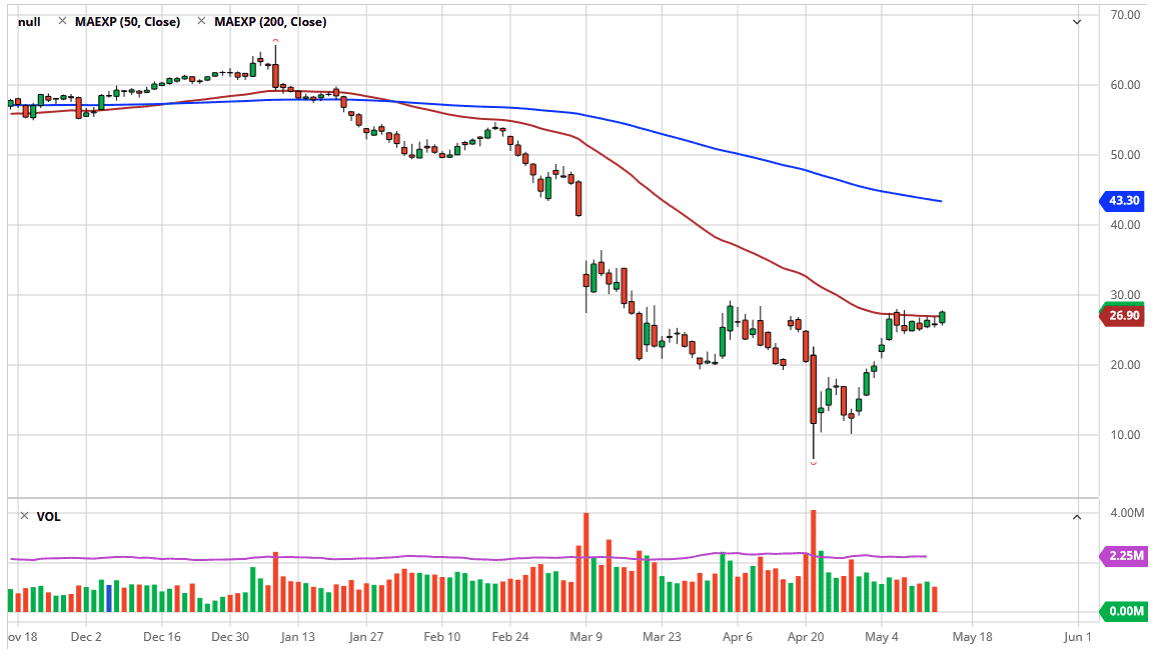

The West Texas Intermediate Crude Oil market has rallied significantly during the trading session on Thursday, slicing through the 50 day EMA and closing towards the top of the range. That being said, the market still has a lot of resistance above, and it will take a significant amount of momentum to make that happen. A break above the $30 level would be the signal that buyers are willing to come in and continue to push to the upside, but it is a bit difficult to imagine that being the case given the economic backdrop.

Having said that, the market will be very noisy between now and then and I think looking for some type of opportunity to start shorting is the best way to go going forward. It should be noted that the June contract closes in a few sessions, and we could see some issues due to the fact that storage is still a major problem. If that is going to be the case, then it is probably a sign that we are getting a bit overdone, and it is likely that the market will sell off. To the downside, the $25 level could be a target and breaking through there will probably open up a potential move down to the $20 handle.

Keep in mind, even though the crude oil markets have recovered quite nicely, the reality is that economic growth is all but dead. There have been a lot of rigs in the United States shut off, but we still do not have a lot of demand. So, at this point even though the crude oil markets have rallied a bit, the reality is that we still have a lot to go as far as the fundamental reasons for rallying, at least not for a longer-term move. Signs of exhaustion might be an opportunity to take advantage of what has been a strong downtrend, and although this has been a nice move, the reality is we are still very much in a downtrend. To the downside, I believe that the $25 level is highly likely to be targeted, but that does not mean that we go straight down. Expect a lot of volatility as the OVX is still extraordinarily high, with volatility continuing to cause major issues with hanging on to crude oil markets overall.