Weakly bullish with low volatility

Yesterday’s signals were not triggered, as there was no bearish price action when the resistance level at 107.67 was reached.

Today’s USD/JPY Signals

Risk 0.75%.

Trades must be entered from 8am New York time Thursday until 5pm Tokyo time Friday.

Short Trade Ideas

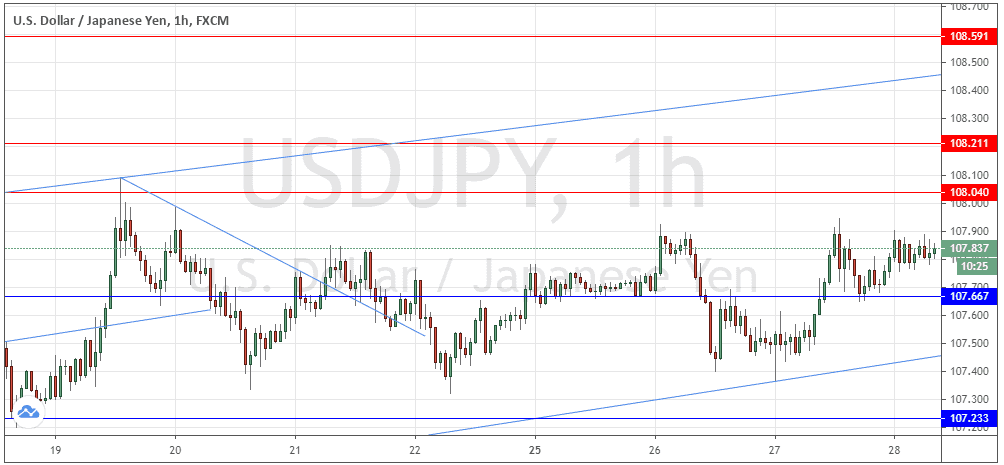

- Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 108.04, 108.21, or 108.59.

- Place the stop loss 1 pip above the local swing high.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade Ideas

- Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 107.67, the lower price channel trend line shown in the price chart below which is currently sitting at about 107.45, or 107.23.

- Place the stop loss 1 pip below the local swing low.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

USD/JPY Analysis

I wrote yesterday that I would only look for long trades in this pair today, but also that I did not expect much action in this currency pair. Ideally, I wanted a bounce at the lower trend line of the price channel, which did not set up.

This was a good call as the price has just edged up slightly on low volatility, as I expected.

The technical picture is unchanged. There is a small bullish advantage with the recapture of 107.67 as new support, but we can see that the price has really gone sideways over the past few days, even though the wide bullish price channel continues to hold.

Both the USD and the JPY are strongly positively correlated at present due to the dominant risk off / risk on market paradigm, with both currencies acting as safe havens. Therefore, we might expect low volatility to continue here, making this a relatively unattractive currency pair to trade. Having said that, rising stock markets should cause a slight bullish bias in this pair, and we are seeing that.

I continue to take the same approach today: a long trade from a bullish bounce at the lower trend line would be an ideal set up. A short trade following a strong bearish reversal at 108.04 would also be interesting. If the price can get established above 108.04 that would be an important bullish sign.

We may see more activity here today as key U.S. GDP data will be released, and any surprise there tends to make this pair move.

There is nothing of high importance due today concerning the JPY. Regarding the USD, there will be a release of Preliminary GDP data at 1:30pm London time.