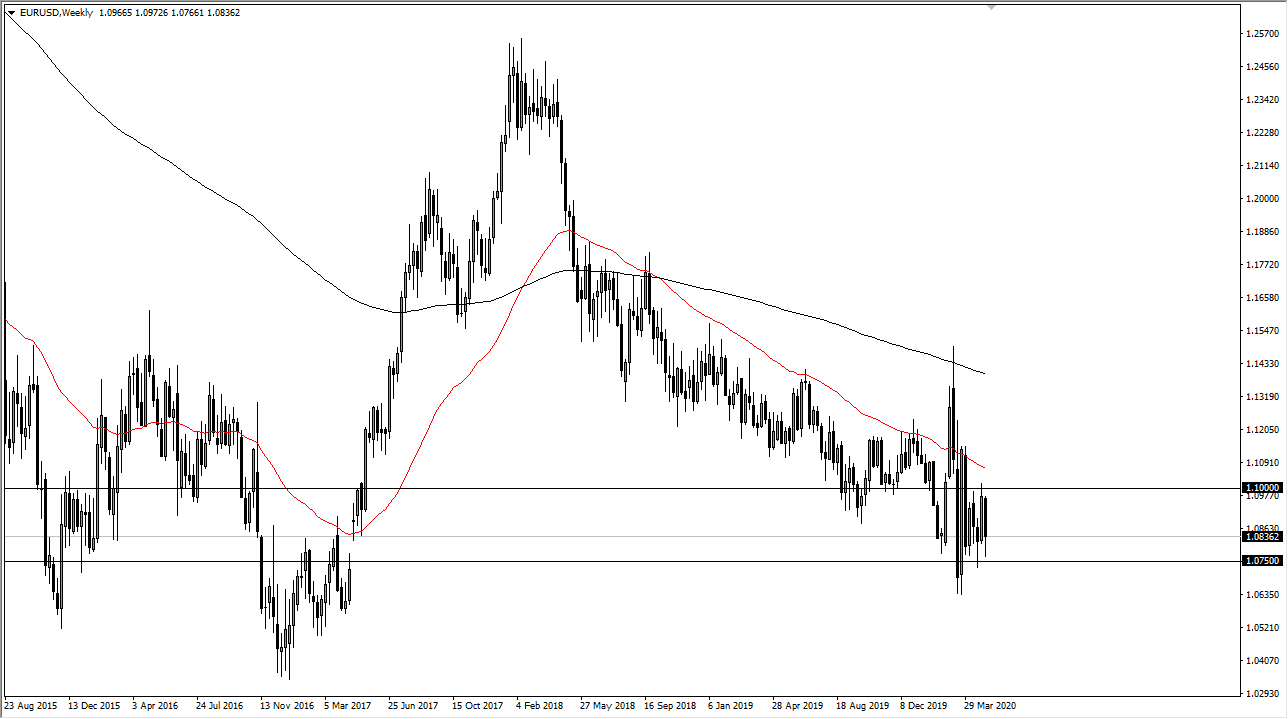

EUR/USD

The Euro fell significantly during the course of the week, as we continue to bounce around between the 1.10 level to the upside, and the 1.0750 level underneath to the downside. Ultimately, the market is probably going to continue to simply slam back and forth, as the market has no clue directionality in the short term. However, as we are in a longer term downtrend and there is a strong bid for US Treasuries, I will continue to fade short-term rallies in this range more than anything else.

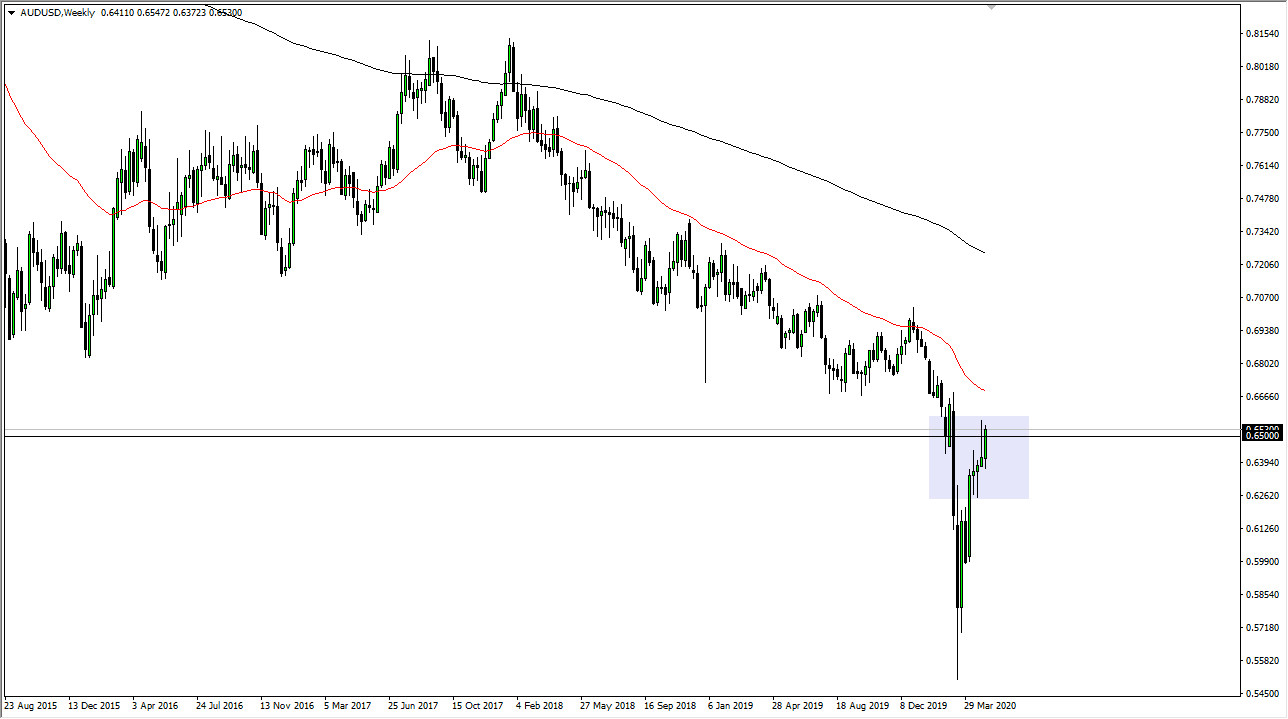

AUD/USD

The Australian dollar rallied significantly during the course of the week, breaking above the 0.65 level. In fact, we ended up closing at the very top of the range from the previous week’s shooting star, so that is a bullish sign. However, once shorter-term charts I see a lot of resistance extending all the way to the 0.67 level so it is highly likely that we will see a bit of a pullback from here. That being said, if we were to break above the 0.67 handle, then the market is probably free to go much higher. Keep an eye on risk appetite, it will have a significant factor to play in what happens next with this pair.

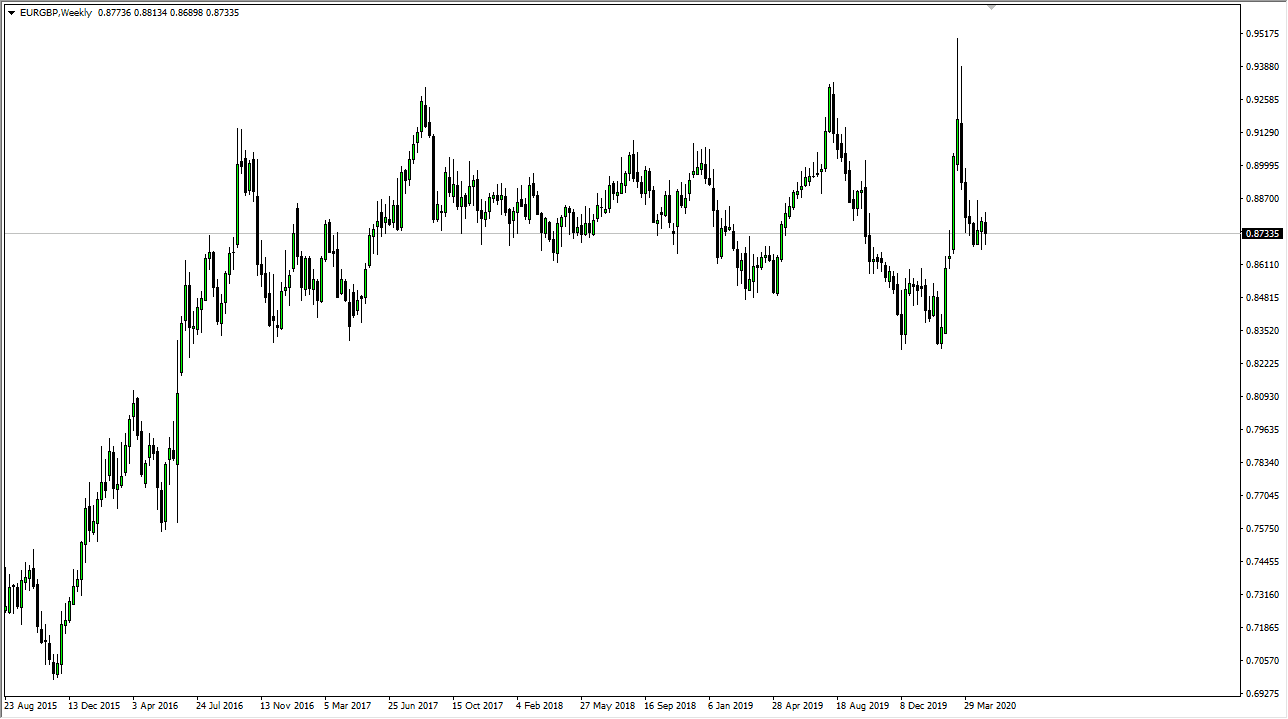

EUR/GBP

The Euro initially tried to rally against the British pound during the week but then gave of the gains. Towards the end of the week, we turned around to show signs of strength again and it looks as if the market is going to continue to bounce around the 0.87 handle. I would anticipate that we will spend the better part of the week in a 100 point range, as both of these currencies are struggling against the greenback. All things being equal, this is a market that continues to see a lot of choppiness and a lot of back and forth. A range bound short-term system can more than likely be employed in this currency pair.

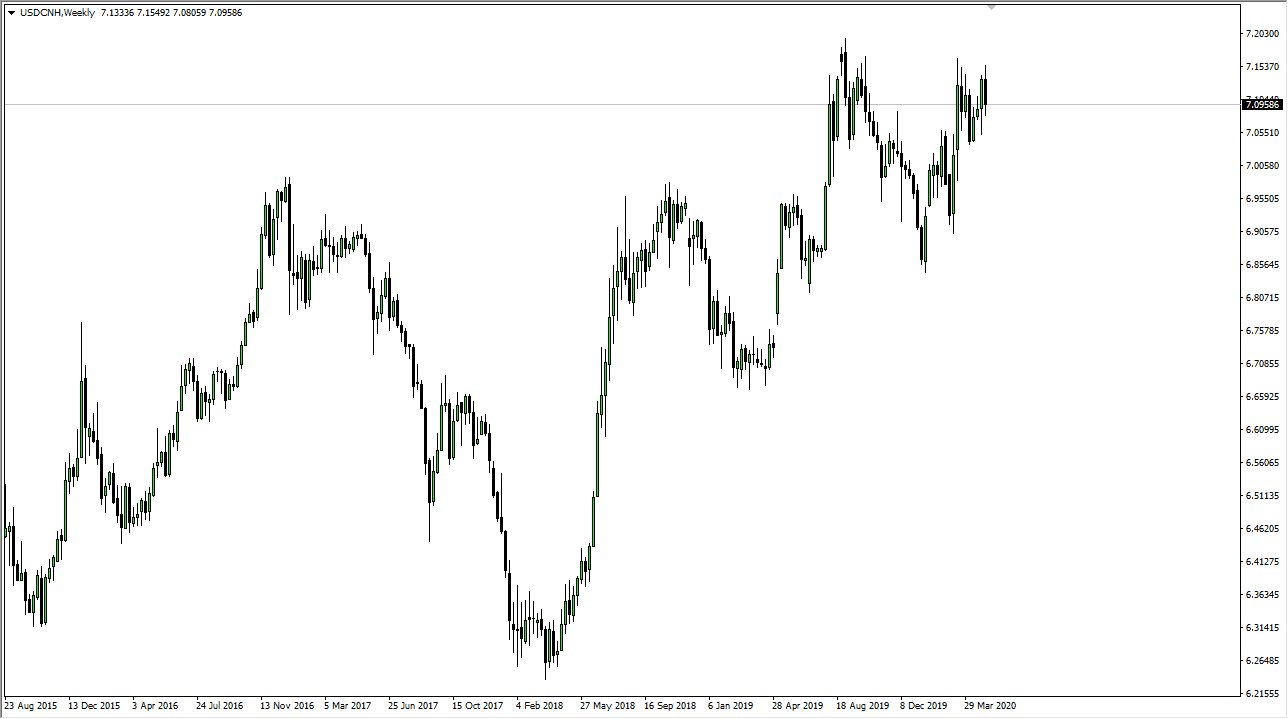

USD/CNH

The US dollar has been rather noisy against the Chinese Yuan during the week, but the most important thing to pay attention to is the Friday candlestick forming a hammer. That hammer of course allows for the idea of the market going higher. The market will continue to be very noisy, and although this is not a market that a lot of people trade, it is crucial that you pay attention to how the US dollar asked against the Chinese Yuan. If the pair rises, it is a sign of a “risk off” type of situation. Obviously, the exact opposite is also true.