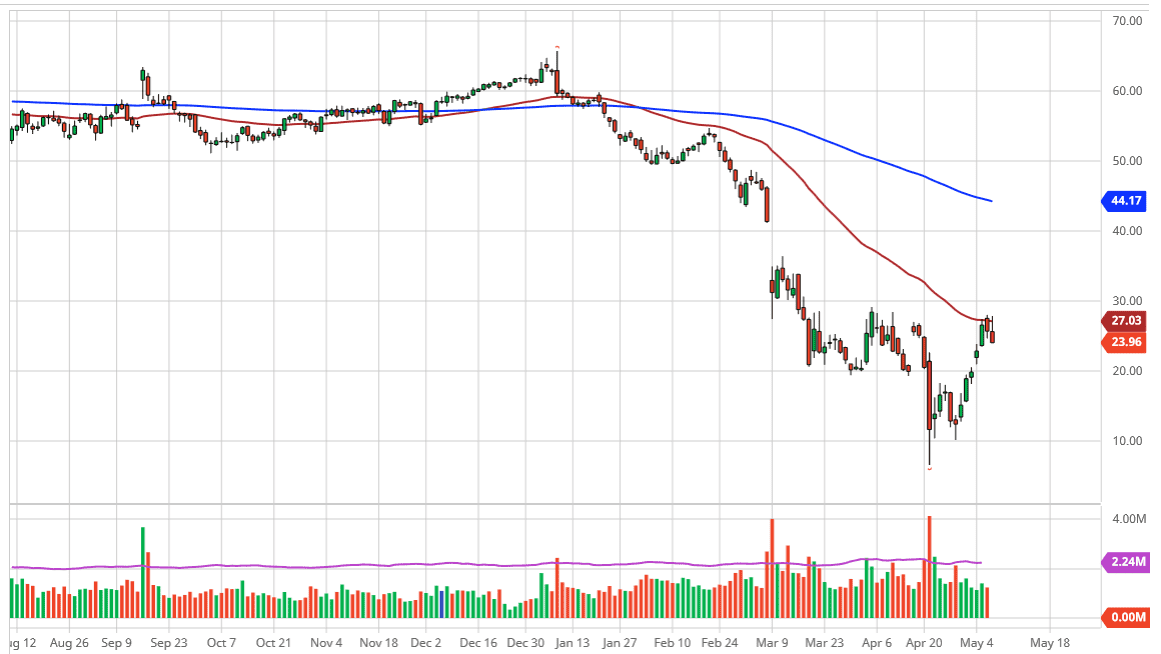

The West Texas Intermediate Crude Oil market initially tried to rally during the trading session on Thursday but ran into the 50 day EMA to start selling off yet again. By doing so, and forming an exhaustive candlestick, it looks as if the market is ready to roll over again. The market has been in a downtrend for some time so it is not a huge surprise that we would give back some of the massive gains that we had seen.

Looking at the chart, it is obvious that we have been in a downtrend for quite some time and the 50 day EMA of course has offered a lot of interest. The fundamental situation is worth paying attention to as well, as the US shale producers have cut the rig count in half. This of course will cut down on some of the supply, but the question now is whether or not demand is going to return anytime soon? That is going to continue to be a major problem for oil markets, so at this point it is highly likely to see a lot of selling pressure regardless of the rig count.

Furthermore, we have the jobs number coming out on Friday which will put a bit of a highlight on just how bad demand is going to be, so quite frankly we have a long time before the massive amount of supply out there gets taken out. With that in mind, I do like shorting this market, but I also recognize that it has been a “rip your face off rally” that we have had to deal with as of late. These are the most difficult to deal with, because they include a lot of short covering, which is quite often done in a bit of a panic. That being said, it is obvious that we have gotten a bit overbought so I would anticipate that the market is probably going to go down towards the $20 level underneath. To the upside, the $30 level offers resistance as well, and if we were to break above there one would have to think that the market is going to go looking to fill the gap above at the $42 level. That is an area where you would expect the market to fill the void rather quickly, but it is hard to imagine how this market continues to go higher in the current trading environment.