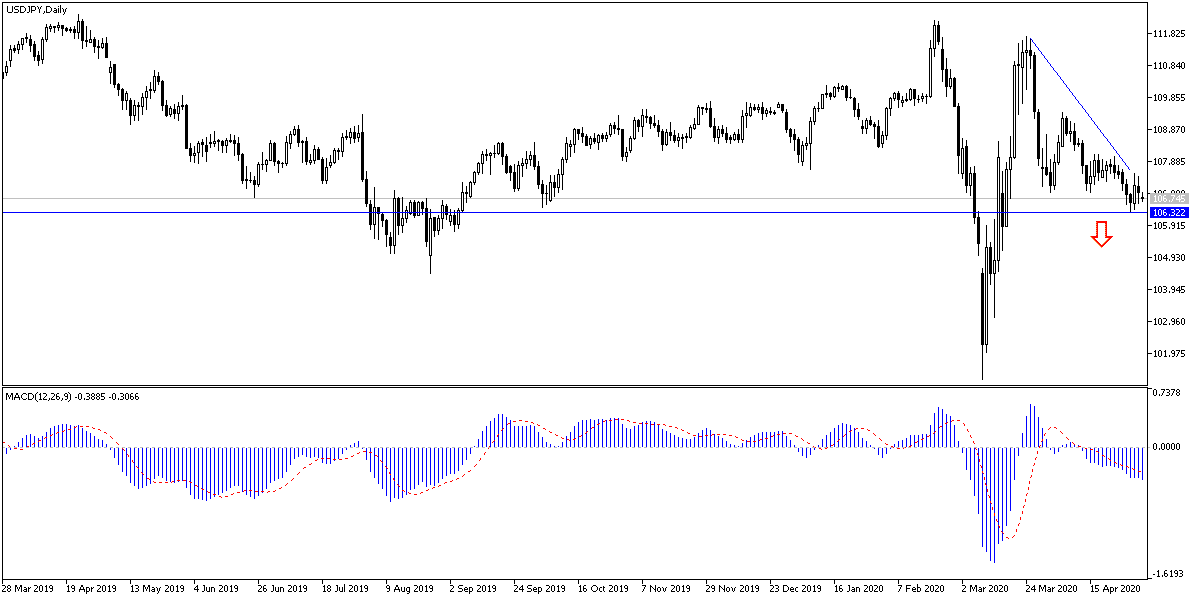

The USD/JPY losses increased pushing it to the 106.35 support, the lowest level of in nearly a month and a half. In the last two trading sessions last week, the pair tried to rebound higher, but gains did not exceed the 107.50 level before closing trading around the 106.92 level. The general trend on the daily chart is still bearish and was confirmed by stability below the 108.00 support, which we expected an increase in downward pressure once it was crossed. Investors will pay close attention to safe havens in the coming period as global economies begin to reopen and the dispute between the United States of America and China about the one responsible for the spread of Coffvid-19, which has caused a severe recession of the global economy and the death of thousands around the world.

The US ISM manufacturing index fell to a reading of 41.5 last month from a reading of 49.1 in March. A reading below the 50 level indicates a contraction in the sector. The results were poor in all areas: production, new orders, employment and export all fell faster in April than in March. Economists believe that the basic details indicate a sharp decline in activity, as production and employment contracted at a record pace. New requests indicate that activity is unlikely to improve in the near term. Economists had expected a further drop.

The COVID-19 pandemic, quarantine, travel restrictions and business closings to combat it have hampered global manufacturers, disrupting their access to supplies and crushing demand for their products.

The American economy has slipped into recession. Gross domestic product - the broadest measure of economic output - fell by an annual rate of 4.8% from January to March, the worst since the economic recession of 2008, although the United States only began entering a closure in mid-March, the April-June quarter is expected to be the worst in the Commerce Department's records dating back to 1947. Economists had expected a further drop in the ISM industrial index.

US industrialization was already in pain before the pandemic led to the economy stalling completely in March. The ISM Manufacturing Index has declined in seven of the past nine months. As President Donald Trump's trade war with China raised costs and created uncertainty that paralyzed investment decisions.

According to the technical analysis of the pair: The general trend of the USD/JPY pair is still bearish and will remain so as long as it remains stable below the 108.00 support, taking into account that the recent decline has reached overbought technical indicators and investors may target this from levels at 106.45, 105.80 and 104.90 respectively . The 108.00 and 110.00 resistance levels are the most important in the path of the bullish correction.

Details of the US jobs report this week will have a strong and direct reaction to the pair's performance. Today, with the no important issues on the economic calendar, investor sentiment will have the final word on the pair’s trends.