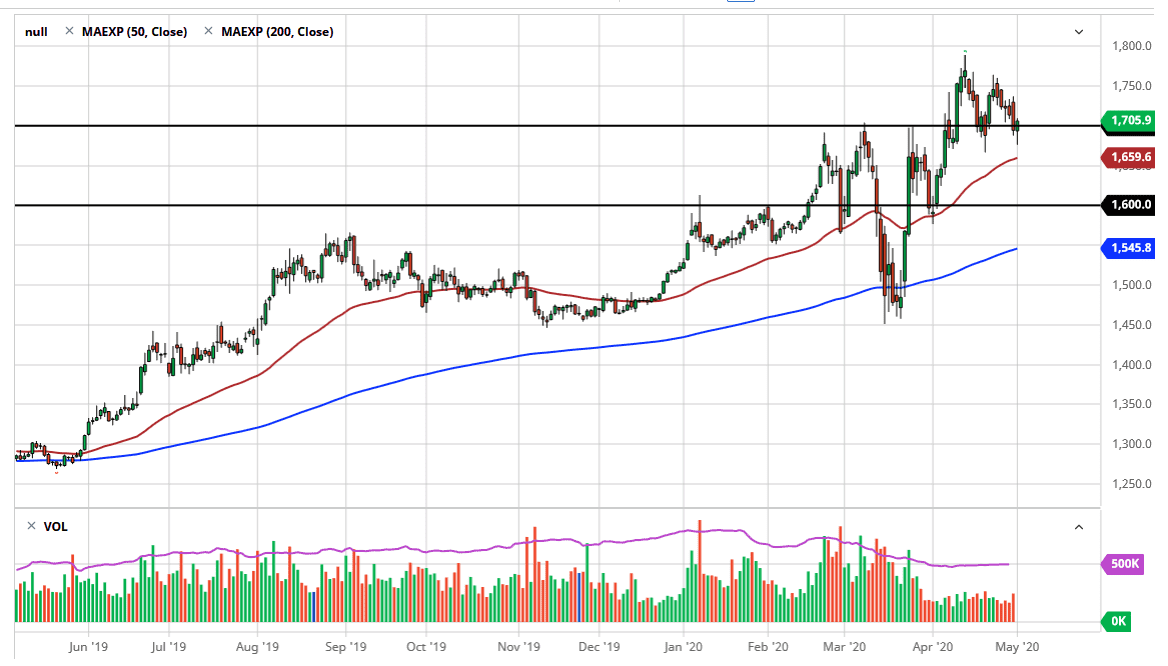

Gold markets pulled back initially during the trading session on Friday but found enough buyers underneath the turn things around and form a hammer. The hammer of course is a very bullish candlestick and the fact that it happened at the $1700 level suggests that there is a lot of buying pressure underneath and if we can break above the candlestick from the Friday session is highly likely would go looking towards the $1740 level. Ultimately, we have been in an uptrend so it makes quite a bit of sense that we should continue to go much higher.

Underneath, we have the 50 day EMA currently sitting at the $1660 level and sloping higher, so it does suggest that we are going to go higher further due to momentum. I think at this point the central banks around the world continue to flood the market with liquidity will continue to drive money into gold based upon fear of devalued currencies. This will be especially true in emerging markets, so if you have the ability to buy gold and other currencies that might work out a little bit better. Nonetheless, even the US dollar is losing value against gold, as the Federal Reserve is printing a ton of currency.

After that, you also have to keep in mind that the global situation is tenuous at best, and that of course will have people looking at the gold market as a way to protect their wealth, so in this sense it is likely that we have a one-way trade given enough time. We look at the candlesticks, you can see that we have formed just a bit of a crunch, forming a symmetrical triangle. If we see the symmetrical triangle at the top of an uptrend, typically that means that we are going to see some continuation. I think at this point the $1800 level is a likely target over the longer term, and then possibly even the $2000 level if we can continue to see upward momentum. I like buying pullbacks and adding as the market continues to go higher. As long as we can stay above the 50 day EMA, it seems very unlikely that sellers will be aggressive. Even then I would be a bit hesitant to short this market, because gold has been in such a huge uptrend for so long.