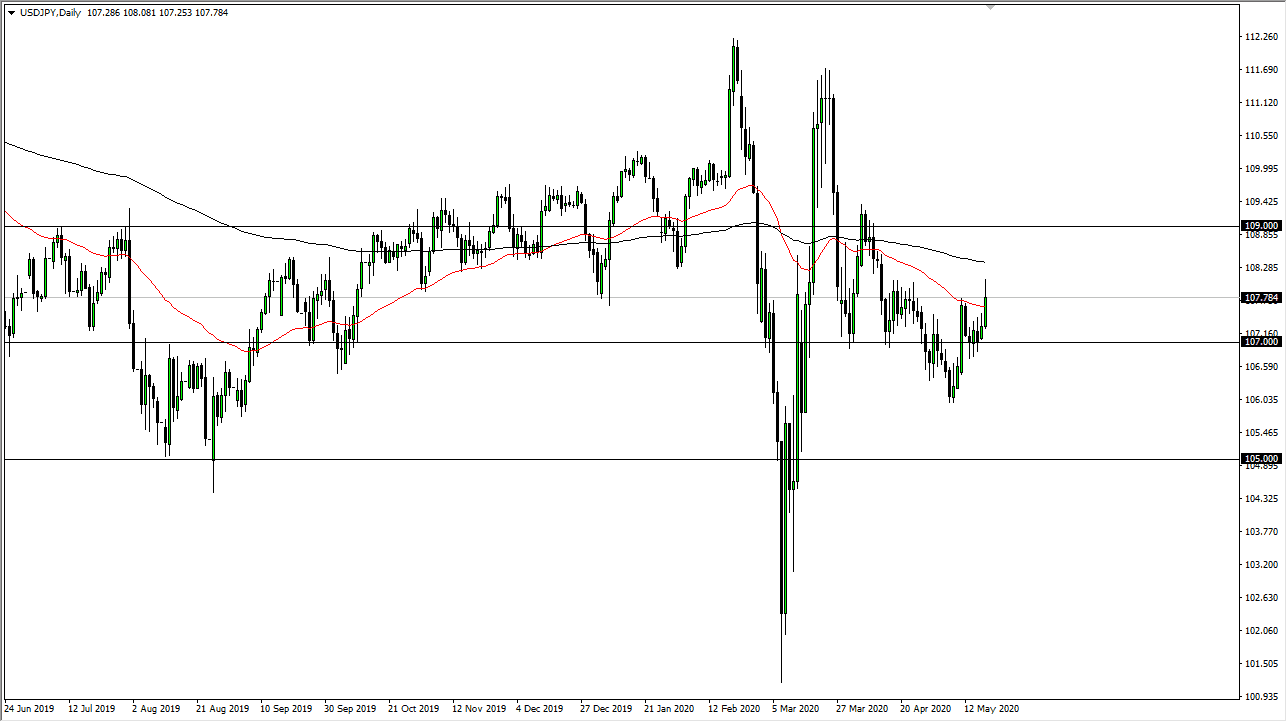

The US dollar has rallied significantly during the trading session on Tuesday but found the ¥108 level to be a bit too resistive to continue going higher. Ultimately, the market is likely to continue to go back and forth in general, perhaps trading between the ¥108 level and the ¥107 level. Ultimately, this is a market that I think continues to see a lot of noisy trading, but that makes sense considering that both of these currencies are considered to be safety currencies. At this point in time, expect a lot of noise and confusion and quite frankly this is a market that has no idea what to do with itself.

Looking at longer-term charts, the Japanese yen has been forming a huge triangle, going back years so we will probably make a big move one way or the other, but right now it looks unlikely that the market is ready to make up that decision. The ¥107 level being broken significantly, and other words breaking below the previous couple of candlesticks, could open up a move down to the 160 and level, possibly even the ¥105 level.

To the upside, I believe that the 200 day EMA which is colored in black will offer resistance, and of course the ¥109 level will as well. I have no interest whatsoever in trying to figure out what to do with this market from a longer-term standpoint, because there is so much in the way of noise that it is almost impossible to imagine that right now. I do believe that given enough time we will probably see the markets make a bigger move, but short-term traders will continue to simply slop back and forth as there is nowhere to be right now. At the end of the day, this is a pair that has been extraordinarily noisy, and I do not see that changing anytime soon. The currency markets seem to be fighting the equity markets, as the equity markets are pricing in the fact that everything is going back to normal next week, while the currency markets see a completely different story. As currency is needed to be exchanged for people investing in other markets, it creates an intense amount of noise that has been exceedingly difficult to navigate. Keep your position size small, it is the only way you are going to survive the next several weeks, and all pairs not just this one.