Amidst expectations of the possibility of approving negative interest rates in the United States, along with the continuation of the pessimistic results series of the American economic releases, the pressure on the USD/JPY, continued until it reached the 106.75 support, giving up gains of the last two trading sessions, which pushed it towards the 107.76 resistance. The pair is stable around the 107.05 level in the beginning of Thursday’s trading. What halted dollar losses were statements made by Federal Reserve Governor Jerome Powell, which excluded the thought of negative interest option at the present time.

On Wednesday, Powell warned of the risk of a prolonged recession caused by the outbreak of the coronavirus, and urged Congress and the White House to take more measures to prevent long-term economic damage. The Federal Reserve and Congress have taken far-reaching steps in an effort to counter what is likely to be a severe slowdown caused by the widespread shutdown of the US economy. But Powell warned that many bankruptcies between small businesses and the prolonged unemployment of many people still pose a serious risk.

"We must do what we can to avoid these results," Powell added.

He said the additional rescue aid from government spending or tax policies, although it is expensive, "is worth it if it helps avoid long-term economic damage and leaves us in a stronger recovery". Powell spoke a day after House Speaker Nancy Pelosi proposed a $3 trillion aid package to channel money to state, local, family, and health care workers. This money will come on top of approximately $3 trillion in previous financial aid provided by the government. The Fed itself has also intervened by cutting interest rates to almost zero and creating several emergency lending programs.

But Trump administration officials have said they first want to see how past aid packages affect the economy. Republican leaders in Congress have expressed doubts about allowing more money to be spent now. Senate Majority Leader Mitch McConnell, a Kentucky Republican, said there was no "urgent need" to act.

However, Powell made his concern clear that the recession could last long enough to cause major damage to the economy and make the recovery weaker and slower. In such a scenario, unemployed workers will lose their skills and relationships in the labor market, making it difficult for them to find a new job. With so many small companies going bankrupt, there will be fewer companies available to employ the unemployed.

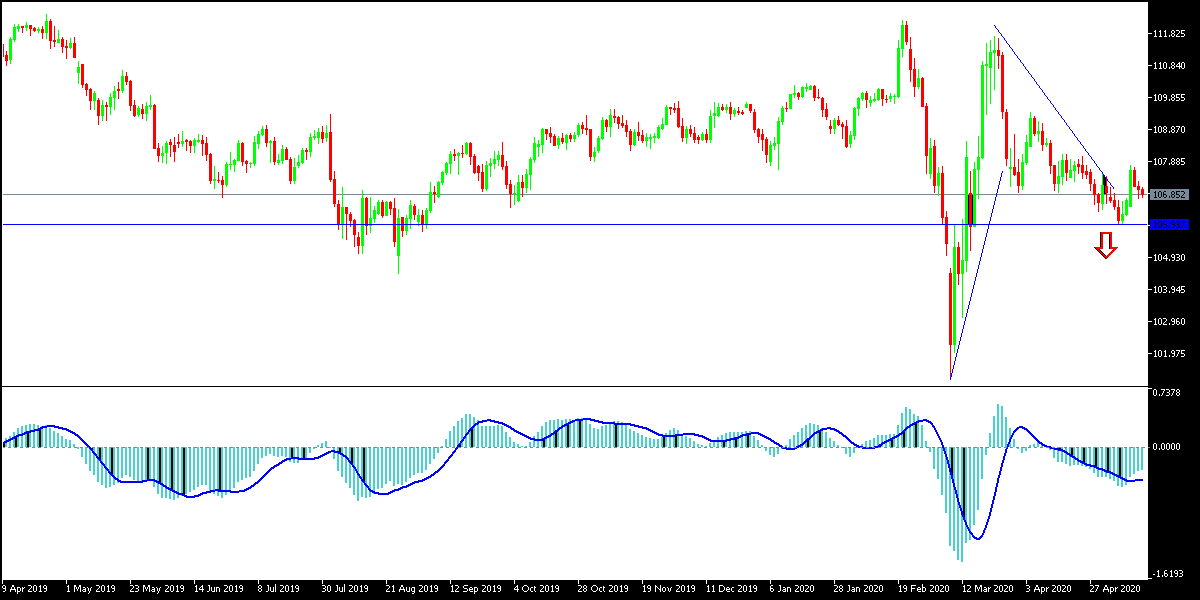

According to the technical analysis of the pair: Despite the USD/JPY losses after Powell's statements, the general trend is still downward as long as it remains stable below the 108.00 support, but it is necessary to take into account that the pair is oversold and buy the pair from the 106.65 And 105.80 support levels respectively. On the upside, 108.00 and 110.00 resistance levels are still the most important for the bulls' return to control. We will see the interaction of investors with Powell's recent comments, as well as the disastrous consequences f the US economy in the Corona era.

Today, the pair will also react to the announcement of the weekly unemployed claims reading.