During the trading week, the USD/JPY tried to avoid further collapse, which pushed it towards the 106.74 support, where the pair bounced to the 107.45 level by the end of trading last week and closed the week trading around the 107.16 level. This came as Federal Reserve Governor Jerome Powell cut the road to expectations to pass negative interest rates, which the US President Donald Trump was looking for. This is part of successive plans by the bank and the US government to contain the devastating effects of the rapid spread of the Coronavirus, with the United States leading the global scene with numbers of cases and deaths.

The dispute over the cause of the Coronavirus outbreak between the two largest economies in the world has added to global financial markets concern about the renewed global trade war. The most prominent was in the return of skirmishes threats US President Trump finally to end relations with China. The Chinese Ministry of Commerce had said it would take "all necessary measures" in response to the new US restrictions on the ability of the Chinese technology giant Huawei to use American technology, describing the measures as an abuse of state authority and a violation of market principles.

On the economic side. US retail sales declined by a record -16.4% in the period from March to April, as business closings imposed by the spread of coronavirus caused shoppers' dimensions, and the US Commerce Department report showed last Friday that a rapid collapse of retail purchases as sales fell over the Past 12 months to -21.6%. The intensity of the decline appears to be unparalleled for retail figures dating back to 1992. The monthly decline in April was almost doubled by the previous record low of -8.3% - recorded just one month ago.

The steepest declines from March to April were in clothing, electronics and furniture stores. With consumers long rushing towards online purchases, the sector monthly gains were at 8.4%. On annual basis, online sales increased by 21.6%. For the retail sector, which was already suffering from the recession, the free fall in spending is a major threat. Therefore, shops, restaurants and car dealerships are at risk.

The decline in retail spending is one of the main reasons for the contraction of the US economy. Retail sales account for nearly half of total consumer spending, which feeds about 70% of the country's total economic activity.

Amid the exchange of accusations between the United States and some countries such as Australia and China over those responsible for the spread of the Coronavirus, Xinhua quoted Chinese Foreign Minister Wang Yi as saying that foreign politicians "insisted on politicizing the epidemic, marking the virus and staining the WHO". “China should be commended for having brought the outbreak there under control and helped other countries”.

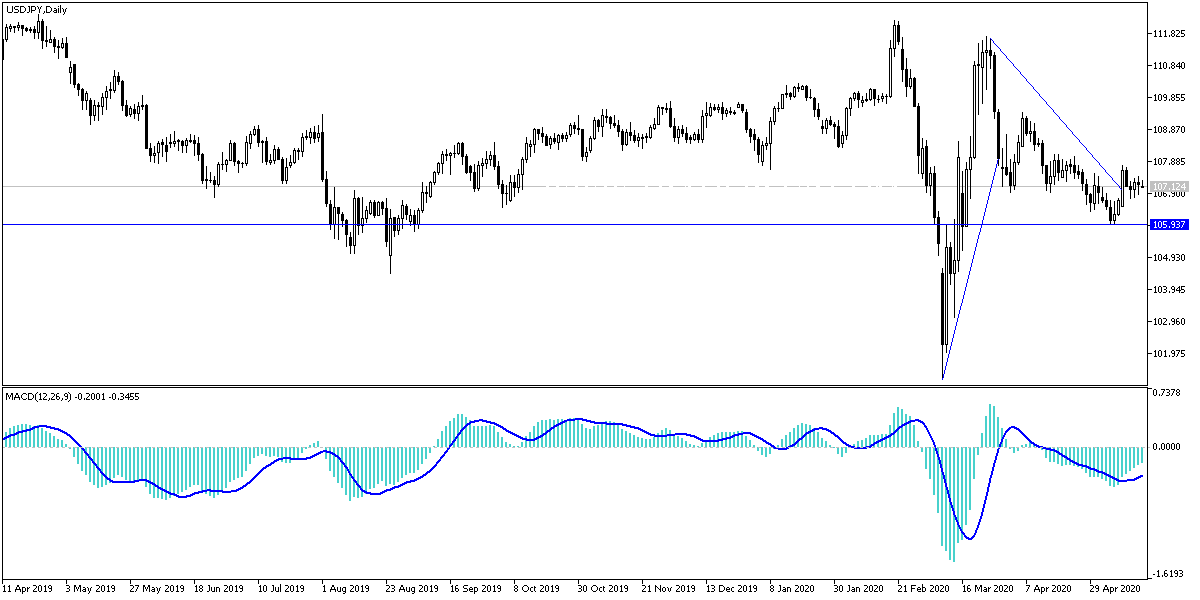

According to technical analysis of the pair: Despite the pair attempts to stop its losses, the general trend remains bearish and will be ready to test stronger support levels, the closest of which are currently 106.65 and 105.90, and at the same time, which confirm the strength of oversold levels, therefore thinking about returning to buy. There will be no strong opportunity for the pair to correct higher without crossing the resistance levels 108.20 and 109.00. It is expected that the volatility of the pair’s performance will increase in the coming days, amid the growing disagreement between the United States of America and China, and between the two sides of the European Union and Britain.

Today, the pair will react to the announcement of Japanese growth rate in the Q1 of 2020.