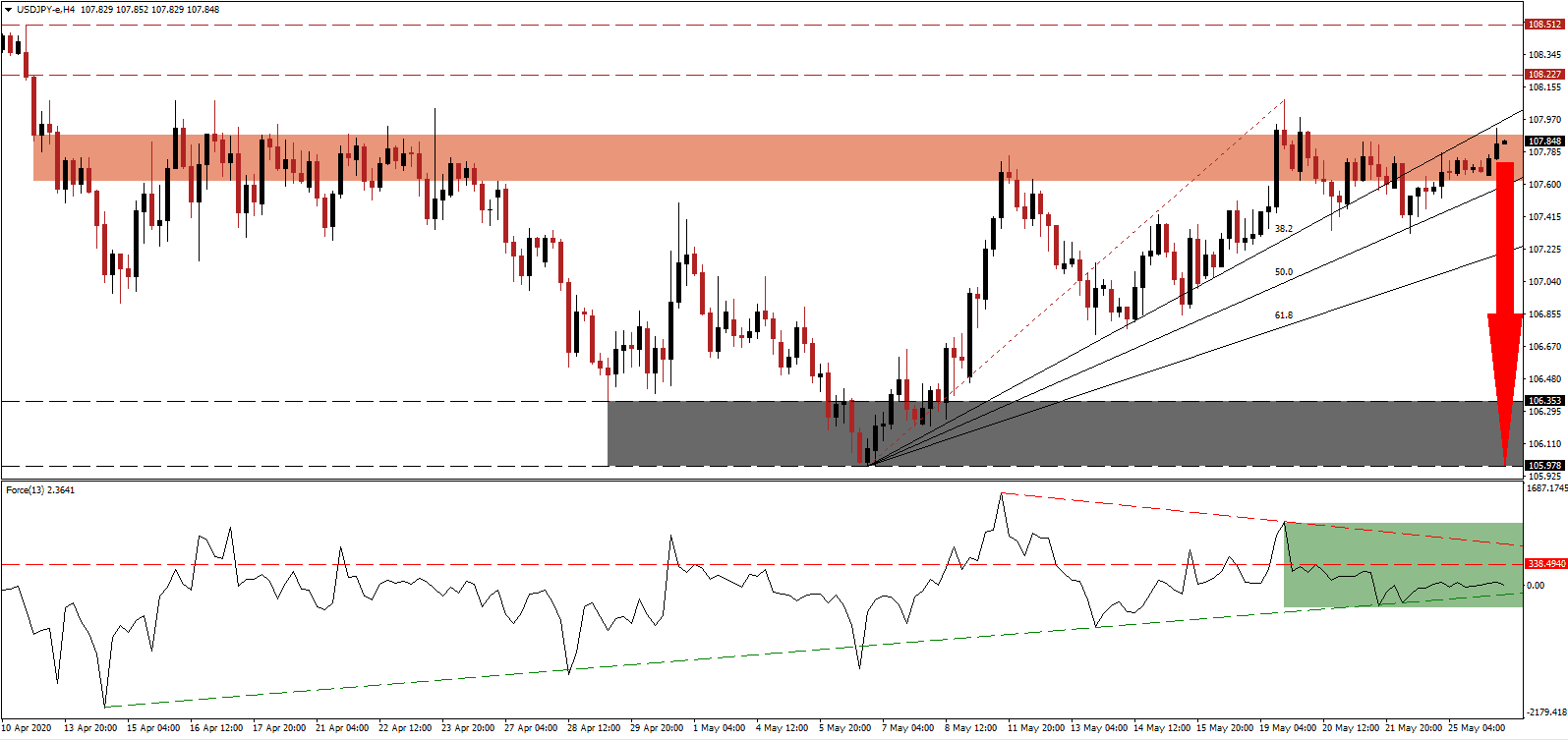

Despite new Covid-19 infections surging across the globe, financial markets remain disconnected from fundamentals. Complacency over permanent changes to consumer behavior is not priced into present models, and retail demand for equities displaced concerns. Warnings of a slow and painful recovery and persistent job losses are ignored, which resulted in capital outflows out of safe-haven assets like the Japanese Yen. It is anticipated to represent a temporary development, as underlying progress remains increasingly bearish. The USD/JPY is well-positioned to enter a profit-taking sell-off after drifting into its short-term resistance zone.

The Force Index, a next-generation technical indicator, offers an early warning sign that a price action reversal is imminent. While price action advanced, the Force Index contracted, resulting in the emergence of a negative divergence. It led to a conversion of the horizontal support level into resistance, as marked by the green rectangle. Adding downside pressures is the descending resistance level, favored to initiate a breakdown below its ascending support level. Bears are in a holding pattern until this technical indicator collapses below the 0 center-line, ceding control of the USD/JPY to them.

Japan announced an end to the state of emergence in almost all prefectures but asked employees to work for home if possible. The constitution does not allow the government to enforce curfews on its population, which remains highly disciplined, and adheres to issued advice. One positive for Japan’s recovery is the low price of oil, with the world’s third-largest economy dependent on imports for nearly 100% of its demand. Breakdown pressures in the USD/JPY have increased inside of its short-term resistance zone located between 107.617 and 107.883, as identified by the red rectangle.

Forex traders are advised to monitor this currency pair for a correction below its ascending 50.0 Fibonacci Retracement Fan Support Level. A breakdown is expected to result in the next wave of net sell orders, providing downside volume. The risk of a second infection wave over the summer months adds a bearish catalyst to the USD/JPY, posed for an accelerated sell-off into its support zone located between 105.978 and 106.353, as marked by the grey rectangle. A breakdown extension, driven by increasing US Dollar weakness, cannot be excluded. You can learn more about a support zone here.

USD/JPY Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 107.850

Take Profit @ 106.000

Stop Loss @ 108.350

Downside Potential: 185 pips

Upside Risk: 50 pips

Risk/Reward Ratio: 3.70

Should the Force Index push through its descending resistance level, the USD/JPY is likely to attempt a breakout. Due to ongoing US errors, ranging from monetary policy to foreign relations, the US Dollar is faced with mounting bearish pressures. The upside is, therefore, limited to its next resistance zone located between 109.056 and 109.373, which offers Forex traders a secondary short-selling window.

USD/JPY Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 108.850

Take Profit @ 109.350

Stop Loss @ 108.600

Upside Potential: 50 pips

Downside Risk: 25 pips

Risk/Reward Ratio: 2.00