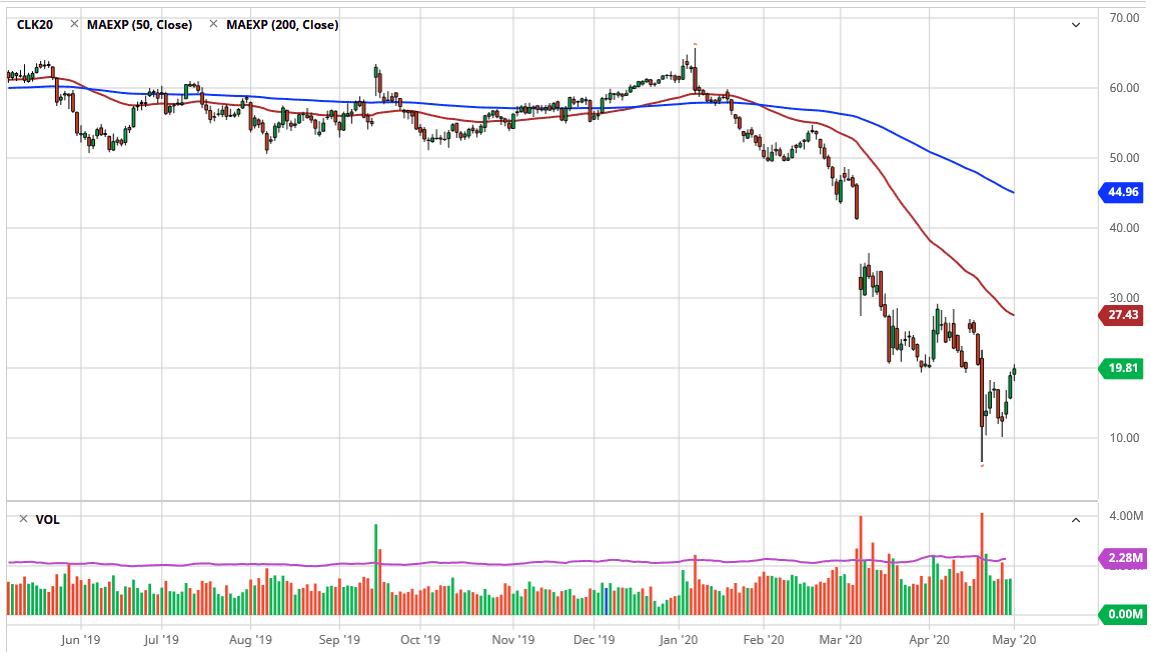

The West Texas Intermediate Crude Oil market rallied a bit during the trading session on Friday, as we continue to see crude oil recover. That being said though, the market is likely to see a lot of noise around the $20 level as it is an area that has previously been massive support. At this point, the market is likely to see selling pressure due to “market memory”, and as a result signs of exhaustion should be taken advantage of.

We continue to have a major oversupply issue at current time, and therefore it is likely that the crude oil will continue to have a lot of negative pressure. Ultimately, the market has a huge area of resistance all the way to at least the $27 level. Signs of exhaustion give you an opportunity to start selling this market, and the higher it goes, the more likely I am to put money to work. The oversupply issue continues to have traders worrying about whether or not there is going to be any storage, and there is no real attempt by industry to burn through supply. Ultimately, I do believe that the market is going to revisit the low again.

That being said, the market ended up forming a bit of a hammer for the weekly candlestick, so it is possible that we may get a little bit further bouncing in this market, but looking for exhaustion to sell this market is the only thing we can do. Ultimately, the 50 day EMA above at the $27 level should be an area that could continue to see a lot of bearish pressure as well. All things being equal, I do believe that it is not until we break above the $30 level that you can think the market can reach towards the $42 level above, as there is a massive gap in the chart that has yet be filled, something that people will continue to see as a target over the longer term. That being said though, it is almost hard to imagine that, due to the fact that the demand for crude oil is simply going to continue to crumble, and the oversupply issue is so extreme. This is a massive negative feedback loop, and at this point it is almost impossible to think about buying crude oil, regardless of the big move we have seen in the short term.