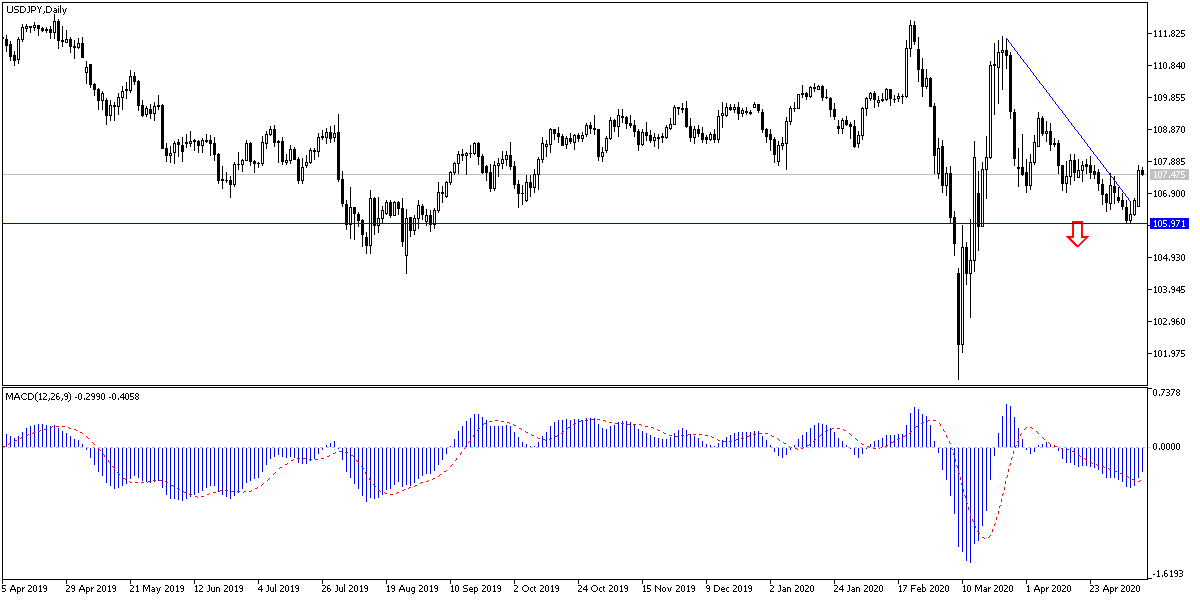

After the markets absorbed the US jobs numbers for April, which were announced last Friday, the markets will monitor the reaction from the announcement of inflation figures and US retail sales this week. With the passage of a jobs storm, the USD/JPY pair returned to the correct higher, reaching the 107.76 resistance in the beginning of today's trading after last week's downward pressure pushed it towards the 105.98 support. The pair is stable around the 107.65 level in the beginning of Tuesday’s trading. Despite attempts to climb, bears still have long-term control.

With some US states returning to open and try coexisting with the virus until a vaccine is found, U.S. President Trump said that the United States is on track to conduct 10 million tests for the Coronavirus by the end of this week, as the country is currently conducting about 300,000 tests per day. According to a senior administration official who briefed reporters on Monday, the states will receive $11 billion in legislation that was recently approved for these tests.

At the White House, Trump also said that the federal government would provide nearly 13 million swabs to states until May.

Trump's statements came as the virus infiltrated the White House, as tests of Vice President Mike Pence and Press Secretary were positive for Coronavirus. White House staff were instructed to wear masks, and in this regard, Joe Biden, the presumed Democratic presidential candidate, said in a Washington Post article on Monday that the test was not enough and urged the administration to do more. Biden wrote: "Instead of seeking again to divide us, Trump should work to give the Americans the same necessary protection he got for himself."

"We have won," Trump told reporters, prompting the National Democratic Committee to declare its response a failure. Despite Trump's remarks to ease fears, there are still fears of leaving the house, according to White House economic adviser Kevin Hassett. He also added that he is not happy with China about its handling of the outbreak and is not interested in reopening a trade deal between Washington and Beijing. "Let's see if they live up to the deal they signed," he said.

The Coruna virus has infected more than 4 million people and registered new cases in South Korea and China, as they re-opened their economies.

According to the technical analysis of the pair: Despite the recent correction attempts, the USD/JPY is still in the range of its declining channel, especially with its stability below the 108.00 support level. And there will not be an opportunity to break the general trend without reaching 110.00 psychological resistance, which needs many factors, the most important of which is to alleviate fears of renewed conflict between the United States of America and China and a successful return to an open global economy despite the presence of the Coronavirus.

Today, the pair will react to the announcement of US inflation figures through the Consumer Price Index.