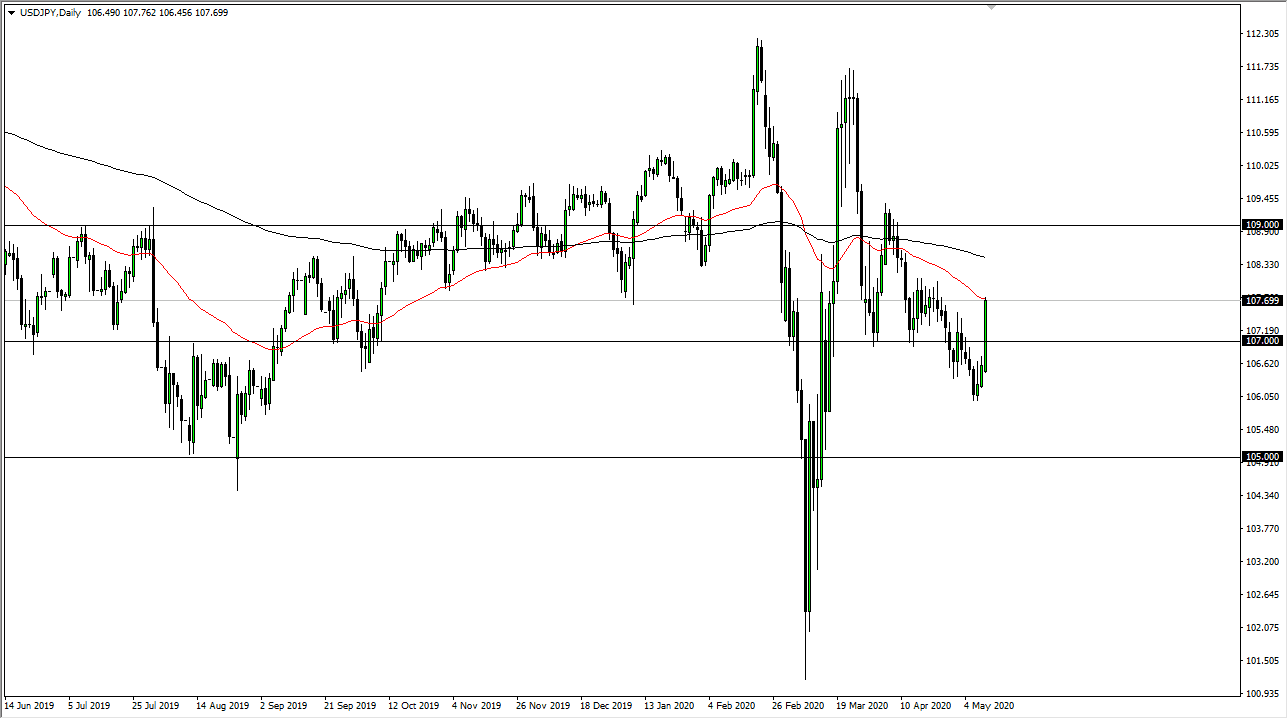

The US dollar rallied rather significantly during the trading session on Monday, slamming into the 50 day EMA. This is an area where I would expect to see a bit of negativity, and as a result I think that the ¥108 level is also an area that could cause some issues based upon previous trading. Ultimately, the question now is not so much as to whether or not we can continue and whether or not the trend is change, but rather whether or not sellers will come back into keep this market going in the same direction it has been for some time?

If the market breaks back down below the ¥107 level, then it is highly likely to offer an opportunity to start shorting again as we will almost certainly go back towards the ¥106 level, and then eventually the ¥105 level. The ¥105 level should be rather important, as it is an area that has caused a lot of attention in the recent past. Having said all of that, if we do break to the upside it will be exceedingly difficult for this market to break above the ¥108 level, let alone the 200 day EMA after that and then the ¥109 level which has been extraordinarily resistive.

The length of the candle is rather impressive, but the reality is that trends like this do not simply disappear overnight. Yes, we had seen some strength in the stock market later in the day, but at the end of the session it should be noted that stock markets wilted a bit. This could drive money back into the Japanese yen, continuing the overall negativity that we have seen. I believe that the ¥107 level underneath will be the initial target, and if we can break down below there then more money will flood into this market.

I do not have a scenario in which I am willing to buy this pair quite yet, even though this is an exceptionally good looking candlestick to kick the move off. There is so much in the way of technical resistance above that it is only a matter of time before the market rolled over from what I see. All we need is a little bit of negativity in the markets globally to have this market roll over and continue to go lower as the Japanese yen is considered to be a “safety currency” and attracts quite a bit of flow in these times.