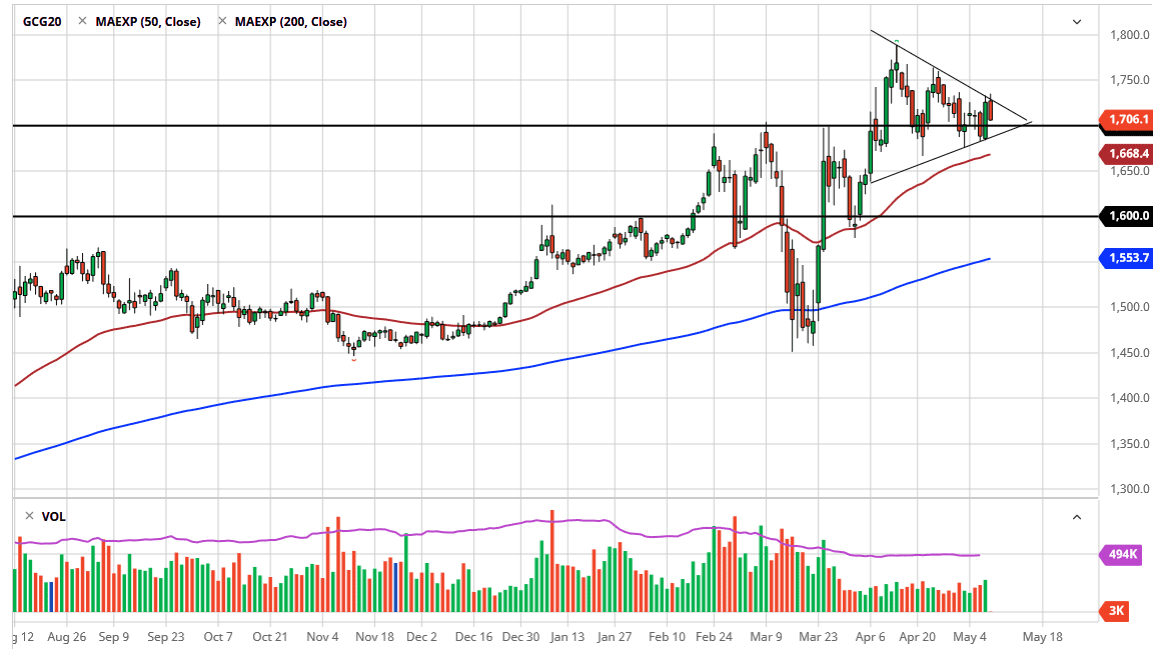

The gold markets initially tried to rally during the trading session on Friday but then pulled back from the triangle that I have drawn on the chart to reach towards the $1700 level. I believe that there is significant support underneath that should continue to turn things back around. The $1695 level should be a significant level. The uptrend line of course does offer support, and of course the 50 day EMA is underneath which should offer significant support. At this point in time, I believe in gold, although Wall Street was a big seller late in the day as “everything is awesome” yet again.

If we can break above the highs from the trading session on Friday, then it is possible that we go looking towards the $1750 level, and then possibly the $1800 level further. To the downside, I would be more than willing to be a buyer underneath the $1700 level and then slowly add as the market works out in my favor. After all, the gold markets are being supported by a multitude of reasons.

The first reason of course is the fact that the central banks around the world continue to flood the markets with liquidity, and therefore hard money will be something that a lot of traders look towards. The natural trade is to buy gold, and that is part of what has been driving this. Furthermore, you can see that the triangle forming is a bit of digestion for the biggest move to the upside. After that, you can also make the argument that we are simply waiting for further bad news, which will more than likely drive the safety trade forward, sending this market much higher.

At this point, I do not really have a scenario in which I am willing to sell gold but would start to rethink things if we were to get below the $1600 level. That is $100 away right now, so I am looking for an opportunity to buy the market “on the cheap.” With all of the cheap money that has been thrown in the market, I do believe that eventually gold markets will take off and we could be at the very beginnings of a longer-term bull market. Buying on the dips has worked for several months, and I do not see that changing anytime soon. Simply adding to trades that work out in your favor will be the best way going forward.